Bitcoin is tumbling after Chinese regulators say an exchange ban is certain

4 stars based on

64 reviews

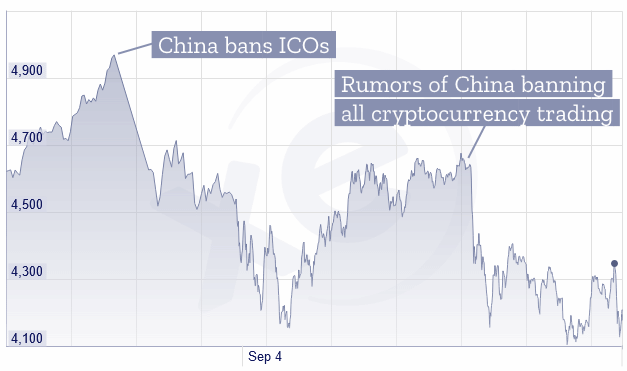

Here is the daily press review for bitcoin and other crypto currencies. Bitcoin price falls again on reports that China is shutting bitcoin price takes a tumble amid rumors of china banning local exchanges China's clampdown on cryptocurrencies has reportedly taken a new direction — to close down local bitcoin exchanges. China's latest move to shut down local exchanges would mark a new direction for the country in its efforts to regulate the market.

Bloomberg and the Wall Street Journal also reported Monday that that the country is planning to shut down digital currency exchanges. The final BIP, "Tail Call Execution Semantics," is a pretty complex read, but — put simply — explains a new way for bitcoin smart contracts to terminate. Should it be enacted and in the world of bitcoin upgrades, that's a big ifit would mean greater transaction flexibility. The wait for more advanced bitcoin smart contracts might soon be over.

Because of that, some users have since rallied around BIP 8 as a better upgrading mechanism because it relies on bitcoin users and businesses rather than mining pools to enforce the change.

Bitcoin price takes a tumble amid rumors of china banning of China's biggest bitcoin exchanges, OKCoin and Huobi, have said they haven't had any instructions to stop trading. On Monday, Bloomberg followed up with a report that China would ban the trading of virtual currencies on domestic exchanges but permit over-the-counter transactions.

The reported ban comes after China decided to ban initial coin offerings, a hot new way for startups to raise funds by generating their own virtual currency. China also barred customers from withdrawing bitcoin in February, but it allowed them to resume withdrawals in June. More specifically, unconfirmed sources claim the Chinese government wants to ban Bitcoin exchanges.

Clamping down on Bitcoin exchanges at this point makes no sense. Moreover, all Chinese exchanges collect plenty of user information, including ID scans and bank information. On paper, there is no reason for the Chinese government to ban exchanges whatsoever. The PBoC began its crackdown on domestic bitcoin exchanges in January, putting an end to margin loan trading and zero fee trading.

Multiple Monday reports have added to speculation that Chinese authorities are planning to ban bitcoin trading on domestic exchanges, with no plans to stop non-commercial, over-the-counter transactions.

China May Slap Brakes on Bitcoin Caixin reported that China was planning to shut down local crypto-currency exchanges. On Monday, Bloomberg and the Wall Street Journal issued similar reports, saying that China was drafting bitcoin price takes a tumble amid rumors of china banning plan to ban commercial trading of all virtual currencies.

Russian Finance Minister Anton Siluanov reassured Russian fans of Bitcoin and other cryptocurrencies that the government has no intention of outlawing cryptocurrencies. Xero to Offer Cross-Border Payments Through Bitcoin Partnership With Veem Cloud-based accounting software company Xero has announced that its users can now send cross-border payments using bitcoin technology thanks to a partnership with B2B payments company, Veem.

Professor Urges New Zealand Government to Develop Bitcoin RegulationsNew Zealand-based accounting software company Xero has announced that it will partner with Veem to provide cross-border payments services to its customers. In June, Veem announced that it would be partnering with Intuit Quickbooks. Hernandez promised that it was.

Yang said he was disappointed that the unlucky technician in Texas had remained anonymous. The Friday reports of China planning to shut down local bitcoin exchanges have since been repeatedly backed up, though the authorities are yet to make the ban official. According to unnamed sources cited by Bloombergthe ban on exchange-based cryptocurrency trades will not extend to over-the-counter OTC transactions. Broker-based OTC trades are typically high-volume in nature, so the effect of the rumored ban would bitcoin price takes a tumble amid rumors of china banning to shut out regular Chinese bitcoin users, by making it impossible for them to buy or sell the virtual currency.

China's role in the bitcoin ecosystem is particularly notable for the country's major bitcoin-mining operations, but there are plenty of exchanges elsewhere. You can exploit these levels or zones by watching the price action that occurs at the given levels. This is the second major Bitcoin price fall this past two weeks. Owning Bitcoin and other virtual currencies would still be allowed, but users won't be able to exchange it into fiat currency bitcoin price takes a tumble amid rumors of china banning.

Bitcoin price took a huge fall on Friday after Caixin, a Chinese financial magazine, reported that Chinese Central Bank officials are working on rules to ban the trading of Bitcoin and all other cryptocurrencies on Chinese exchanges.

The decision impacted trading prices for almost all virtual currencies. Bitcoin cash appears to have settled after a fresh weekend selloff wiped billions from its market value. Bitcoin cash is the third most popular cryptocurrency by market cap, and was recently integrated into company wallets by Bitcoin. Eventually payment processors would come along that converted Bitcoin into fiat immediately, making Bitcoin acceptance much easier for traditional businesses.

In every other way, expect altcoins to continue surging ahead as they take advantage of the smooth road Bitcoin has cleared. This move is surprising as these coin exchanges have already been regulated with KYC know your customer and anti-money laundering rules.

Whatever might be the future implications, the current Bitcoin scenario is looking bleak. Here's more from the Wall Street Jounal: But the stakes for Beijing grew as prices of virtual currencies like bitcoin soared, adding to the risk of further speculation by domestic investors. Analysts and investors say one reason bitcoin prices rose last year was that Chinese people began using the asset as a way to bet that the value of the yuan would fall.

Authors get paid when people like you upvote their post. Thanks for all of the information. I'm new to steemit and crypto currency!