Bitcash bitcoin chart

11 comments

Wonder workshop dash and dot robot pack uk

According to someone more boned up on the topic than your columnist, self-executing digital contracts have been around since at least - when Paul Keating still ruled the land with his colourful invective. The premise of a blockchain contract is that if a prescribed event occurs, then a certain action is taken. Unlike a standard paper contract that is enforceable by law, such smart contracts are enforced by cryptographic code and are executed in line with predetermined, programmable rules.

One example is estate planning: In this case, the family benefits from reduced processing fees, the elimination of lawyers and trustees from the process and increased transparency and reduced human error.

This means smart contracts can disrupt existing services that have speed bottlenecks such as international monetary transfer , or act as intermediaries in complex situations involving regulation and numerous parties such as an advertising buying agency. Blockchain is also relevant for trusted intermediaries, such as trustees and public sector services. Although predicting the future remains the domain of clairvoyants, we do our best to identify the winners and losers over the medium term.

For banking customers, the speed to settlement is a major drawcard of smart contracts. Aligning loan approval with drawdown access will be of great benefit in a variety of consumer use cases. A likely scenario is that consumers will hold smart contracts containing their personal data, along with encryption keys to share that data with other providers. Another benefit is that credit checks would be verified through a decentralised ledger and consumers with a stronger credit history that is, about half the population would receive more competitive offerings.

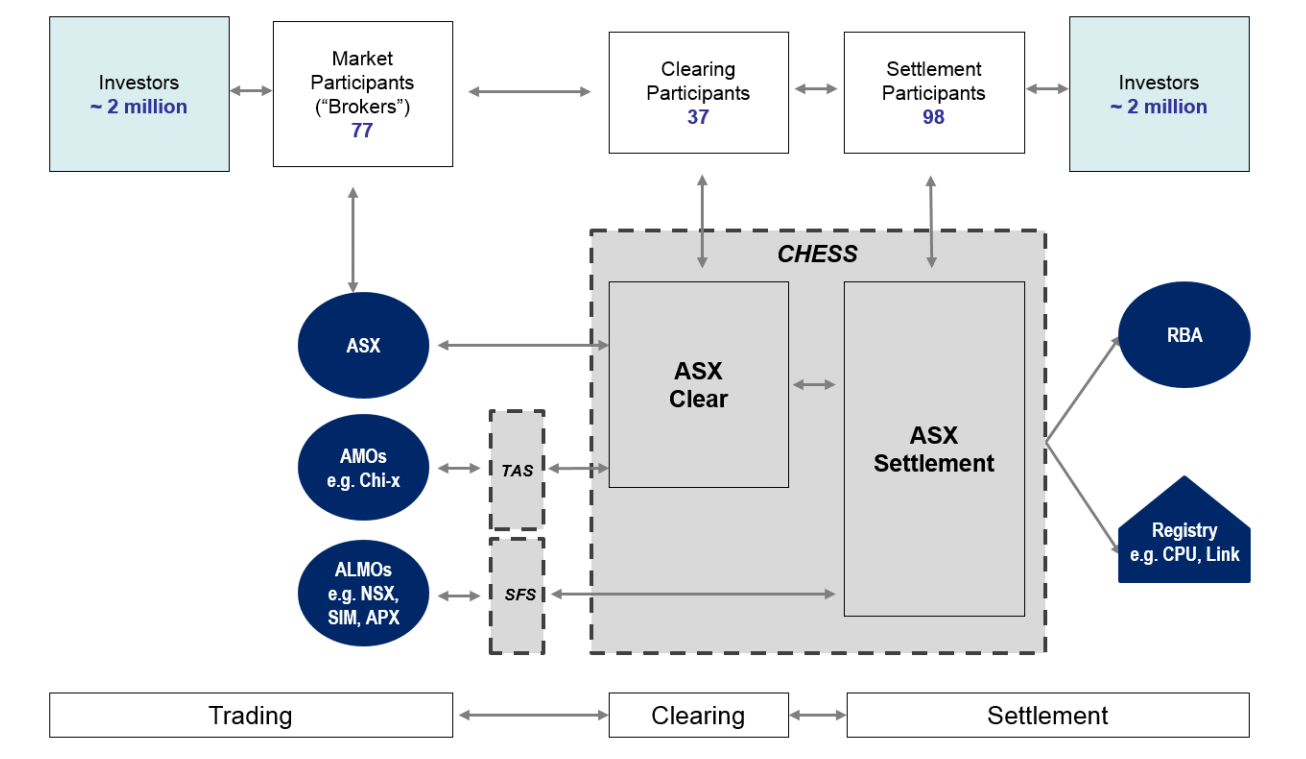

Companies that are dominant in their market have an incumbency advantage over new entrants when it comes to developing smart contract technology. This will reduce trading costs and settlement time, while accentuating barriers to entry for aspiring rivals.

Property owners will be able to connect directly with prospective tenants and verify their identity, rental history and financial means. Companies such as Freelancer. Other winners are those who build IT and telco networks, given the need for more computer power and data transfer. On the flipside, likely losers are service companies that are a conduit between customer and supplier. PEXA, which plans to list this year, has done a good job in disrupting an archaic property transfer market.

But it may face headwinds if legal software house InfoTrack decides to invest in an electronic property settlement platform, based on smart contract technology. The share registries Computershare CPU and Link Administration face clear and present pain if private ledgers become the norm. Both companies have taken steps to try to weather the oncoming smart contract storm, but it remains to be seen what role a third-party ledger administrator would play between market participants and exchange operators.

Through standardised technology approved by the regulator, companies may be able issue smart contract shares directly to shareholders. Each smart contract would correspond to one share and would have the same existing shareholder rights written into its code such as voting, dividends and transfers. Intellectual property companies had better watch their backs too, because the recurring fees charged over the life of a trademark and patent could vanish. The companies covered in this article unless disclosed are not current clients of Independent Investment Research IIR.

Under no circumstances have there been any inducements or like made by the company mentioned to either IIR or the author. The views here are not recommendations and should not be considered as general advice in terms of stock recommendations in the ordinary sense. Many readers will remember Boreham as author of the Criterion column in The Australian newspaper, for well over a decade.

Key quotes and take-aways Patrick Poke Livewire Markets. Buy Hold Sell Livewire. Weimin Xie MX Capital. Shane Fitzgerald Monash Investors.