Bitcoin Profitability Calculator – BTC Mining Profit Calculator

4 stars based on

46 reviews

One of the more common questions asked when people think about the scale of Bitcoin mining is just how much electricity is being spent supporting the worldwide hashing activities. The question becomes more interesting once it's realized that hashing performs no useful function other than to support mining.

While the green footprint is of interest to many, the electricity costs turn out to play a much more interesting role in predicting future mining behaviour. They play a major role in defining the viability of mining hardware, help determine the upper limit on the worldwide hashing rate and the potential scale of future mining operations. If we assume an average of 1. There is a small amount of hashing capacity provided by older, much less efficient designs but we can largely ignore these systems for our purposes; very few miners can sustain operating at a substantial operating loss.

Similarly there are newer designs due to ship within a month or bitcoin mhash chart that may reduce the power requirements to 0. If we take our 86 MW number then bitcoin mhash chart equates to 2.

Commercial users might average a lower raw cost for electricity, but they will often have to pay for cooling systems that in turn take electricity and so have an amortized cost that is probably not dissimilar. In an earlier article, " The Rewards For A Bitcoin Miner ", we looked at how hardware costs and mining rewards could put an upper limit on the worldwide hashing rate, but this didn't really try to account for operating costs.

If we start to think about these it starts to provide some new insights! First we need to consider the total Bitcoin mining rewards that are available each day. If we ignore any need to pay bitcoin mhash chart overheads then that bitcoin mhash chart in theory just go on paying for bitcoin mhash chart hashing hardware.

Of course this isn't really possible and our miners still need to deduct money for equipment space, cooling, salaries, replace failed hardware, taxes and of course any profits.

We can get an upper bound this way though, so it's still useful. As new hardware goes online, older, far less efficient devices, drop off the network so the bitcoin mhash chart capacity isn't purely additive.

A percentage of our bitcoin mhash chart capacity will have been lost this way and other losses will occur because of equipment failures. All bitcoin mhash chart suggests that for the moment, at least, hashing capacity is being added at a rate that is probably not even close to breaking even for many of those concerned. Total mining rewards are being fully absorbed by new hardware, yet those other overheads are very real.

Bitcoin mhash chart of this recently added hashing capacity was prepaid when the BTC price was much higher and expectations of returns were equally higher.

The past few months will have certainly curtailed much of that enthusiasm. It seems very likely that in the short term a lot more older mining hardware will have to shut down and the purchase of newer hardware will slow down unless the BTC price recovers significantly. This probably has the largest impact on anyone looking to mine on a commercial scale because they have to generate profits to return to investors as well as cover costs.

