Bitcointiccom tmarit fyrir bitcoin mining altcoins

23 comments

Hitbtc api example php

February 25, 24 replies. Welcome to final part of the four part series asking Bitcoin experts to share their views on what the future holds for Bitcoin. We have so far looked into the following:. In part four we ask our experts what they think Bitcoin will be trading at in 12 months time.

This is based on the assumption that all exchanges and measurements will move to mBTC as the defacto denomination rather then BTC at the moment. Obviously, this estimate is only capable if adoption continues to surge and the inclusion of bigger players such as Wall Street jumps in. Kingsley Edwards, Founder of LeetCoin responds: Alexander Lawn, director of KnCMiner responds: No idea, I would be happy to see Bitcoin continue its rise, but not at the cost of stability.

With increased adoption it can only increase in value, if that means within the developing world, who are only a generation behind w. Mrs P, the founder of The Bitcoin Wife responds: February is going to be a rockstar month for Bitcoin. Mark Norton, from Bitcoin Warrior responds: I am guessing that Bitcoin is going to keep going through these birthing pains it has been having.

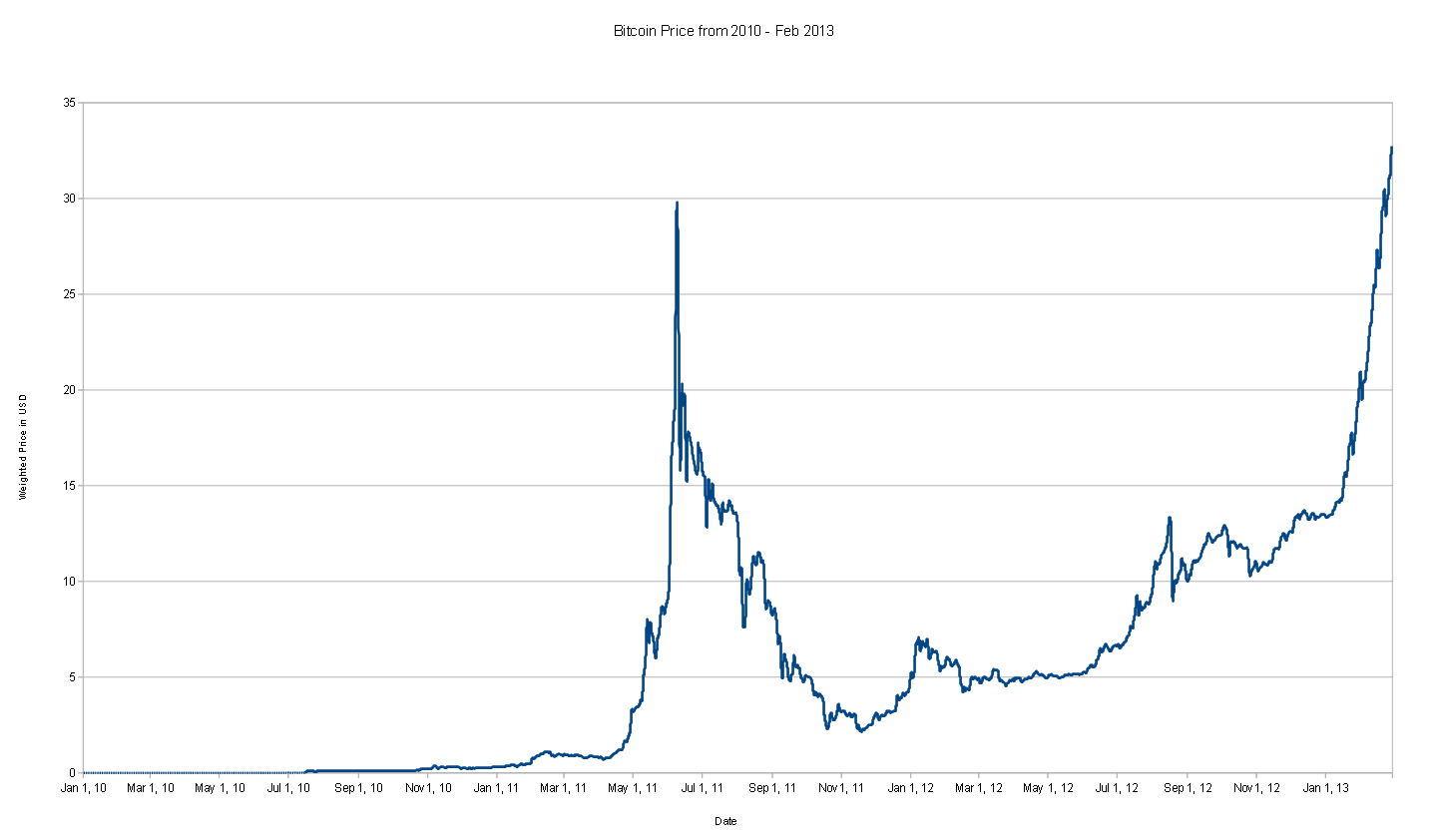

We can expect to see sudden spikes and crashes with plateaus always higher than they were before. The ending price will really depend on what kind of news we hear during the year: Does Argentina go big for Bitcoin?

