Imagine If You Bought $1, $5, $10, $100 or $1000 Worth Bitcoin in 2009

5 stars based on

36 reviews

Joseph Haubrich specializes in financial institutions and regulations. Ashley Orr is a contributing author. Bitcoins are digital representations of value, a fiat currency based on cryptography—the use of encryption to store and transfer value securely. Transactions using bitcoins are decentralized in that they are validated and certified through a network of users rather than one central administrative site.

Though bitcoin has attracted a lot of bitcoin price june 2013, bitcoins are not widely accepted as a method of payment at most retailers, so the transaction volume associated with bitcoin is only a fraction of that of other forms of payment. Since its inception, daily transaction volume has varied from days with no transactions to overtransactions on November 28, The median number of transactions per day is 6, a tiny level bitcoin price june 2013 activity compared to credit cards and US currency.

Infor example, 20 billion credit card transactions were processed, according to one reportwhile fewer than 2 million Bitcoin transactions were confirmed during the same time period. Bitcoin trades simultaneously for different prices on different exchanges, and the price is highly volatile.

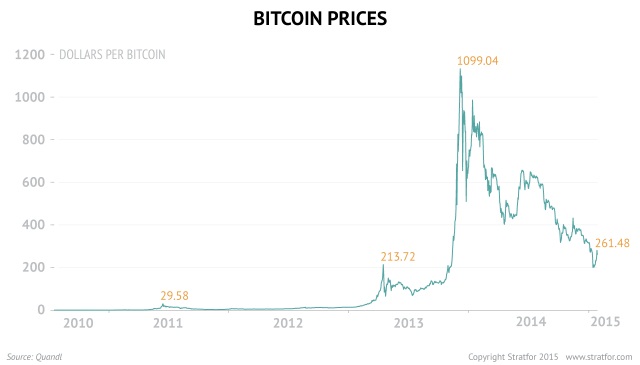

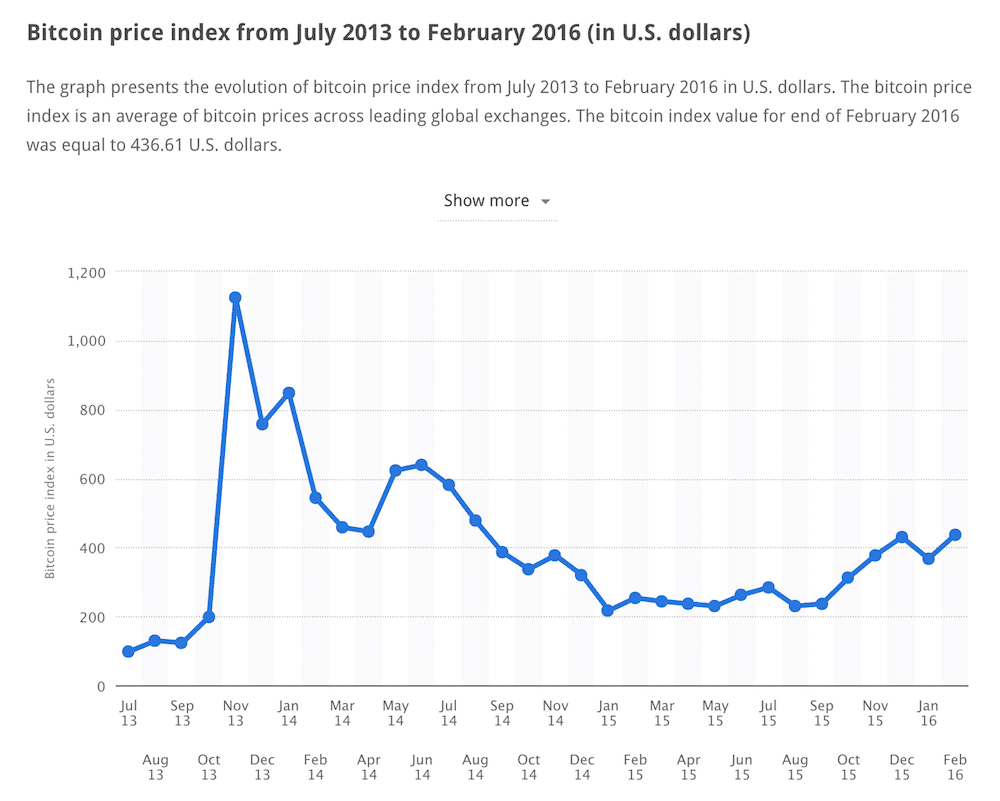

This volatility is greater than that of the US dollar; another way to put it is that bitcoin prices are subject to high rates of inflation and deflation, whereas the Federal Reserve monitors the inflation rate in the United States and can adjust monetary policy to prevent hyperinflation or bitcoin price june 2013. This allows the holder of a US dollar to have confidence that the value of his or her money will not be subject to great losses, an assurance bitcoin holders do not have.

Another way to note the changing value of bitcoin is to look at what it will buy. In bitcoin, it has varied 1. Bitcoin price june 2013 practical problem for merchants posting prices in bitcoin is that they must quote prices out to several decimal places, whereas prices in most other currencies are rounded to two.

So for instance, if bitcoins were used to purchase a gallon of unleaded gasoline in Junethe price would have been 0. Another difference between dollars and bitcoins is the way they are produced. Once transactions are confirmed, the miner who confirmed the transaction receives bitcoin as a reward, that is, compensation for his or her work.

In comparison, for dollars, the Federal Reserve determines the amount of high-powered money that is produced currency plus bank reserveswhich ultimately determines the total number of dollars in the world. Even ignoring bank accounts, there are a lot more dollars around than bitcoins: The current supply of bitcoin is nearly 13 million, whereas there are In terms of value, the differences are also large.

As of Januarythe amount of bitcoins in circulation valued in US dollars was around 9. Once the entire supply of 21 million bitcoins has been mined, their value at the current exchange rate will be barely over 1 percent of the value of US dollars even assuming no growth in US currency.

So bitcoins, despite their high profile and relatively high value, still make up only a small portion of the value of US currency. And as a fraction of all payments in the world, it is even less. Countercyclical capital regulation can reduce the procyclicality of the banking system and dampen aggregate bitcoin price june 2013 fluctuations. I describe two new capital buffers introduced in Basel III and discuss why their countercyclical effects may be small.

If over time regulators want to increase the degree of countercyclicality bitcoin price june 2013 capital regulation, they might consider adopting a rule-based countercyclical buffer, that is, bitcoin price june 2013 buffer that is automatically lowered during recessions according to a rule. I present a conservative example of such a rule and its effects bitcoin price june 2013 capital requirements over the business cycle. In the latest entry in their Notes from the Field blog, the Community Development Department discusses job access—in this case, how people get to work.

The problem is a persistent one for low-income workers across the country and was highlighted during a recent trip to Dayton, Ohio. Researchers from academia and central banks exchange ideas on modeling inflation and inflation expectations and their relationship to the macroeconomy. Bitcoin versus the Dollar Haubrich Senior Professional Economist Joseph Haubrich specializes in financial institutions and regulations.

Exploring the Option of a Rule-Based Countercyclical Buffer Filippo Occhino Countercyclical capital bitcoin price june 2013 can reduce the procyclicality of the banking system and dampen aggregate economic fluctuations. The answer may be transit Emily Garr Pacetti In the latest entry in their Notes from the Field blog, the Community Development Department discusses job access—in this case, how people get to work.