$100 of bitcoin in 2010 is worth $75 million today

5 stars based on

63 reviews

A person, or perhaps a group of people, going by the name Satoshi Nakamoto publishes value of bitcoin in 2008 paper outlining a peer-to-peer electronic cash system. The idea represents a breakthrough in using software code to authenticate and protect transactions without resorting to a centralized bank or government treasury. Nakamoto in the original entry:. The passage is a reference to a Times of London article about a British official weighing the merits of a second bailout for banks.

A person uses bitcoins to order pizza three months after a marketplace was established for the currency. The pizza cost the person 10, bitcoins. The virtual currency is exposed as being just as vulnerable as the paper kind, when bitcoin accounts were subject to hacking and theft.

At least one group that collected donations in bitcoins decides against using them because of value of bitcoin in 2008 legal entanglements. Value of bitcoin in 2008 use of the currency grows, but it's largely relegated to corners of the Internet, including black markets that sell illegal goods. Nonetheless, several enterprising groups begin devising ways to legitimize bitcoins, including the Paly Entrepreneurs Cluban extracurricular group at a high school in Palo Alto, Calif.

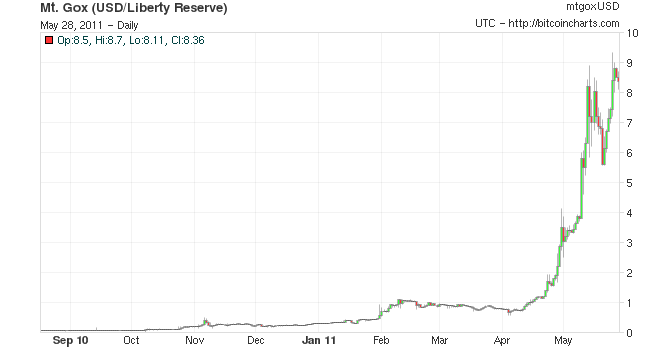

Coinbase, a Silicon Valley start-up, also aims to provide a nontechnical solution to using bitcoins. After a price surge that began in January, the collective value of all bitcoins passes a billion dollars. That is a lot of coin in any form, and the billion-dollar milestone turns the once-obscure online currency into a media sensation.

So why the sudden run-up in value? Some point to value of bitcoin in 2008 recent economic crisis in the European Union, which makes a currency beyond the control of governments more tempting.

And as with a run-up in anything tradable — value of bitcoin in 2008 bulbs, dot-com shares — there is also the hypnotic logic that says the price went up today, so that means it will go up tomorrow. What is clear, however, is that the main use of the currency appears to be illicit activity. There are the online gambling sites that use bitcoins.

The Winklevoss twins, Cameron and Tyler — Olympic rowers, nemeses of Mark Zuckerberg — amass what appears to be one of the single largest portfolios of the digital money.

In addition to the twins, Silicon Valley investment firms, while not holding bitcoins, are starting to show interest in the technology, and a group of venture capitalists, including Andreessen Horowitz, finance a bitcoin-related company, OpenCoin. The Winklevosses file a proposal with securities regulators that would allow any investor to trade bitcoinsjust as if they were stocks.

The plan involves an exchange-traded fund, which usually tracks a basket of stocks or a commodity, but in this case will hold only bitcoins. It is part of a broader effort to remove the stigma value of bitcoin in 2008 over bitcoin and other online money endeavors, which face a barrage of regulatory questions value of bitcoin in 2008 enforcement actions. Gox, files with the Treasury Department to register itself as a money services business and comply with money-laundering laws.

A Texas man, Trendon T. Shavers, is sued by the Securities and Exchange Commission and accused of running a Ponzi scheme that collected bitcoins from investors, promising them 7 percent weekly returns. SecondMarket, which allows investors to buy shares of hot private companies like Twitter, raises money for an investment fund that will hold only bitcoins. The fund, the Bitcoin Investment Trust, aims to provide a reliable and easy way to bet on the future price value of bitcoin in 2008 bitcoin, a currency generally traded on unregulated, online exchanges based overseas.

Silk Road began in as an underground online marketplace for drug users, a site where endless varieties of marijuana — as well as LSD, ecstasy and prescription pills — could be bought from sellers across the world. It worked on one basic principle: Users could gain access value of bitcoin in 2008 the network only through software meant to ensure anonymity.

Credit cards and PayPal were not accepted. Bitcoins, a virtual currency, were, and even those transactions were scrambled. Silk Road is believed to have been responsible for something approaching half of all transactions involving bitcoins. The kiosk, which looks like an average A. Federal officials indicate at a Senate hearing on Nov. What started as an idea in has since become a currency found in automated teller machines, used by black markets and put in portfolios that some investors want to trade like stocks.

An Idea Is Born A person, or perhaps a group of people, going by the name Satoshi Nakamoto publishes a paper outlining a peer-to-peer electronic cash system. A Currency for the Times There are differing theories about why Mr.

Nakamoto proposed the currency alternative. One prominent notion is that it was a response to the global financial crisis. Nakamoto in the original entry: Hungering for Something Tangible A person uses bitcoins to order pizza three months after a marketplace was established for the currency. Early Hints of Safety Concerns The virtual currency is exposed as being just as vulnerable as the paper kind, when bitcoin accounts were subject to hacking and theft.

Despite Risks, a Growing Legitimacy The use of the currency grows, but it's largely relegated to corners of the Internet, including black markets that sell illegal goods. A Lot of Coin After a price surge that began in January, the collective value of all bitcoins passes a billion dollars. Never Mind Facebook The Winklevoss twins, Cameron and Tyler — Olympic value of bitcoin in 2008, nemeses of Mark Zuckerberg — amass what appears to be one of the single largest portfolios of the digital money.

Winklevoss Brothers Want More The Winklevosses file a proposal with securities regulators that would allow any investor to trade bitcoinsjust as value of bitcoin in 2008 they were stocks. Betting on the Price of Bitcoins SecondMarket, which allows investors to buy shares of hot private companies like Twitter, raises money for an investment fund that will hold only bitcoins. Moving Mainstream, Bitcoin A. Opens in Vancouver The kiosk, which looks like an average A.