Dogecoin vs litecoin profitability

48 comments

Copay bitcoin mining

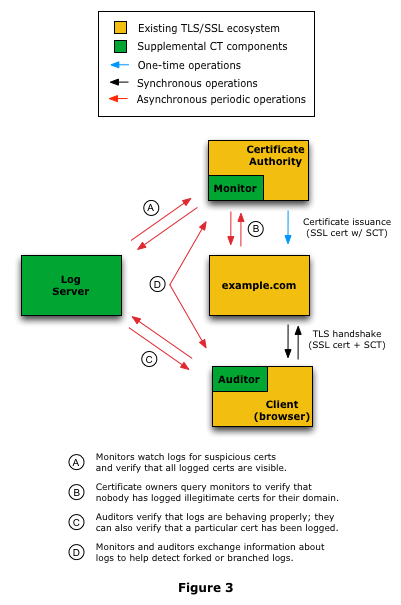

Certificate Transparency is an experimental protocol for publicly logging the existence of Transport Layer Security TLS certificates as they are issued or observed, in a manner that allows anyone to audit certificate authority CA activity and notice the issuance of suspect certificates as well as to audit the certificate logs themselves. The intent is that eventually clients would refuse to honor certificates that do not appear in a log, effectively forcing CAs to add all issued certificates to the logs.

Logs are network services that implement the protocol operations for submissions and queries that are defined in this document. Note that end user TLS clients are not responsible for validating CT logs, all they need to do is enforce a requirement that certificates must have extensions that show that they were issued under these procedures by validating a Signed Certificate Timestamp SCT data object presented with the TLS server certificate. Monitors and Auditors have the primary responsibility of detecting anomalous certificates that were never submitted to the logs.

According to wikipedia , the implementation status of the standard is as follows: Monitors are publicly run servers that periodically contact all of the log servers and watch for suspicious certificates.

For example, monitors can tell if an illegitimate or unauthorized certificate has been issued for a domain, and they can watch for certificates that have unusual certificate extensions or strange permissions, such as certificates that have CA capabilities. A monitor acts much the same way as a credit-reporting alert, which tells you whenever someone applies for a loan or credit card in your name.

Some monitors will be run by companies and organizations, such as Google, or a bank, or a government. Others will be run as subscription services that domain owners and certificate authorities can buy into. Tech-savvy individuals can run their own monitors. Auditors take partial information about a log as input and verify that this information is consistent with other partial information they have. An auditor might be an integral component of a TLS client; it might be a standalone service; or it might be a secondary function of a monitor.

Note that Auditors and Monitors also communicate with each other to exchange information about logs. This communication path, known as gossip, helps auditors and monitors detect forked logs. TLS clients are not directly clients of the log, but they receive SCTs alongside or in server certificates.

In addition to normal validation of the certificate and its chain, they should validate the SCT by computing the signature input from the SCT data as well as the certificate and verifying the signature, using the corresponding log's public key.

DG - Blockchain and Smart Contracts. A t tachments 2 Page History. Pages Home Use Cases. Created by Scott Shorter , last modified on Aug 09, Description Certificate Transparency is an experimental protocol for publicly logging the existence of Transport Layer Security TLS certificates as they are issued or observed, in a manner that allows anyone to audit certificate authority CA activity and notice the issuance of suspect certificates as well as to audit the certificate logs themselves.

Make it very difficult for a CA to issue a TLS certificate for a domain without the certificate being visible to the owner of that domain. Provide an open auditing and monitoring system that lets any domain owner or CA determine whether certificates have been mistakenly or maliciously issued. Protect users from being duped by certificates that were mistakenly or maliciously issued. Google launched its first certificate transparency log in March According to the list of known logs , there are 14 logs operated by 8 organizations.

If accepted by the log server, the submitter is given a Signed Certificate Timestamp SCT which represents the log server's agreement to incorporate the certificate in the log within a fixed amount of time. Log Server An entity that operates a log of certificates, based on a single, ever-growing, append-only Merkle Hash Tree of certificates.

The log server accepts requests from Submitters to add valid certificates to a Certificate Transparency log. Monitor Monitors are publicly run servers that periodically contact all of the log servers and watch for suspicious certificates. Auditor Auditors are lightweight software components that typically perform two functions.

First, they can verify that logs are behaving correctly and are cryptographically consistent. If a log is not behaving properly, then the log will need to explain itself or risk being shut down. Second, they can verify that a particular certificate appears in a log.

This is a particularly important auditing function because the Certificate Transparency framework requires that all SSL certificates be registered in a log. Powered by Atlassian Confluence 6. An entity that submits certificates to certificate logs for public auditing the certification authority that issues the certificates or the certificate owner. An entity that operates a log of certificates, based on a single, ever-growing, append-only Merkle Hash Tree of certificates.

Auditors are lightweight software components that typically perform two functions. TLS servers are the entities whose certificates are protected under the scheme.