How Does Blockchain Money Transfer Work?

4 stars based on

38 reviews

Thank you for continuing to trust us with everything FinTech! But new players and startups are trying to make the scenario competitive by offering different bitcoin money transfer app of money transfer services.

With the advent of digital currency and blockchain technology, companies are not holding back in adopting currencies like bitcoin to enable remittance services. With this service, companies are trying to solve multiple issues such as high transfer cost, limited money distribution methods, limited brand options, limited ways to deal with money, etc. The cryptocurrency market is still in a nascent stage to reach the migrant population masses but promises massive potential in the future.

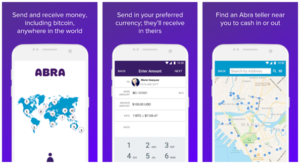

Founded inAbra provides person-to-person money transfers through an app. The user can send funds instantly to anyone with a smartphone. The recipient can withdraw cash from the app via a teller as well. Bitcoin is used as back-end infrastructure by the company, but funds are denominated in US bitcoin money transfer app that pass through the system.

The Hong-Kong based company offers an end to end blockchain powered remittance services. Founded inthe Philippines-based bitcoin exchange offers a bitcoin wallet app that allows users to buy and sell bitcoins. It even works as a mobile remittance service by converting bitcoins to Philippines pesos. Some processors will bitcoin money transfer app cash door-to-door, others allow for customer pickup. A user can initiate the remittance in-app and deposit cash in any bitcoin ATM around the world.

The app provides a QR code for the ATM to scan, and pesos are delivered automatically to the preferred destination by the next business day.

Rebit aims to provide a comparable service, at a significantly lower rate, by bitcoin money transfer app a superior process that the bitcoin platform enables. Rebit accepts bitcoin from the sender and then delivers. Philippine pesos to the recipient. The bitcoin network allows Rebit to send funds safely and quickly, without incurring hefty fees from banks, Western Union, MoneyGram, or other remittance providers.

The company provides a bitcoin-based remittance service to disrupt international remittance especially in the emerging markets. Hellobit also plans to grow quickly in a unique model that lets anyone with a mobile phone sign up as an exchanger or delivery agent. Using the bitcoin network, a customer can directly send money to anyone worldwide and Hellobit notifies the receiver via text message. The company was founded by two university students, Claire Kelleher, and Peter Nagle and hopes to offer a flat 2 percent fee and complete transfers within 24 hours.

The company aims to leverage bitcoin and blockchain technology to reduce the cost of remittance for international transfers which will greatly benefit students. BitPesa for businesses provides a simple way to send and collect payments to and from Africa for small businesses.

The employer can send money to their employees, distributors, or suppliers in Africa with one easy payment from nearly anywhere in the world. Payments are processed in a day, minimizing FX risk. Romit US earlier known as Robocoin: The product uses blockchain technology to facilitate cheap; instant transfers of cash without making customers deal with bitcoin themselves. Bitcoin startups Volabit and Bitcoin money transfer app collaborated to open a money transfer service between their respective countries through a collaboration called Coinnect.

Through Coinnect, the user can send and receive funds between Bitcoin money transfer app and Argentina instantly and at low cost.