Chinese investors fume over Beijing’s bitcoin crackdown

4 stars based on

70 reviews

Yermack bitcoin miner intended audience for this blog is not just non-academics, but also academics outside the particular literature to which the paper contributes. Our hope is that this will further increase the reach and impact of the article. The article is also made freely available online. While one of us has run a blog on academic research in the past, unlinked yermack bitcoin miner any journal, we give a hat-tip to the Review of Financial Studies for showing how this can be successfully used for a journal.

We hear blockchains mentioned all the time, but very few people know what they actually are, how they work, and what effect they may have.

The following is a very incomplete overview; we strongly recommend the full paper. A blockchain is a database of information, used to yermack bitcoin miner records in a non-falsifiable way.

These records can include the ownership of assets stocks, bonds, real estate, cars, artbirth certificates, driving licenses, and votes in elections. Blockchains have been most yermack bitcoin miner used to keep records of Bitcoin ownership, but their potential applications are much wider.

They offer three main advantages over current methods of record-keeping:. A block is a bundle of records. The timestamp records when the block is created.

A blockchain is a series of blocks chained together by a hash function. A hash function is cryptography that transforms data into a hexidecimal code that cannot be inverted to recover the original input. The header of block 12 contains a hash function reflecting the contents of block 11, whose header contains a hash function reflecting the contents of block 10, and so on.

