How do I account for bitcoin mining and sales?

4 stars based on

43 reviews

In this article, we explore the complex tax issues that cryptocurrency miners will face for this filing season. Is cryptocurrency earned from mining taxable? The IRS provides limited guidance on the U. Convertible virtual currency means Bitcoin any other virtual currency that can be:.

Dollars or other currencies including virtual currency. The IRS declared in its crypto notice that mining income is taxable gross receipts for purposes of U. An example could be the exchange which a miner transacts with if it is liquid. How this calculation would actually work is in an example down below. All is not lost, because deductions are claimed against the income, otherwise the profitability of mining would be significantly reduced for U.

Generally, in assessing bitcoin mining and taxes consequences of mining, this will require a taxpayer to determine if mining is a trade bitcoin mining and taxes business or is a hobby. Why is this important? Under Code Sectionordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business are deductible. However, under Code Sectionexpenses incurred related to an activity that is not engaged for profit a hobby are deductible only to the extent of the income.

The electricity generated from the activity is bitcoin mining and taxes the residential electricity bill. This is known as code section A. A taxpayer cannot take a home office deduction with respect to a hobby. A tax advisor should be contacted to help assess the home office deduction and ability to take a write-off for electricity. It should also be noted that the cost of mining equipment may be subject to depreciation provisions, although equipment is relatively cheap relative to the Section and bonus depreciation K provisions, meaning a significant amount can be written off in the first year.

Inventory is an example of an asset that is not a capital asset in the hands of a taxpayer. It might be on the burden of a taxpayer to show their habitual treatment of mined bitcoin i.

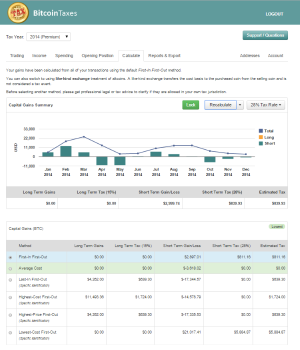

Crypto bro intends to operate his mining activity as a trade or business. At the current difficulty, the miner generates 0. He mined on December 26, 27, 28, 29 and 30th. He skipped December 31, The first layer of tax is recognized on the tax return, the year the coins were successfully mined. The second layer of tax applies to the tax return year when the Bitcoin is disposed of.

Amounts above are totaled but span two tax return years. Calculation ignores Self-Employment Tax Impact which would also apply to increase the ordinary rate. Cryptocurrency taxation bitcoin mining and taxes complex, and there are even more complex considerations for miners. Do you have any questions or thoughts of other challenges that miners may face related to U. Feel free to post them here, however this is not personal tax advice, so it is also recommended you consult your tax advisor.

Upcoming tax reform could result in changes to tax law as discussed in this article. This series contains bitcoin mining and taxes discussion of U. Under Circular to the extent it applies, this article cannot be used or relied on to avoid any tax or penalties in the U.

Last, bitcoin mining and taxes article does not create a client relationship between author and reader. Picture Credit Cover Picture: Me using Microsoft Excel. The OriginalWorks bot bitcoin mining and taxes determined this post by cryptotax to be original material and upvoted 1. To call OriginalWorkssimply reply to any post with originalworks or! Half of it can be deducted from your income for income taxes. The actual math is a bit complex.

Also, these are legit Social Security taxes, meaning you do get SS credits for paying them. This probably doesn't matter unless you don't have a job bitcoin mining and taxes. But hey, if you quit your job to work on bitmining full time, there you go. If, as quite possible, your bitmining is unprofitable, you could theoretically use it to reduce your income taxes from another job or business.

If you can convince the IRS it's not just a tax shelter disguised as a business. If you are planning to go into business as a bitminer, please research Sectionsince it will probably make your life much easier. Or, as cryptotax says, consult a tax adviser on it. Bitcoin mining and taxes for the thoughtful post as always. I kept it out of the example because it would muddy up the charts.

Also agree on Section Planning with a tax adviser is best because other non-crypto related tax return activity should be considered in overall decision-making. Today, I see the biggest grey areas are electricity deductions i.

Since bitcoin isn't backed by anything except market psychology, is it wrong to say the fair market bitcoin mining and taxes of bitcoin is 0? I don't follow your second question. Are you referring to my example in the article, re-worked if the price declined and the sale resulted in a loss? I can make another post with that example if there is demand for it.

Yeah i am basically using your example-different dates. Except instead of selling, they are held. It seems the fair market values you are using are from the day that they are mined. That is, For convenience, Let say the reported In my example in the post, the first layer of tax is recognized on the tax return, the year the coins were successfully mined. Of course same with dislaimer above, this is not personal tax advice, cannot be used to avoid penalties, and is subject to new legislation after the date of this post.

Convertible virtual currency bitcoin mining and taxes Bitcoin any other virtual currency that can be: More information can be found in the Part I-A blog: Hobby Generally, in assessing tax consequences of mining, this will require a taxpayer to determine if mining is a trade or business or is a hobby.

The difference between the two scenarios Takeaway Cryptocurrency bitcoin mining and taxes is complex, and there are even more complex considerations for miners. Authors get paid when people like you upvote their post.

To receive an BiggerUpvote send 0. I'm not a tax professional, but I am a small businessman, so I learned this stuff.

This is not tax advice see general disclaimer for authored post above. I added more information above regarding fair market value.