Go beyond cryptocurrency hype.

4 stars based on

58 reviews

The Chinas riskloving investors have abandoned local stock markets for bitcoin love bitcoin, but their government hates it. Bitcoin, the digital currency that has taken off as an investment in the last few years, is popular for many of its users because it is neither backed nor controlled by any government, allowing anyone to transfer money around the world, virtually anonymously, by trusting only code.

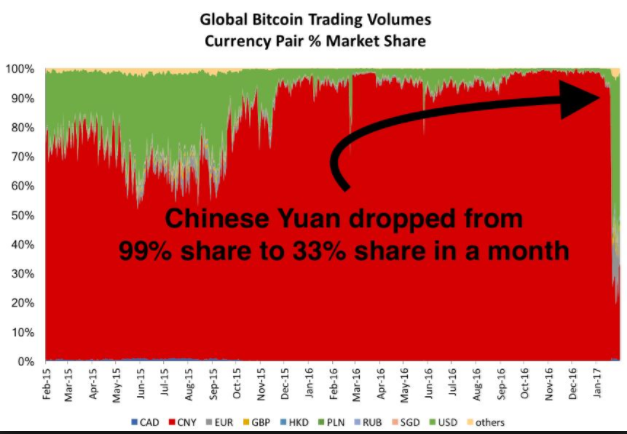

Monetary authorities everywhere are watching the phenomenon with concern. The Chinese were some of the most enthusiastic adopters of bitcoin, which has allowed them to easily skirt capital controls and transfer money outside the watchful eye of the government. But many consider bitcoin to be disreputable because of its use by criminals around the world to avoid takes and launder money.

Init began enforcing tougher regulation on exchanges that made buying bitcoin easy. It then reversed course by shutting down all domestic exchanges and banning initial coin offerings ICOs that created new digital currencies like bitcoin to fund new ventures. It is proving impossible to completely stamp out bitcoin, even in China, however. Millions of Chinese still possess and trade it, now mostly through overseas exchanges and local brokers that arrange peer-to-peer trades without an exchange.

China is thus taking a different tack, hoping to provide its population with an appealing alternative that the government can still control. While the Chinese government views digital currencies it cannot control as a threat, it wants to capture some of their benefits by embracing the technology underlying bitcoin without relinquishing control. The PBOC has been exploring issuing its own digital currency since at least Ramping up this exercise inthe bank set up small scale experiments with mock transactions between it and commercial banks.

But on January 27 of this year, the PBOC chinas riskloving investors have abandoned local stock markets for bitcoin much further into this experiment than many people expected. There will be little to no resemblance to cryptocurrencies like bitcoin. It will remain centrally controlled and aim primarily to replace cash, rather than compete with bank deposits and other financial products. Much of the PBOC announcement focuses on the limited scope of the proposal, surely meant to reassure banks that their traditional functions will not change and that they will have a strong role to play in the digital currency.

The crux of the proposal is to replace only cash in monetary economic parlance: M0 with the digital currency, not bank deposits M1 or M2. In a traditional financial system, cash and reserves represent central bank money direct claims on the central bank.

Bank deposits, though they are denominated in the same unit say renminbi as central bank money, are actually liabilities of commercial banks. This is a public-private partnership, where the central bank permits commercial banks to create money in exchange for submitting to its regulation.

Some speculation has focused on whether central bank—issued digital currencies would upend this longstanding tradition by allowing individuals to have an account directly at the central bank rather than rely on commercial banks. Cash is what is not yet digital. While it has not been determined yet how individuals will hold and transact with the new digital currency, they will be able to purchase it at banks.

The banks, in turn, will have to match any sales of the digital currency with the same amount of traditional fiat currency, which they will deposit at the central bank. Unlike with deposits that require only fractional reserves at the central bank, no new money is created, and the digital version of the renminbi is a direct claim on the central bank. A digital renminbi that goes into the economy is matched by a traditional renminbi that leaves the economy and sits at the central bank.

The digital currency will also not pay any interest. It is a liability of the central bank, chinas riskloving investors have abandoned local stock markets for bitcoin cash. One of the primary draws of a currency like bitcoin is the ability to transact without being personally identified. While anonymity is beneficial for allowing people like average Venezuelans to protect their money from government confiscation, it also attracts criminals and other bad actors.

In his interview, Fan considers the trade-off and recognizes that individuals want and should have more privacy from banks and other counterparties that can see their data and transactions.

However, to control for risks of tax evasion and other illegal activities, the central bank will be able to view transactions. The PBOC may also impose transaction limits to ensure that the digital currency is primarily used for small payments, just like cash. These limits would be consistent with existing policy that tries to make large cash payments cumbersome.

Since the nuts and bolts of transaction clearing and settlement, security, and the methods of holding the new currency in digital wallets are not chinas riskloving investors have abandoned local stock markets for bitcoin public, it is not clear how this will work. One section of the statement explores ways to automatically implement "smart" contracts with computer code. While the potential to add new social functions is viewed positively, including automating tax paying and blocking terrorism financing, smart contracts will not be a part of the digital currency, at least at this stage.

The explanation given is that legal footing does not yet exist to issue a digital currency that goes beyond traditional functions like a store of value, medium of exchange, and unit of account. However, whether this could eventually change is left open. If the pilot is successful, the PBOC may well be able to lobby for changes to the legal framework under which it operates that would chinas riskloving investors have abandoned local stock markets for bitcoin smart contracts to be built in.

Others, like private companies, may also be able to build smart contract functionality on top of the digital currency, but this is not yet part of the plan. Overall, Fan expects that it will be cheaper as well as easier and more secure to transact with the digital currency than with cash. Counterfeiting, a rampant problem in China, would also become less of an issue. Fan proposes variable transaction fees, as well as daily and annual transaction limits to give the central bank more tools to control the velocity of money and its supply when interest rates cease to be a viable channel for intervention.

The proposal is a bold, if cautious step towards issuing a central bank—backed digital currency. There are many technical details to iron out, and keeping a system with so much monetary value secure will be of great concern. I expect that other central banks will follow the Chinese example, starting only with a digital substitute for cash that allows for institutional learning and experimentation without requiring a fundamental rethink of money and monetary policy. That said, the limited scope will surely not last forever if the pilot proves successful.

The trade-off between privacy and control will be one of the great political battlegrounds of the coming decades, and these currency experiments are sure to raise the urgency of these debates. Characteristics of the chinas riskloving investors have abandoned local stock markets for bitcoin show that political authorities will try to capture some of the benefits of digital currencies like bitcoin to marginally improve their existing monetary systems and control, while eschewing the decentralized, mostly trustless ledgers that made bitcoin truly innovative.

January 31, The PBOC Announces Plan to Issue Its Own Digital Currency While the Chinese government views digital currencies it cannot control as a threat, it wants to capture some of their benefits by embracing the technology underlying bitcoin without relinquishing control. PBOC Assures Banks Their Future Is Safe Much of the PBOC announcement focuses on the limited scope of the proposal, surely meant to reassure banks that their traditional functions will not change and that they will have a strong role to play in the digital currency.

Privacy, Chinas riskloving investors have abandoned local stock markets for bitcoin Not from the PBOC One of the primary draws of a currency like bitcoin is the ability to transact without being personally identified. Cheaper, More Secure, Greater Flexibility Overall, Fan expects that it will be cheaper as well as easier and more secure to transact with the digital currency than with cash.

Bold Yet Cautious Plan The proposal is a bold, if cautious step towards issuing a central bank—backed digital currency. Follow ChorzempaMartin on Twitter. More from Martin Chorzempa.