Bitcoin mining with an antminer s9 in september 2017oudatedcheck desc

17 comments

Buy windows 7 32 bit os

The legal status of bitcoin varies substantially from country to country and is still undefined or changing in many of them. While some countries have explicitly allowed its use and trade, others have banned or restricted it. Likewise, various government agencies, departments, and courts have classified bitcoins differently. While this article provides the legal status of bitcoin, regulations and bans that apply to this cryptocurrency likely extend to similar systems as well.

According to the European Central Bank , traditional financial sector regulation is not applicable to bitcoin because it does not involve traditional financial actors.

The European Central Bank classifies bitcoin as a convertible decentralized virtual currency. In the European Parliament's proposal to set up a taskforce to monitor virtual currencies to combat money laundering and terrorism, passed by votes to 51, with 11 abstentions, has been sent to the European Commission for consideration.

As of [update] bitcoin was legal in Algeria, but per the Huffington Post , "Algeria is going to ban bitcoin in the new Finance law of article of the law " [13]. Virtual currency is that used by internet users via the web. It is characterized by the absence of physical support such as coins, notes, payments by cheque or credit card. Any breach of this provision is punishable in accordance with the laws and regulations in force. The following day, the monetary authorities also reacted in a statement issued jointly by the Ministry of Economy and Finance, Bank Al-Maghrib and the Moroccan Capital Market Authority AMMC , warning against risks associated with bitcoin, which may be used "for illicit or criminal purposes, including money laundering and terrorist financing".

On 19 December , Abdellatif Jouahri, governor of Bank Al-Maghrib, said at a press conference held in Rabat during the last quarterly meeting of the Bank Al-Maghrib's Board of that bitcoin is not a currency but a "financial asset", He also warned of its dangers and called for a framework to be put in place for consumer protection.

As of 17 January , The Central Bank of Nigeria CBN has passed a circular to inform all Nigerian banks that bank transactions in bitcoin and other virtual currencies have been banned in Nigeria. It noted that "Central bank cannot control or regulate bitcoin. Central bank cannot control or regulate blockchain. Just the same way no one is going to control or regulate the Internet. In September the Bank of Namibia issued a position paper on Virtual Currencies entitled [23] wherein it declared cryptocurrency exchanges are not allowed and cryptocurrency cannot be accepted as payment for goods and services.

The Reserve Bank Of Zimbabwe is sceptical about bitcoin and has not officially permitted its use. Bitcoin would seem to be classified pursuant to the current provisions of the PPSA simply as an " intangible ".

As of April the Bank of Montreal BMO announced that it would ban its credit and debit card customers from participating in cryptocurrency purchases with their cards [31].

Treasury classified bitcoin as a convertible decentralized virtual currency in Per IRS, bitcoin is taxed as a property. In September , a federal judge ruled that "Bitcoins are funds within the plain meaning of that term". Bitcoin is legal in Mexico as of It is to be regulated as a virtual asset by the FinTech Law.

News reports indicate that bitcoins are being used in the country. The Costa Rican Central Bank announced that bitcoin and cryptocurrencies are not consider currencies, and are not backed by the government nor laws. However, they are not illegal.

There are a few merchants who do accept bitcoins in the country. The Bank of Jamaica BoJ , the national Central Bank, has publicly declared that it must create opportunities for the exploitation of technologies including cryptocurrencies.

Accordingly, in the BoJ will be embarking on a campaign to build awareness of cryptocurrencies as part of increasing general financial literacy and understanding of cryptocurrencies.

Indications are that early BoJ signals point to their general framework on "electronic retail payment service systems" possibly being brought to bear on initial cryptocurrencies considerations.

Bitcoins may be considered money, but not legal currency. A bitcoin may be considered either a good or a thing under the Argentina's Civil Code, and transactions with bitcoins may be governed by the rules for the sale of goods under the Civil Code. The Central Bank of Bolivia issued a resolution banning bitcoin and any other currency not regulated by a country or economic zone in Not regulated, according to a statement by the Central Bank of Brazil concerning cryptocurrencies, but is discouraged because of operational risks.

There is no regulation on the use of bitcoins. A 26 March by Superintendencia Financiera de Colombia states that the use of bitcoin is not regulated. The Ecuadorian government has issued a ban on bitcoin and other digital currencies. Ecuador's new project would be controlled by the government and tied directly to the local currency—the dollar. Users will be able to pay for select services and send money between individuals.

This was slated to begin in mid-February Bitcoin is considered a commodity, [47] not a security or currency under the laws of the Kyrgyz Republic and may be legally mined, bought, sold and traded on a local commodity exchange. The use of bitcoins is not regulated in Cyprus. As a DMCC licensed company, Regal Assets DMCC operates in a secure regulated trading environment and offers a service to global investors to the highest standards of international compliance.

As of , the Israel Tax Authorities issued a statement saying that bitcoin and other cryptocurrencies would not fall under the legal definition of currency, and neither of that of a financial security, but of a taxable asset. Bitcoin is not banned by any governmental party in Saudi Arabia. The government of Jordan has issued a warning discouraging the use of bitcoin and other similar systems. The Central Bank of Jordan prohibits banks, currency exchanges, financial companies, and payment service companies from dealing in bitcoins or other digital currencies.

The government of Lebanon has issued a warning discouraging the use of bitcoin and other similar systems. Bitcoin is not regulated as it is not considered to be electronic money according to the law. Bitcoin is neither recognized nor regulated in Iran. Government officials, however, discourage investing in cryptocurrencies until after the regulations are made.

