Bitcoin's 43% Arbitrage Trade Is a Lot Tougher Than It Looks

5 stars based on

40 reviews

As an observer of the Bitcoin market as long as this original cryptocurrency has existed, it never made much sense to me from an investment perspective. Bitcoin prices were too volatile and the volatility seemed too random. Volatility can be a good thing for traders, mind you, but only if you think you have an idea why the price bitcoins 43 arbitrage trade is a lot tougher than it up and down the way it does.

Otherwise it is just a good way to lose all your money. But a couple of recent events have changed my view of Bitcoin. I now think I can explain its volatility and predict it well enough for bitcoins 43 arbitrage trade is a lot tougher than it trading.

And the best part is that it takes no rocket science at all. Your mother and mine can make a living trading Bitcoins. There will only ever be 21 million Bitcoins and only odd million of those have so far been "mined. My first realization about Bitcoins this year came among the annual predictions I publish every January. My son Cole, who is 12 and now taller than mewas for awhile a Bitcoin miner.

Bitcoins 43 arbitrage trade is a lot tougher than it were paying twice as much for electrons as Cole was receiving in Bitcoins for his labor. Anyone bitcoins 43 arbitrage trade is a lot tougher than it a robust solar installation want to buy an Ant Miner? Then a few weeks ago Bitcoin prices started to rise again and I saw Bitcoin stories with headlines like "Too Big to Fail. This led me to a realization that I think is going to become popular: Bitcoin is a great idea, blockchain is an even better idea, but since neither is backed by the full faith and credit of, well, anyone, a Bitcoin will always be a sorry substitute for a dollar or a yen.

The price of Bitcoins will rise as folks in China find the need to use them to get money out of that country. But when their money finally is out of the China it is inevitably converted straight into dollars and the Bitcoin crashes as a result. So there may be some cyclical arbitrage opportunity in Bitcoins, timing the market to take advantage of the suckers, but as a true currency, Bitcoin will probably never cut it.

This says nothing about technical merit, mind you. What matters here is psychology and behavior. It would have been an easy win for those with large existing Bitcoin holdings like the Winklevoss twins, who were behind the first ETF proposal to go down in flames.

Upon the news, Bitcoin dropped in price by 25 percent then recovered completely within two days! When the second ETF application was denied the drop was much smaller and the recovery even quicker. I mean, it will be volatile of course and there will be many bumps in the road. If it loses that status then fine, it can go down, but something is going to win here and Bitcoin is the prime contender. These folks are much like stockholders. There are only a finite number of shares of a given stock.

When I buy one I slightly make the price go up. If I hold that share, I also ever so slightly put upward pressure on the stock price because my one share is not available for sale. You can spend Bitcoin at Dell and lots of other places to buy computers. Now what really happens is that I can convert Fiat currency to Bitcoin, send it to Dell For the nice minimal transaction costs and Dell instantaneously turns it back into Fiat.

Dell and I hardly cared about Bitcoin: Dell and I were Bitcoin owners for only a fraction of a second, but we were owners. All we want is non-volatility for the few seconds we owned it. As long as the USD to Bitcoin exchange rate remains relatively stable in that tiny timeframe, we accomplished our value transfer. Realization number three -- Bitcoin transactions are increasing.

That is, more and more Bitcoins are being owned for fractional seconds. At some point enough transactions especially big ones mean a lot of Bitcoin is out of the supply pool tied up in transactions. Bitcoin gets harder to find if even for a few seconds. Hence you have to convince more people from the first type of owners the stored value holders to sell their Bitcoins back into the supply, driving prices up.

Bitcoin is having some high-transaction issues which might cause a technical downfall from what I describe, but in general, whichever cryptocurrency wins will end up ever-increasing in value because of a finite money supply and the scarcity of money itself! As I wrote in my prediction, a large part of the Bitcoin market -- the really big transactions -- are rich people in bitcoins 43 arbitrage trade is a lot tougher than it with capital transfer controls using Bitcoins to get parts of their fortunes out of Dodge and into some safer economy.

There are lots of such countries and -- this is the important part -- there will always be lots of such countries. This suggests my new Bitcoin trading strategy, which I admit I have only tried so far on paper.

Bitcoins go down in value when the demand for them as transaction instruments decreases. When that happens -- when Bitcoin prices drop by 20 percent or more -- BUY! The price will inevitably come back up, I assure you. Nothing short of some other cryptocurrency taking the business from Bitcoin is going to change this trend.

