Game robot tr?n thoat kh?i nha tu

18 comments

Ubuntu bitcoin faucet bot v1 1

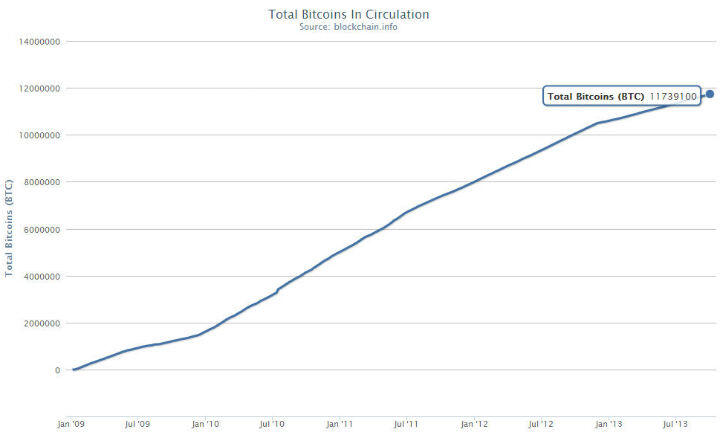

There will only ever be 21 million bitcoins in circulation. This point is central to the core monetary consensus around Bitcoin as a whole. The total issuance and inflation rate over time were parameters known from day one. These were both important properties for Bitcoin investors.

Deflationary assets with very public inflation rates are rare ; Bitcoin fills an extremely unique store of value property not necessarily found in other markets. Not all assets need a strictly defined monetary policy in the same way as Bitcoin. Even gold differs with the ability to mine at different rates. With Ethereum, these monetary supply parameters were not set in stone in the same way as Bitcoin.

Consensus formed around a model with an essentially undetermined cap. Ethereum's vision and the ultimate issuance mechanism were unknowns at the start of the project. The Proof-of-Stake consensus Ethereum hoped to transition to was uncharted waters. Early investors understood this uncertainty and the undetermined supply cap. Well undetermined is not entirely true; the current Ethereum Ice Age implemented as calcDifficultyDiehard in the Homestead release essentially limits the coin supply to just slightly over million.

By the blocktimes will be hundreds of seconds and increase rapidly. However, the implication of the Ice Age or 'Difficulty Bomb' is such that the community must form consensus on how to evolve the monetary policy at a certain point in time, otherwise the blocktimes will grow so long that the system becomes unusable.

If people want to keep using Ethereum, there must be a hardfork to change the mining difficulty and thus the inflation rate. Consensus must be formed by the community as to how best to evolve the economics. Ethereum is a system built with problems hinging on problems with unknown solutions.

There is even uncertainty that Proof-of-Stake and the implementation of Slasher consensus will be possible in the first place. Casper the PoS algorithm represents a significant area of economic and technical uncertainty around the Ethereum project. Vitalik and representatives from the Ethereum Foundation have been pretty clear that issuance under Casper PoS will be much lower than the current mining curve. While zero or even negative from fee-burning inflation rates have been mentioned as potentially possible, it has been made clear that it unknown what the exact rate will be.

This coin emission rate will be determined by the lowest amount needed to have a secure PoS consensus. I think we've been consistent on the issuance question. The issuance is whatever it needs to be to ensure reasonable lvl of security. Based on further comments by Vitalik, it looks like the initial version of Casper can expect to dole out.

It will be interesting to see how this inflation rate marriages with the burning of Ether and the loss of coins that will come with a heavily utilized system.

Once we add partial tx fee burning and if fees go up, may go to 0 or lower. World GDP growth represents a realistic long-term cap on inflation. I do not think a higher rate of inflation is sustainable long term.

This hovers around 2. As the Ethereum Foundation continues their groundbreaking work on PoS consensus and protocol validation, users will get a much better view of what the long term monetary supply will be. Negative inflation is interesting. We just don't know. Well not to mention anything about the stark contradiction to their immutability claims but Ethereum classic has implemented and finalized a monetary policy. Barry Silbert likes to poke and prod on twitter about Ethereum being 'uncapped' and the Silbert-owned Grayscale investments blabs on about this in their 'Investment Thesis'.

Ethereum Classic makes false statements about ETH supply not consistent with the Ethereum Foundation's roadmap or guidance. This is misleading and frustrating from an asset with a monetary policy designed especially to be attractive to institutional investors through the shady Ethereum Investment Fund. ETC is not moving to PoS consensus so this discussion is not entirely relevant; only Ethereum Classic pumpers misleading others about the monetary policy of Ethereum.

None of them know what they are talking about. They just want their classic coins to be worth something, maybe they will be. I would add that the point of a blockchain is not "monetary policy" and blockchains that focus on it to the detriment of everything else are missing the point.

Inflation exists to pay for security. It serves a purpose. So Ethereum's inflation should be very low. This has been the design forever yet opportunists and partisans lawyer this point as if Ethereum has crazy highm uncapped inflation. VitalikButerin barrysilbert newcurrency VladZamfir josephjpeters kallerosenbaum Barry, fix Ethereum inflation… twitter.

Someone could fork bitcoin and make more coins. The problem is getting everyone who uses Bitcoin to use that version. Not many people conceivably would because the main social contract behind Bitcoin is the coin limit. The inflationary aspect of the currency is what scares me as well, over the long term it seems like currencies with a finite production limit should do better.

Well we don't even know if inflationary is what ethereum is going to be. There is nothing wrong with inflation. It might be necessary to provide the security of the network. I too am really concerned about Ethereum's lack of monetary policy. I have a suspicion that ETH might well run into issues if killer dApps don't start to be released soon.

Is ETH to be the internet of agreements, or are other blockchains going to take that title from it? I think there needs to be something big happening in the Ethereum world really soon, and Casper just won't really cut it. The whole point of this post is to show that Ethereum does have monetary policy. Casper is the best shot at scaling blockchains to date. There is plenty big happening in Ethereum.

Great thoughts as useful. I really need to keep up with ETH developments better. There are just so many things happening. Do you know how progress is going on sharding? All I know is that it is technically difficult and potentially increases the attack surface for the network. Wonderful explanation for those of us me that don't take enough time to really understand these things.

I wish my upvote counted for more solely to give you credit for your on-point posts. An Ethereum monetary policy? Bitcoin maximalists and ETC pumpers will go on and on about how the supply of ETH is not capped and how terrible that is. What is the monetary policy of Ethereum? How many coins will there be in 6 months?

Has the Ethereum foundation wavered on the future Ether issuance? The monetary policy is not the hot topic for today. What about Ethereum Classic Well not to mention anything about the stark contradiction to their immutability claims but Ethereum classic has implemented and finalized a monetary policy.

Authors get paid when people like you upvote their post. I was active in the Tweet thread about this. I saw that, would have liked but I don't have a Twitter. What was with that troll. I love this quote. I am just a bot trying to be helpful. There is a reason that limit is so highly regarded.

Where else is it bigger? Discount Ether today lol Sharding and Casper are unsolved problems that have glimmers of light but a lot of work ahead.

Vitalik Buterin tweeted 27 Jun - I believe in ETH. Most of my savings are ETH based!