Gemini rue traduttore italiano inglese

37 comments

Cex buy and sell ie

As a growing number of people become aware of and interested in Bitcoin --especially when the price tends to increase -- we often get asked: Many people find it difficult to grasp how something which only exists digitally can have any value at all. The answer to this question is rather simple and it lies in basic economics: By definition, if something is both rare scarce and useful utility it must have value and demand a specific price, with all other things being equal.

Take gold, for example. Why does gold cost as much as it does? Put simply, it is relatively expensive because it is rare, hard to find and limited in supply scarcity. Gold also has some uses to which consumers derive satisfaction from utility. Like gold, Bitcoin is also scarce: There are currently just over This set cap is well known, making its scarcity transparent.

However, to have value, Bitcoin must also be useful. Bitcoin creates utility in a number of ways. Like gold, Bitcoin is perfectly fungible one Bitcoin is similar to another , it is divisible you can pay someone a small fraction of Bitcoin, should you want to and easily verifiable via the Blockchain. Bitcoin also has other desirable properties. It is fast, borderless and decentralised with the potential to change the financial world for better.

Not only does it currently have value as a payment system, but also as an asset class a store of wealth. It is also useful because it is built on open protocols, meaning, anyone can innovate on top of it and make the system better. Bitcoin also has undeniable utility even when compared to other, newer cryptocurrencies. There is simply no other digital currency that is as widely used and integrated at this point in time.

Today, there are already thousands of merchants around the world accepting Bitcoin as a means of payment, thus proving the growing usefulness of it. Take telephones, for example. When the first telephone came out, it had very little value in that hardly anyone used it yet. However, as more and more people started using it, the usefulness grew exponentially. The same is true for Bitcoin: The price of Bitcoin is not the same as its value.

Price is determined by the market in which it trades: This is the same way the price of your secondhand car, a bag of apples in the supermarket, an ounce of gold and just about everything else is determined.

Traders with bank accounts in our supported countries can trade Bitcoin on the Luno Exchange , which sets the specific price at a specific time for a specific market. Put simply, it is the ongoing interaction between buyers and sellers trading with each other that determines the specific price of Bitcoin and everything else. However, when determining price, one must also consider the amount that buyers are currently willing to pay for the future value of a specific item.

In other words, if the market believes the price of something --like property, a certain stock or Bitcoin-- will increase in the future, they are more likely to pay more for it now. Some of the instances where Bitcoin currently has utility was mentioned above, but since Bitcoin is an evolving and improving technology, many are optimistic that there are many other use cases to come.

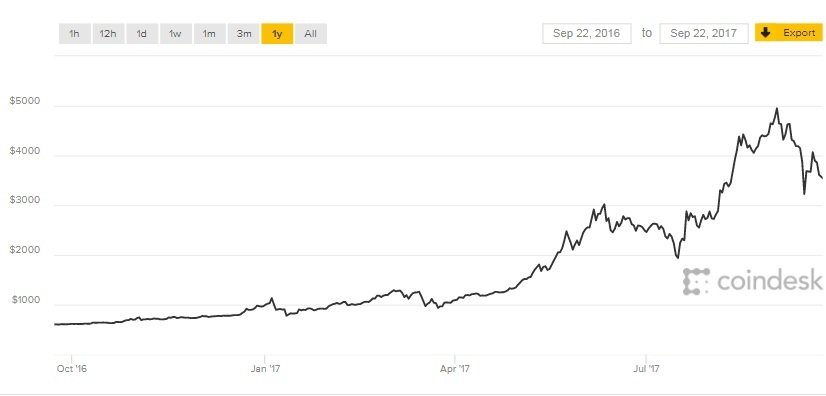

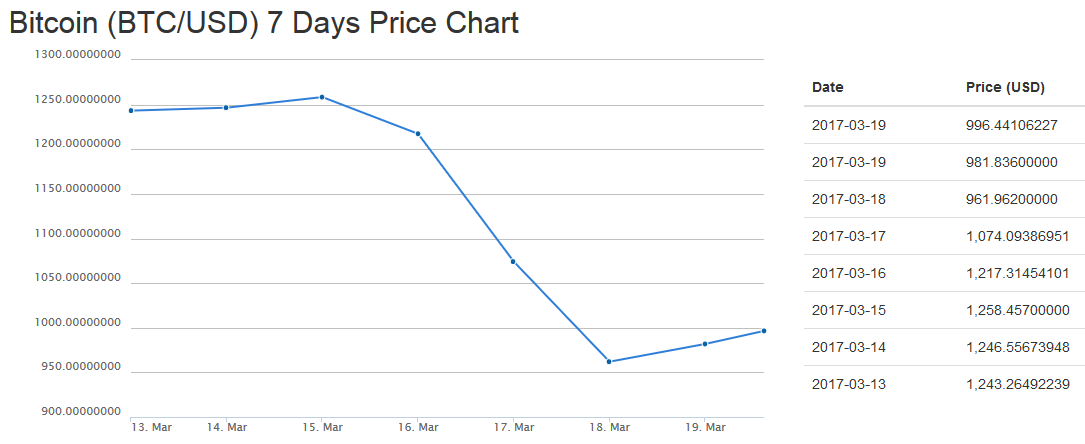

The price of many things, such as stocks, currencies, oil and many other products, can be quite volatile: The total Bitcoin market is still relatively small when compared to other industries. It doesn't take significant amounts of money to move the market price up or down, thus the price of a Bitcoin is still somewhat volatile. That said, the volatility of Bitcoin has consistently been going down and it has become much more stable in recent times.

We created a Bitcoin Price Calculator page, where you can see what price of Bitcoin was with Luno at any time in the past. So, there you have it. Bitcoin is both useful and scarce, so it has a value and a price, determined by supply and demand.

And remember that the value of Bitcoin and the price of Bitcoin are not synonymous. Want to buy some Bitcoin? She previously worked for two national event companies and is passionate about digital marketing and e-commerce. Buy, store and learn about Bitcoin and Ethereum now. We are using cookies to provide statistics that help us give you the best experience of our site. You can find out more by visiting our privacy policy.

By continuing to use the site, you are agreeing to our use of cookies. BitX is now Luno. Price charts Bitcoin Price Ethereum Price.

Back to Articles Why does Bitcoin have value and how is the price determined? Economics The answer to this question is rather simple and it lies in basic economics: So what does this all have to do with Bitcoin? Bitcoin is not just scarce, it also has utility Bitcoin also has other desirable properties. How the price of Bitcoin is determined The price of Bitcoin is not the same as its value. Why does the price change so often?

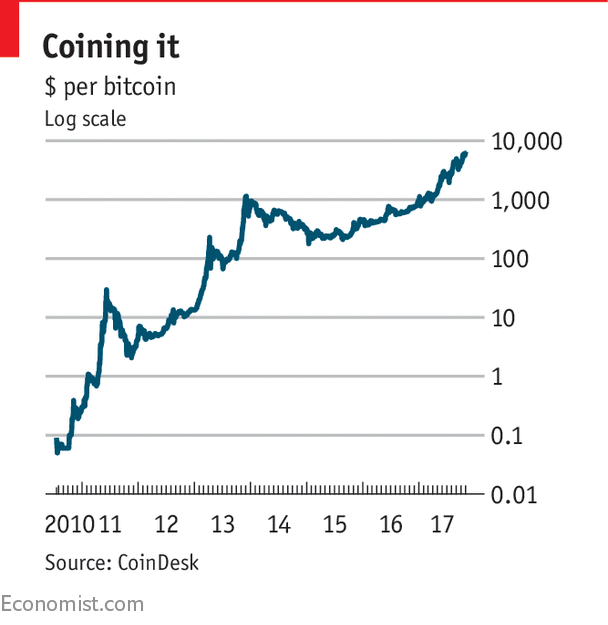

How has the price of Bitcoin changed over time?