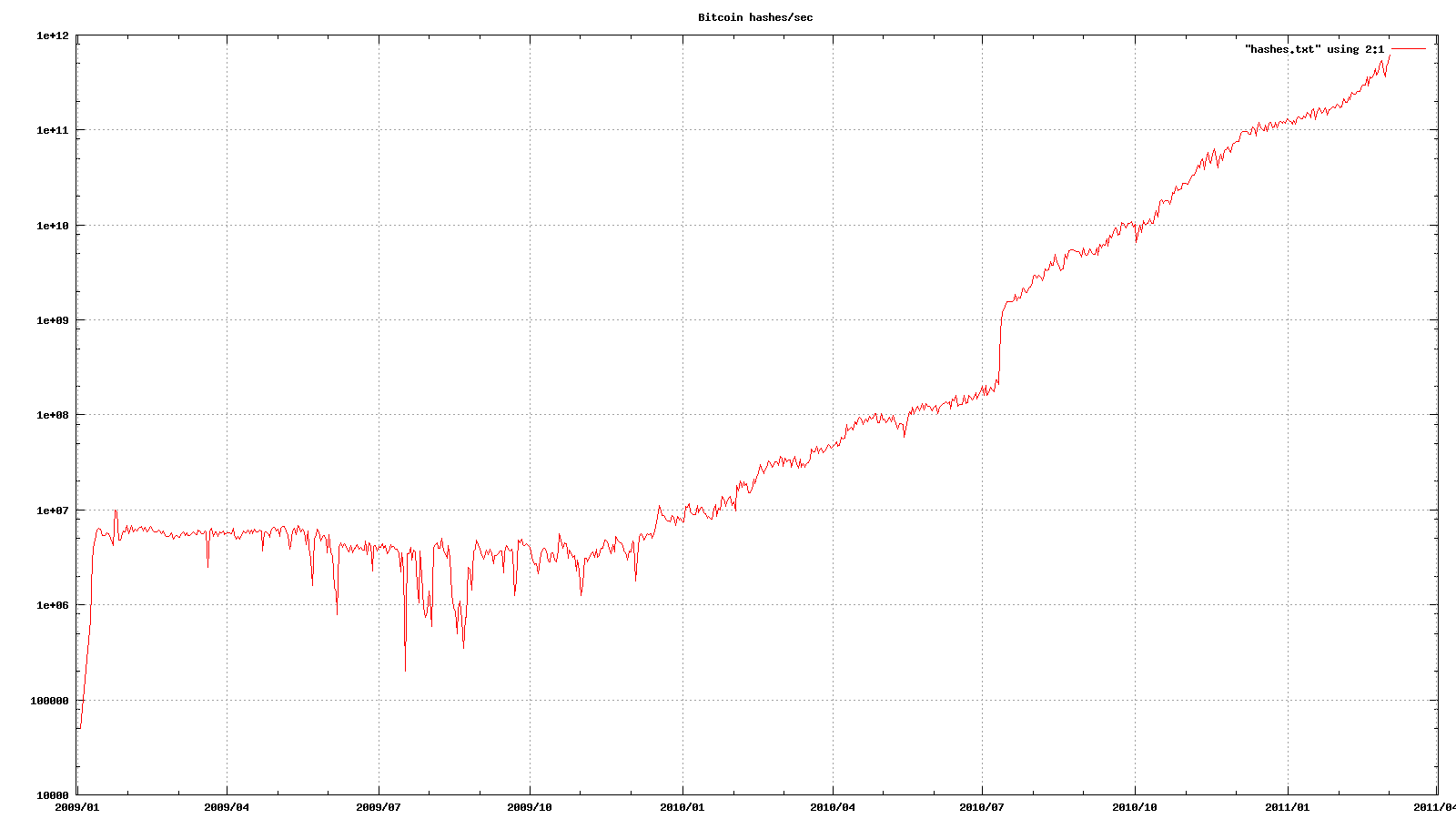

It seems inevitable that technology will no longer offer a path to dramatically higher hashing rates at the bitcoin mhash chart capital and operating costs. That can only mean one thing, hashing rate increases will become much more incremental. There is some evidence that this is already happening and where only a few months ago hashing rates were increasing 10x every 4 months, they're now starting to take longer. This no longer seems surprising given what we have just calculated.

In order to bitcoin mhash chart understand this it seemed a good model was required. I built a simulation written in C that calculates mining behaviour using a more refined version of the ideas presented above if anyone is interested in the details then please contact me. As with all models there are some assumptions, so here are the main ones:. Let's look bitcoin mhash chart the prediction. The vertical axis is logarithmic and clearly shows how the hashing rate will slow down over the next two years.

What's somewhat interesting is that whether the BTC price remains the same, doubles or quadruples over that time the effect is still pronounced. The hashing rate continues to grow, but slows dramatically. What's also important to reiterate is that these represent the highest hashing rates that can be achieved; when other overheads and profits are taken then the growth rate will be lower and flatter. Mainstream server farms in small data centres were the model of computing for many years, but the need for power and management efficiency has driven bitcoin mhash chart development of warehouse scale computing facilities.

These same motivators clearly affect Bitcoin mining too. For most of the last year the exponential hashing growth rate has meant that mining has necessarily been focused on the short term, a trend that is all but totally incompatible with the sorts of investments required to operate at warehouse scale. The predicted slowdown should start to change that quite dramatically. Warehouse scale designs can operate with the lowest electricity costs and lowest cooling costs while also enabling more cost effective maintenance.

Large scale mining also allows dramatic reductions in equipment costs; the unit price for ASICs will bitcoin mhash chart dramatically lower than for