Does one of the big investment houses, or a pension fund, suddenly decide that Bitcoin is a good investment and pour money in? Or does the US decide that Bitcoin transactions across borders is a violation of currency control laws and crack down on Coinbase and CampBX? Nubis Bruno, Co-Founder of Conectabitcoin responds: Rodolfo Novak, Founder of Coinkite responds: Thats a tough question, the value of Bitcoin will be determined by regulation and some other factors which are ultimately controlled by government.

I am optimistic, the sheer force of Bitcoin and the revolution it brings to our outdated currency systems will allow it to flourish. The fact that there will be no more than 21 Million Bitcoin in existence will make them more valuable. Vitalik Buterin, Author at Bitcoin Magazine responds: Low thousands seems reasonable. It will never again grow as fast as it did in , but I think there is still quite a bit of progress to go. With the rise of other crypto currencies, predictions like these are harder to make.

On top of that we are dealing with something that has a 10 billion USD market cap revolutionising something that has a trillion USD market cap. Simon Edhouse, Managing Director of Bittunes responds: I think it will dip up and down, but competition from other currencies, and ones that do certain jobs better than Bitcoin will hold back its steady rise. Morgan Rockwell, Founder of Bitcoin Kinetics responds: Max, Co-Founder of Bitcoin Manchester responds: But lets strip it down to three possible scenarios.

Interesting will be to follow China, Russia and India as well as Africa, as these territories have a significant potential to be a game changer. I perceive Bitcoin as a payment method, not as an asset class, so I think it does not matter if Bitcoin price will go up, down or in circles, more importantly how many transactions will be done with Bitcoin in 12 months and how much value will be created for whole economy by it.

Willett, Founder of Mastercoin responds: I expect the multi-year exponential trend-line to continue, although there are a huge number of variables which could expand the rate of growth or cause bitcoin to crash to near-zero. The question everyone wants to know the answer to: What will Bitcoins price be in a year. I wish I could give a straight answer. I must, however, first explain my thinking.

Currently the value of Bitcoin is driven mostly by speculation, due to the immense gains of the past year. This is not a long term value driver. As Bitcoin is used more in actual purchasing transactions, instead of being held for capital gains, the underlying value of the currency will increase.

Slowly speculation, on the scale it is being done today, will dwindle, and the currency will stabilize considerably. But what I can predict is merchant adoption will go viral in the next 12 months. As big name merchants continue to implement bitcoin as a payment option more merchants will follow suite. That means more profits or more savings for customers. The adoption by merchants will help stabilize the price of bitcoin. Antony, Business Development at itBit responds: John Delono, Founder of Bitcoin Reviewer responds: Eddy Travia, Co-Founder of Seedcoin responds: The fact that you are asking me this question I think is very interesting.

Everyone benefits both in the short and long term. This seems to be spreading the currency in a very well designed way. Only time will tell how this experiment will turn out. Nikos Bentenitis, Founder of CoinSimple responds: Frederic Thenault, Founder of iceVault responds: I am not keen on encouraging speculation, and the honest truth is that nobody knows what it will be like.

Bitcoin is a wonderful technological innovation and really helps move the needle in terms of changing and modernising the financial industry, by providing a great, peer-to-peer, decentralised network not owned by any central authority. Now, it also still faces some hurdles and uncertainties regulatory, technical, security, and some other limitations , so our only recommendation would be for people to use caution and only invest an amount that they can afford losing entirely. Aaron Williams, Founder of Atlanta Bitcoin responds: A curated list of the most interesting stories in tech Actionable guides that can help your business grow Exclusive discounts on new tools and products Leave this field empty if you're human: We have so far looked into the following: Adrian, Founder of SatoshiBet responds: It should be a year of big name business adoption.

Wouter Vonk, Founder of Bitgild responds: Depends on Wallstreet and Regulators. A curated list of the most interesting stories in tech Actionable guides that can help your business grow Exclusive discounts on new tools and products Subscribe: Leave this field empty if you're human: