How do bitcoin faucet work

21 comments

4gh s bitcoin chart

Lending Bitcoin on Poloniex currently earns 0. Who are you lending to? And why would the mostly anonymous borrower ever pay you back? This post will address these questions as more, as we dive into the fast and frequent world of lending to margin traders on Poloniex. At its core, lending on Poloniex is peer-to-peer margin lending.

In traditional financial markets, margin lending is mostly monopolized by the brokers who create the trading platforms. What makes this development exciting is that we can make money on cryptocurrency exchanges from something other than trading.

Lending to margin traders can be a lower risk though still not risk free way to earn a significant return on otherwise idle funds. The mechanics of lending on Poloniex are straightforward. Lenders deposit funds to their Poloniex account in the same way that traders do.

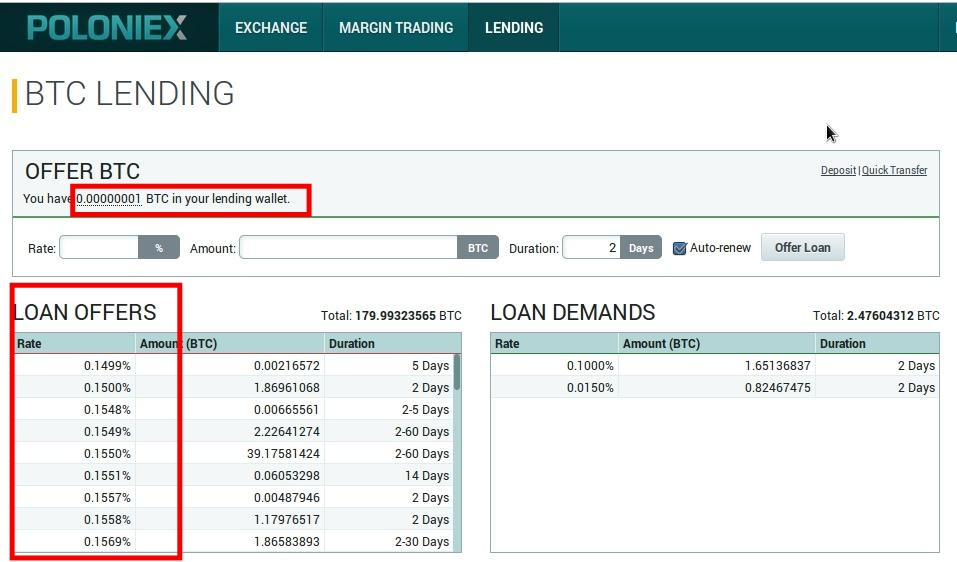

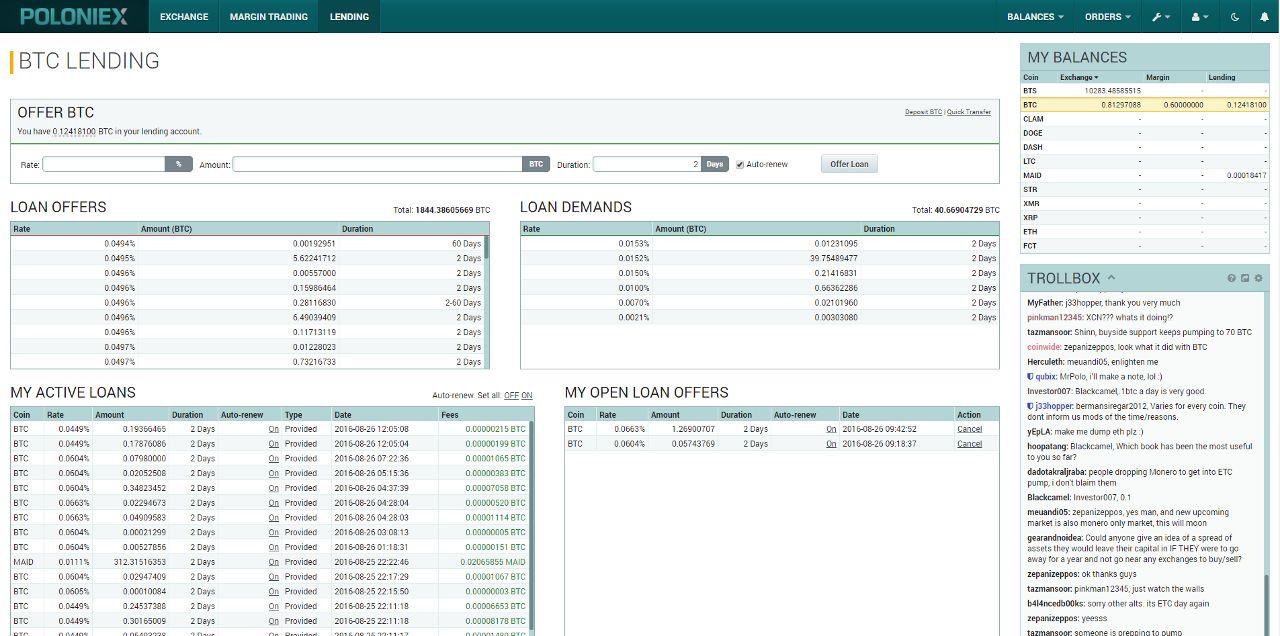

They transfer their balances to a lending sub-account and create loan offers for margin traders using the Poloniex loan order book. Loan offers for a given currency are organized in the order book based on how favorable they are to the borrower. Loan offers with lower rates and longer maximum durations get priority over loan offers with higher rates and shorter maximum durations.