Say Goldman Sachs throws billions into doing exactly as I propose but as an institution. That will drive Bitcoin values generally higher and decrease price volatility a little, but the general trend will continue. The success of this strategy comes, I think, from the limited supply of Bitcoins. With only 16 million in circulation and only 21 million EVER, there will always be price changes with larger transactions, which is to say there will always be profit opportunities.

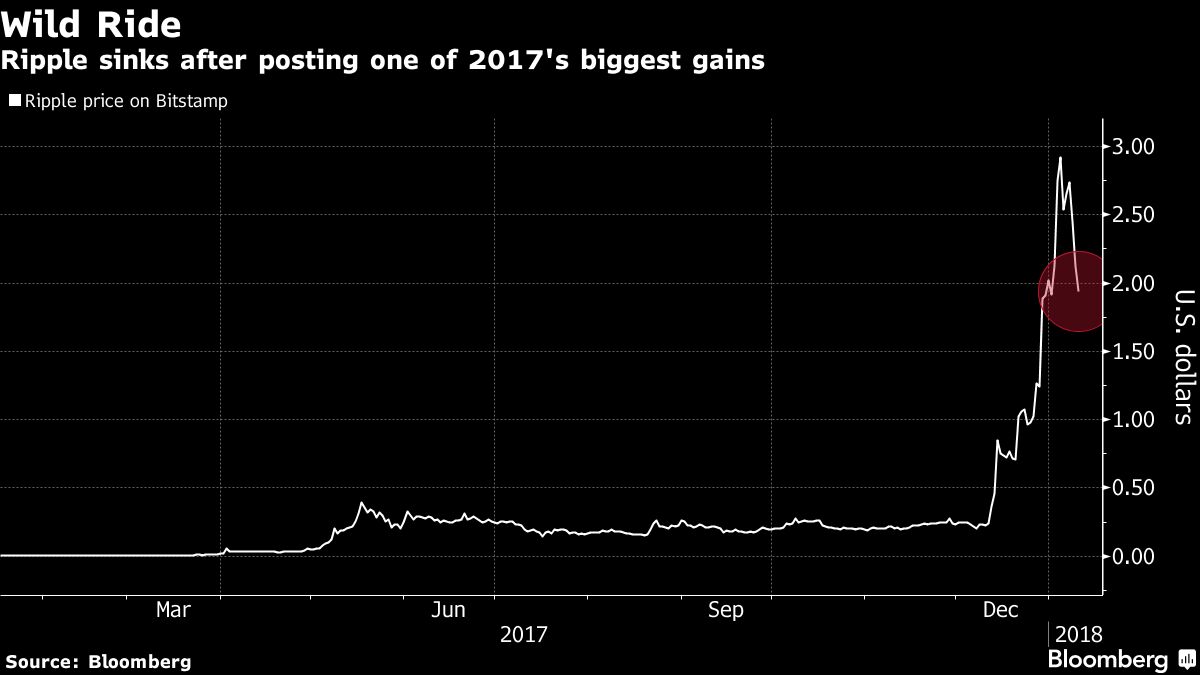

I wonder if bitcoins 43 arbitrage trade is a lot tougher than it was part of the Bitcoin plan from the beginning? Another growing cryptocurrency is called Ripple and it was designed, frankly, to avoid these very profit opportunities.

There are billion Ripples, for example, compared to 16 million Bitcoins. Bitcoin is the Wild West cryptocurrency.

Now for the paper test of my trading strategy. Using the interactive Bitcoin historical daily price chart at 99bitcoins. This is neither an optimal nor a perfect trading strategy and it misses bitcoins 43 arbitrage trade is a lot tougher than it lot of profit opportunities, but is easy to automate.

But maybe my huge Bitcoin paper trading success had to do with starting at the very beginning when a Bitcoin was worth only a nickel, which will never happen again.

This happens a lot in other financial instruments. How to get rich trading Bitcoin By Robert X. Cringely Published 1 year ago. Google News gets a major revamp and an AI injection. Smarter and simpler than ever. Gmail's new 'Smart Compose' feature writes replies for you.

Data breach activity declines sharply in Younger generations lack understanding of cybersecurity careers. How to rollback and uninstall the Windows 10 April Update Comments. Everything removed or deprecated in the Windows 10 April Update 70 Comments. Fedora 28 is here -- download the overall best Linux-based operating system now!