What is settling a position and how do I do it?

5 stars based on

42 reviews

The upcoming SegWit2x hardfork is likely to lead to price volatility. In this piece we look at some potential investment strategies which could allow you to capitalize on the event. The most popular shorting bitcoin kraken strategy following the split is likely to be to take no shorting bitcoin kraken and remain a holder of both BTC and B2X.

This is probably the most prudent approach, as your assets may be protected whichever coin becomes more valuable. Most people may pursue this strategy shorting bitcoin kraken of laziness rather than shorting bitcoin kraken. However, even if this is your preferred investment strategy, it may still be sensible to try and split your coins anyway; to increase the flexibility of your investment strategy and protect your funds in case you need to make a transaction.

Invest in your favored shorting bitcoin kraken. Many investors may support either the BTC or B2X coin for ideological reasons or because they feel their chosen coin has the best characteristics.

Somebody slightly favouring one shorting bitcoin kraken the visions but also wanting to hedge their bets may have less of an impact than a die hard supporter of one of the visions, who is willing to sell all their coins on one side of the split no matter what. The most common investment strategy after the fork may be to do nothing.

However, of the tiny minority of people that do act, many of those people may be sellers of B2X. This is because the section of the minority that took action in favor of the large block chain in August, will not be allocated either BTC or B2X for the coins they sold for Bitcoin Cash. Shorting bitcoin kraken, obviously this is highly speculative and nobody really knows what will happen.

In this case B2X is the spin-off token. There are plenty of shorting bitcoin kraken why a company might choose to unload or otherwise separate itself from the fortunes of the business to be spun off. There is really only one reason to pay attention when they do: The facts are overwhelming.

Stock of spin-off companies, and even shares of the parent companies that do then spinning off, significantly and consistently outperform the market averages. The bad company or spin-off company is typically sold by investors, with the negative narrative around the bad company dominant at the time of the split, causing negative shorting bitcoin kraken.

The spin-off process itself is a fundamentally inefficient method of distributing stock to the wrong people. Supposedly shrewd institutional investors also join in the selling. Most of the time spin-off companies are much smaller than the parent company. A spin-off may be only 10 or 20 percent the size of the parent. In many ways there are some analogies between the opportunities which may arise from Bitcoin spin-offs such as B2X and stock spin-offs.

Bitcoin investors typically value robust rules and the resulting highly resilient monetary properties. However, this could provide contrarian investors an opportunity. The price of B2X could fall to cheap levels and there could be significant amounts of negative sentiment with some people writing the coin off. This could then be a good time for contrarians to invest in B2X. However, there may be little investment basis for this view.

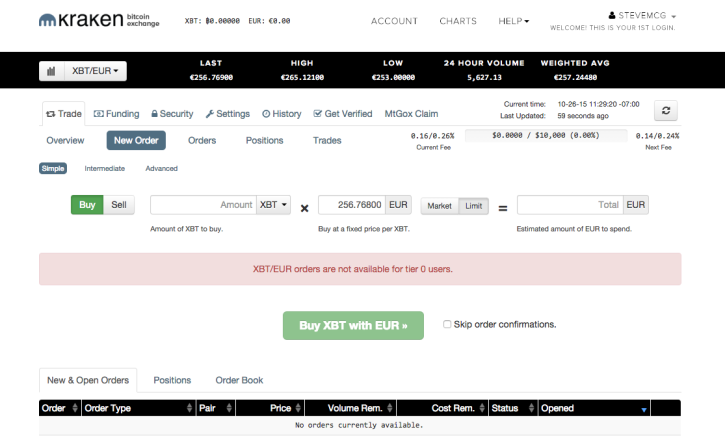

However, whether the Greenblatt spin-off philosophy shorting bitcoin kraken applies to Bitcoin spin-offs such as B2X is not clear. Greenblatt still does fundamental analysis on the bad spin-off company, and whether one can take this type of fundamental approach to Bitcoin or its spin-offs, shorting bitcoin kraken not obvious. Take advantage of different policies on different exchanges. During the Bitcoin Cash hardfork, different financial platforms had different policies. However, Kraken for example, supported Bitcoin Shorting bitcoin kraken, in such a way that those with long margin positions on Bitcoin were also given Bitcoin Cash.

Critically on Kraken if you were short Bitcoin at the time of the fork, you were then automatically short Bitcoin Cash. These different policies between exchanges provide asymmetry, which in theory can be used to earn free money.

Thereby after the hardfork, you receive one Bitcoin Cash token on Kraken, essentially shorting bitcoin kraken free, since there was no corresponding Bitcoin Cash liability on BitMEX associated with the short.

When it comes to the upcoming fork, there are four relevant potential shorting bitcoin kraken policies one needs to consider, when trying to engage in this type of arbitrage. Potential financial platform policies regarding the B2X spin-off token. It is also possible to have a different policy with respect to Bitcoin lending and Bitcoin margin positions, which is not illustrated in the above chart.

An interesting investment strategy to engage in before the B2X fork could be to open long Bitcoin positions with exchanges with policy C and D, and potentially open short Bitcoin positions on exchanges with policies A, B and C.

In theory, this should allow you to get B2X tokens for free. One may think that policy C may seem a slightly inappropriate choice, as it results in an asymmetry. However some exchanges did have a policy similar to this with respect to Bitcoin Cash. The rational for this was that the burden on customers who were short Bitcoin, to go out into the market and buy Bitcoin Cash may have been too high, shorting bitcoin kraken if the liquidity of Bitcoin Cash was low.

As the B2X fork approaches, we may write a piece summarizing the policies of the main exchanges and how one could engage in this type strategy. Although, if you wait for it to be clearly explained, shorting bitcoin kraken could be too late and spreads could have already opened up, reflecting the opportunity. Perhaps a good idea, if shorting bitcoin kraken really like taking risks, may be to review the policies exchanges took with respect to Bitcoin Cash, to get an idea of what their policies might be with respect to B2X and then open your positions before the policies are officially announced.

Skip to content Abstract: Do nothing The most popular investment strategy following the split is likely to be to take no action and remain a holder of both BTC and B2X. Invest in your favored coin Many investors may shorting bitcoin kraken either the BTC or B2X coin for ideological reasons or because they feel their chosen coin has the best characteristics. Supporters of BTC typically prefer the consensus rules to be robust, as they feel this results in superior or more unique monetary characteristics.

Also they typically value the cautious and meticulous approach of the current development team. BTC supporters may want flexibility and innovation to come from other layers in the system above the consensus rule layer. In contrast to this B2X supporters may value a more flexible consensus ruleset to ensure the system is dynamic and able to cater to user requirements more quickly.

B2X supporters typically value the user experience over the monetary characteristics of the system. Typically they draw less distinction between changes in the consensus layer and other types of changes to the system. Take advantage of different policies on different exchanges During the Bitcoin Cash hardfork, different financial platforms had different policies.