When margin traders execute trades that require them to borrow funds, the Poloniex platform will match the trader with the best available loan offer the one at the top of the order book.

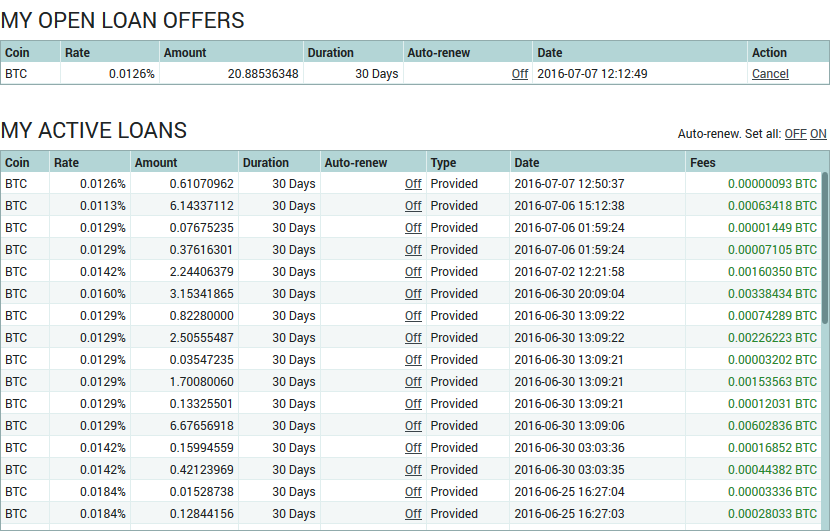

At this point, a loan is opened. The loan will stay open until the margin trader closes the trade or the maximum duration of the loan is reached. When a trade is closed, the interest on the trade is paid from the margin trader to the lender. The interest is calculated based on the agreed upon rate and the duration of the loan. In the lending market, demand originates with margin traders who want to borrow a specific cryptocurrency for the purpose of speculation.

Demand from margin traders will cause lending rates to rise as they compete to borrow funds. Supply in the lending market originates with lenders who wish to earn a return on their idle funds by lending them out. Excess supply will cause lending rates to fall because lenders will compete to offer the best rates to the margin traders.

It may seem unintuitive, but this huge increase in demand for Bitcoin loans was caused by the large increase in the Ether price. The Ether price increase created lots of demand from margin traders who wanted to borrow Bitcoin. The traders then sold this Bitcoin for Ether with the hopes that the Ether would continue to increase in price. Default rates in this scenario are high, especially in the cryptocurrency space where the lender has little recourse if the borrower defaults.

As soon as the borrower closes their trade, the funds are automatically returned to the lender. Additionally, Poloniex is able to implement strict risk controls for borrowers, where the borrower's loan is auto-liquidated if their available collateral drops below a certain threshold. As of this writing, our lending bot has completed , loans, with 0 defaults. The cryptocurrency space has been plagued with exchange hacks and failures, such as the now infamous Mt. If an exchange becomes insolvent or otherwise loses customer funds, there is a high probability of a substantial or total loss for the lender.

Exchange outages, and periods of high volatility are highly correlated because the increased trading volume caused by volatility taxes the exchange's servers. A temporary exchange outage during a period of high volatility could lead to margin traders losing all of the collateral in their accounts as well as some of their borrowed funds. In this situation, the trader would be unable to repay the entirety of their margin loan. When funds are on loan to margin traders, they are not available to be exchanged until the margin loan has matured.

Because the borrower will be making money from the crashing price, they will not want to close the loan, and you as the lender could be left holding the bag. While it is not without risk, peer to peer margin lending can be an effective way to earn a significant amount of interest on idle cryptocurrency.

It carries significantly less risk than trading, and should carry a substantially lower default rate than peer to peer lending on platforms where users have full custody of their borrowed funds. Do your diligence, never invest or lend more than you can afford to lose, and consider automating your lending for higher returns with less effort! This was really helpful. I just searched google for lending on poloniex and your article came up among others.

It is the best. I invested in Ether and as soon as I tripled my money I took out my original investment. Now I consider all my gains to be the house's money. So I'm looking to loan some out. Glad I found your post! The Long and the Short of Lending on Poloniex. Overview At its core, lending on Poloniex is peer-to-peer margin lending. Mechanics The mechanics of lending on Poloniex are straightforward. Supply and Demand In the lending market, demand originates with margin traders who want to borrow a specific cryptocurrency for the purpose of speculation.

Risks Lending to margin traders on Poloniex carries three main risks for the lender. Conclusion While it is not without risk, peer to peer margin lending can be an effective way to earn a significant amount of interest on idle cryptocurrency. Authors get paid when people like you upvote their post. Thanks for sharing, i'm new to margin trading on Polo and this explains a lot.