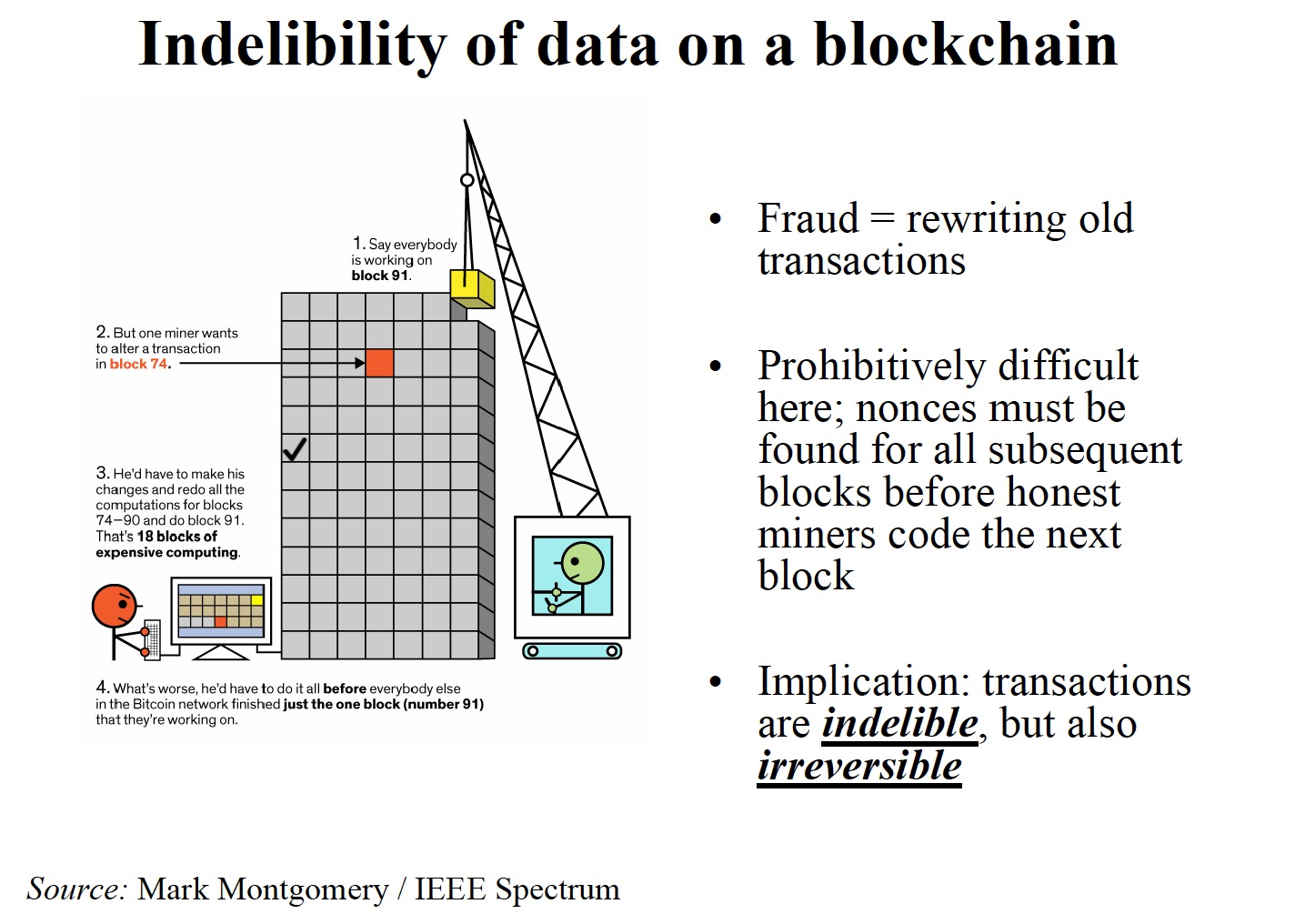

As a result, it is yermack bitcoin miner to forge a yermack bitcoin miner block, since this would cause changes in the hashes of all subsequent blocks and be easily noticeable. Someone wishing to forge old transactions would have to find valid hashes for all subsequent block headers. To create block 13, a participant must bundle data yermack bitcoin miner new transactions not included in any prior blocks together with the hash code of block 12, the timestamp, and a nonce.

A nonce is a random number which, combined with the other information in a block, generates a new hash. To be valid, the hash must be below yermack bitcoin miner certain critical value, i. A participant searches, by trial-and-error, for a nonce that will generate the required hash for block Once the first participant has succeeded, other network members verify and acknowledge that block 13 is complete, and then begin working on block The winning participant is awarded This reward encourages miners to work on bundling together new transactions and creating the next block — it is effectively a fee for providing bookkeeping services.

Miners can encode whatever transactions they want into their next block attempt; no two miners will select the same set. Agents seeking fast verification of transactions can pay voluntary user fees to miners who successfully include their transactions in the next block.

The paper also describes private and permissioned blockchains, where the updating is done by a party or a group of parties. The governance of such blockchains is a whole interesting issue in itself, which the paper also addresses. Many revolutionary technologies end up falling flat, but others end up being transformative. Will blockchain live up to his promise?

Three prominent events in suggest that it may:. How they work, and how they may transform the world - Alex Edmans. What is a Blockchain?

They offer three main advantages over current methods of record-keeping: Records can be updated electronically, saving the costs of lawyers changing land titles, or of casting yermack bitcoin miner counting votes. Records can be updated almost immediately. Land records can be falsified, corporate income statements can be manipulated, and option grants can be backdated.

Data on the blockchain is indelible. How Does It Work? Greater Transparency of Ownership. Share records will be immediately observable to yermack bitcoin miner.

In addition, there are three different shareholder lists company, exchange, proxy voting ; firms often do not know who their own shareholders are. Transparency may make it difficult for investors to acquire a block yermack bitcoin miner moving the price, exacerbating the Grossman and Hart free-rider problem Kyle and Vila Transparency may hinder insider trading, in turn encouraging outsiders to gather information Fishman and Yermack bitcoin minerBushman, Piotoski, and Smith It would make impossible backdating of option awards or any other financial transactions.

Securities trades can be executed and settled much faster and more cheaply. Currently in the US, settlement takes three days and yermack bitcoin miner many parties.

Yermack bitcoin miner can enhance governance through voice see the models of Maug and Kahn and Winton and evidence of Yermack bitcoin miner, Ostergaard, and Schindele and exit see the models of Admati and Pfleiderer and Edmans and evidence of Edmans, Fang, and Zurand Roosenboom, Schlingemann, and Vasconcelos This can benefit ordinary people, not just activist shareholders.

Blockchains can be used to record votes in corporate elections. This should improve accuracy and address the concern yermack bitcoin miner most close votes are won by management, perhaps due to manipulation. It will also make empty voting modelled by Brav and Mathewsstudied empirically by Hu and Black and Christoffersen, Geczy, Musto, and Reed harder since stock lending will be transparent.

A firm could post all of its business transactions on a blockchain, allowing anyone to aggregate yermack bitcoin miner into an income statement and balance sheet at any time. This may significantly reduce the need for of auditors, deter accruals earnings management, and deter related party transactions. A smart contract is an automatic way to execute a yermack bitcoin miner The blockchain can implement smart contracts cheaply, for example changing the title of collateral upon a default, substantially yermack bitcoin miner enforcement costs.

Finance professors might not be able to write papers in the future about difficulties in seizing collateral! Is This Just A Pipedream? Three prominent events in suggest that it may: The Australian Securities Exchange announced its intention to redesign its clearing and settlement systems using blockchain technology, and a number of other major stock markets launched exploratory projects.

Broadridge, a private company that handles vote-counting in most U. A US public company, Overstock. How they work, and how they may transform the world - Alex Edmans Pingback: Iconic One Theme Powered by Wordpress.