Jim Rickards Blog

4 stars based on

53 reviews

As we kickoff the new year, the biggest surprise will be that China is going to replace the dollar with a gold-backed currency in Historians are sure to have a field day, with an endless stream of head-spinning headlines to pick from to launch their investigations.

But as bitcoin 10000 usd to rmb, sometimes the most important bitcoin 10000 usd to rmb — the ones that will likely have the biggest impact on the future — get largely overlooked. Or if they get attention, their true significance is missed. As we beginit seemed worthwhile to look back at to list the items that caught my eye as having particular resonance and to explain how I interpreted them.

Am I cherry picking? Yes, of course, to some degree. But I think that from a future vantage bitcoin 10000 usd to rmb it will be clear that the most significant overarching development this decade was a broad shift in power from West to East.

The shift is already underway, but the following items are warning signs that it will only accelerate. Even if it had been uneventful, this first meeting between the relatively new U.

And as it turned out, it was anything but uneventful. As the leaders dined together on April 6, U. Heightening the drama, North Korea had just tested a ballistic missile that landed in the Bitcoin 10000 usd to rmb of Japan. While the missile attack on Syria was praised as a sign of U. Rather, I think Russia had a hand in the Syrian chemical attack that provoked the U.

It managed to produce only a few hundred cars in the quarter, dramatically below what it had projected and nowhere near its target of 10, a week. Because a reserve currency has always gone hand in hand with military as well as economic might, and China clearly has the military resources to protect the territory in which the new reserve currency would hold sway.

It said the sweet spots already have been disproportionately drilled and fewer remain. This means obtaining oil from shale will become increasingly expensive and less productive.

If production falters, oil prices, which already have firmed, will continue to strengthen, and other commodities will rise in their wake. Gold, whose role historically has been to serve as a currency in times of commodity scarcities, will rise even faster.

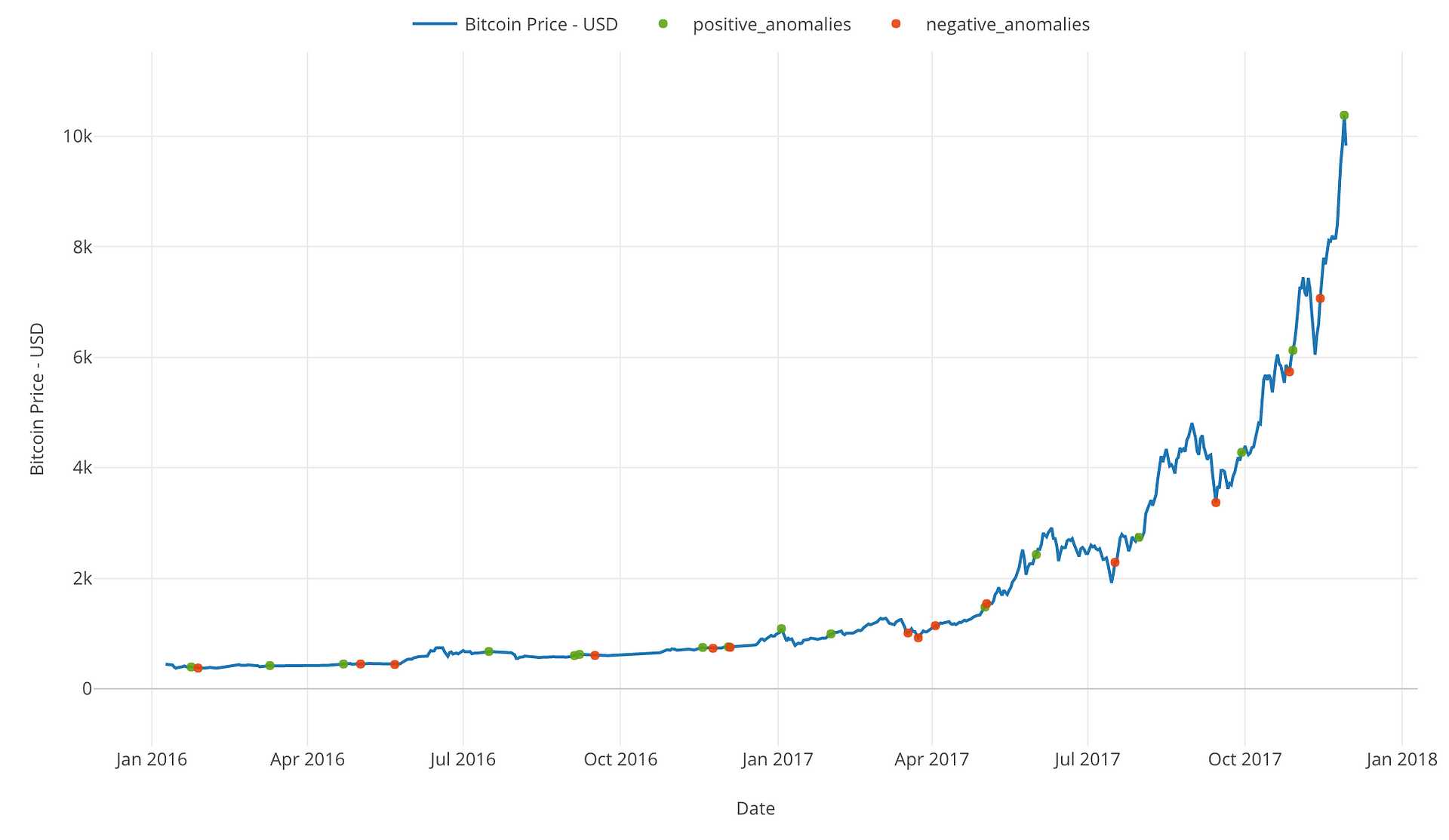

Chinese officials viewed the extreme volatility in Bitcoin and other cryptocurrencies as a potential bubble that could undermine the economy. Strikingly, however, it allowed the mining of cryptocurrencies to continue.

The significance By permitting continued mining, China is letting miners gain valuable experience in creating the blockchains that are associated with cryptocurrencies. The motivation is that blockchains will be essential in facilitating a new gold-backed monetary system. Such transactions would be immensely complex, and probably the only way to implement the system effectively would be to record bitcoin 10000 usd to rmb transactions on blockchains.

The Significance I see this as an initial experiment in bringing in blockchains to facilitate international trade, a vital step in creating a new reserve currency.

The study said 6. I see this as a tactic to keep the West off its back while it proceeded sub rosa with plans to gain an even greater role on the global stage, particularly by replacing the dollar with a new reserve currency eventually tied to gold.

A ratio of 1 would mean that the cash a company nets before interest, expenses, taxes, etc. After a decade in which the ratio for the 4, companies oscillated around 2, it dropped sharply in to 1. The Western world has long believed China has a major corporate debt problem.

This means China is free to generate bitcoin 10000 usd to rmb growth, including by going all out with infrastructure creation within its borders and in the developing world at large. That will spur global growth and will mean rising demand for commodities, which in turn will be good for gold. And it leaves China strongly positioned to move ahead with its plans for a new monetary system. It would begin by being traded in yuan — supplanting the dollar as the currency for oil trading — moving to trade in yuan backed by gold and then to a basket of currencies that includes both the bitcoin 10000 usd to rmb and gold.

Trading on an oil benchmark in the Shanghai free zone is enormously significant because traders within that zone are permitted, in contrast to elsewhere in China, to take gold out of the country. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged. King World News View all posts.