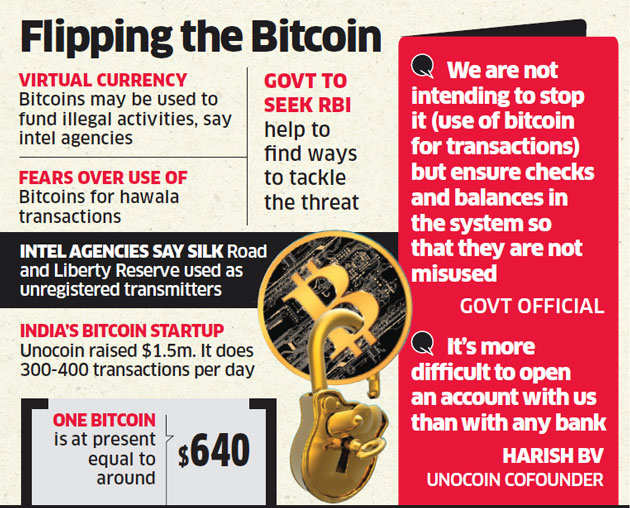

In September , Bangladesh Bank said that "anybody caught using the virtual currency could be jailed under the country's strict anti-money laundering laws". Finance minister Arun Jaitley, in his budget speech on 1 February , stated that the government will do everything to discontinue the use of bitcoin and other virtual currencies in India for criminal uses.

He reiterated that India does not recognise them as legal tender and will instead encourage blockchain technology in payment systems. On 13 August Nepal Rastra Bank declared bitcoin as illegal. This news was followed right after India's restriction of converting bitcoin and cryptocurrencies into fiat currency. For organizations and institutions it is banned by State Bank of Pakistan.

Bank will not get involved if there is any dispute. They will not facilitate any transaction for it. For individuals, it is neither legal nor illegal and they can hold cryptocurrencies at their own risk. National Assembly of Pakistan can pass law to declare bitcoin legal or illegal in Pakistan, but there is no such news from National Assembly yet. The bank has issued an official notice on its website and has also posted the news on its official Twitter account.

While private parties can hold and trade bitcoins in China, regulation prohibits financial firms like banks from doing the same. On 5 December , People's Bank of China PBOC made its first step in regulating bitcoin by prohibiting financial institutions from handling bitcoin transactions.

On 16 December it was speculated that the PBOC had issued a new ban on third-party payment processors from doing business with bitcoin exchanges, [67] however a statement from BTC China suggests this isn't accurate, and rather payment processors had voluntarily withdrawn their services.

On 1 April PBOC ordered commercial banks and payment companies to close bitcoin trading accounts in two weeks. On 9 February , multiple bitcoin exchanges in China delayed or paused bitcoin withdraw service, with or without announcement. Some of the announcements, [71] [72] [73] [74] if not all, claim that regulation activities have been or are to be taken. News resources [75] also show that, although such activities were carried out by PBOC, they were not done via legal approaches, but by "appointment" instead.

None of the exchanges presented or have claimed to receive any lawful paperwork. The crackdown on bitcoin and other virtual currency traders was accompanied by Chinese media touting the dangers of virtual currency as a tool for criminal activities.

On 8 January , the Secretary for Financial Services and the Treasury addressed bitcoin in the Legislative Council stating that "Hong Kong at present has no legislation directly regulating bitcoins and other virtual currencies of [a] similar kind.

However, our existing laws such as the Organised and Serious Crimes Ordinance provide sanctions against unlawful acts involving bitcoins, such as fraud or money laundering. He also decided that bitcoins will not be regulated by HKMA. However, the authority will be closely watching the usage of bitcoins locally and its development overseas. Japan officially recognizes bitcoin and digital currencies as a "means of payment that is not a legal currency" see Article of Japans's Payment Services Act PSA 25 May On 7 March , the Japanese government, in response to a series of questions asked in the National Diet, made a cabinet decision on the legal treatment of bitcoins in the form of answers to the questions.

The decision also acknowledges that there are no laws to unconditionally prohibit individuals or legal entities from receiving bitcoins in exchange for goods or services. Taxes may be applicable to bitcoins. According to Nikkei Asian Review , in February , "Japanese financial regulators have proposed handling virtual currencies as methods of payment equivalent to conventional currencies".

The city of Hirosaki is officially accepting bitcoin donations with the goal of attracting international tourists and financing local projects. While not illegal in the country, Korean authorities will prosecute illegal activity involving bitcoin [88] and have indicted at least one individual for purchasing drugs with bitcoin.

There are no laws in South Korea regulating the use of bitcoin at present. South Korea On 12 December , the president of the Bank of Korea recommended at a press conference that bitcoin be regulated in the future.

Bitcoin ATMs are banned here [7]: Taiwan but bitcoins can be purchased at over convenience store kiosks. Regulators have warned the public that bitcoin does not have legal protection, "as the currency is not issued by any monetary authority and is therefore not entitled to legal claims or guarantee of conversion".

While bitcoin is not illegal in Taiwan, financial institutions have been warned by regulators that necessary regulatory actions may be taken if they use it. On 6 December , Perng Fai-nan said that bitcoin is only used in certain communities. Besides, he also opined that the value of bitcoin is a bubble and is highly volatile.

Therefore, he advised the public against the speculation of bitcoins to prevent making a loss during the process. The central bank is closely watching the development of bitcoin and plan to impose regulations in the future.

It is stated that bitcoins remains highly volatile, highly speculative, and is not entitled to legal claims or guarantee of conversion. However, despite this, three of the four major convenience store chains in Taiwan make available purchases of bitcoin through their kiosk systems, [97] and the largest chain now allows bitcoin to be used for purchases of goods.

There are no regulations related to the use of bitcoin and other cryptocurrencies in Cambodia. The National Bank has stated that cryptocurrencies are illegal in Cambodia and has instructed commercial banks in the country not to accept bitcoin and other cryptocurrencies in financial transactions.