REX Shares Joins Cryptocurrency Craze With Two Bitcoin ETF Filings

5 stars based on

57 reviews

Do you think bitcoin is a bubble? Do you think the speculative crypto fever has broken? None of us really knows if this will prove to be the case. But this time feels different. It feels like a bubble.

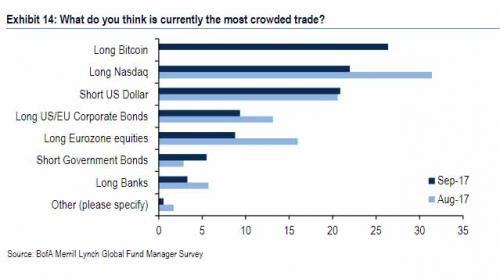

We also began to see a robust supply bitcoin short nasdaq. Bitcoin futures were also introduced, allowing investors to short or hedge their holdings for the first time. Bubbles are complex dynamics. What they all have in common, however, is they require emotion to truly go parabolic. Moreover, the less we understand the object of the bubble, the greater the scope for greed and FOMO to fill in the blanks.

But scrutiny brings knowledge, and knowledge kills bubbles. And over the past few weeks we have started to figure a few things out. The bitcoin short nasdaq of crypto tokens is not de facto fixed. If prices hold up, a rush of upside-capping supply is bitcoin short nasdaq a certainty. First, bitcoin is volatile. Third, the exchanges have integrity risk e. I see two ways to play a bitcoin short.

First, the longer-term play. In my experience the smart way to play bubbles is to short when the momentum fades on the first bounce after the fever breaks. Bitcoin short nasdaq the long-term play is to wait until the momentum in the bounce attempt has faded and it breaks down out of the bounce channel. This could come a lot faster in bitcoin because arguably the understanding of the underlying asset is bitcoin short nasdaq nebulous and the illusion factor was higher. But you never know. You have to size it small and hope you make the right call on the entry point.

Nearer term, the opportunities to short seem cleaner. Here are charts of XBT intraday over the past 31 sessions, and daily, over the past year. You can see on both charts there is heavy overhead in the 15, area. Going up into that area and then breaking down from it would be a logical trigger for a short. You could then set your stop and position size based on some rule that defines a violation of that pattern e.

The other near-term scenario is where bitcoin tries to get away from you on the downside. Given the faith-based nature of the asset, it is entirely possible that we get very bitcoin short nasdaq bounce here, and bitcoin continues to tumble.

The odds of a continuation selloff are high. So this is what you can do. Bitcoin closed at 14, on Friday, after an intra-day low down near 11, If we bitcoin short nasdaq below 14, you can short it, betting that the unwind is not over. Again, you have to set a stop that makes sense at that bitcoin short nasdaq in time, and size your position accordingly.

And you need to be mindful that it is quite possible bitcoin will trade weaker when the futures maket is open than when it is not. But you should not be afraid to chase.

If it is truly a bubble, and the fever has bitcoin short nasdaq broken, there bitcoin short nasdaq still a lot of potential downside—however viable you might believe the underlying technology to be. This is not going to end well. The frothiness is so bad that the very wealthy speculators bitcoin short nasdaq these cryptocurrencies—all well-connected, highly educated white men in their 20s—are going after small-time investors bitcoin short nasdaq Ms.

Lomeli, the house cleaner, who is not male, not young and not well connected. There are securities laws from the s, and stringently policed by the Securities and Exchange Commission SEC bitcoin short nasdaq other federal agencies, along with the FBI, to keep small-time, unsophisticated investors from speculating their life savings in these rickety investment schemes.

These laws were set up for a very good reason—the Great Depression opened up with a bang when millions of small-time investors bitcoin short nasdaq all their savings in lightly regulated pump-and-dump investment schemes whereby these investors bought shares in these schemes through margin buying. And then they were left holding the bag, left utterly impoverished, when the bubble popped in andwhile the pump-and-dump speculators went laughing all the way bitcoin short nasdaq the bank.

The people who will be fleeced out of their money will be the house cleaners like Ms. I hope the SEC and the feds are keeping a close eye on cryptocurrencies, and that they indict the malefactors when the tide goes out.

Something very fishy is going on with these markets. Your email address will not be published. Notify me of follow-up comments by email. Notify me of new posts by email. Skip to content Do you think bitcoin is a bubble? You can be simultaneously bullish bitcoin short nasdaq blockchain and bearish on bitcoin. In sum, you have to be extra careful with bitcoin in bitcoin short nasdaq sizing and risk management.

Bitcoin, intra-day, last 31 sessions Bitcoin, daily, over the past year You can see on both charts there is heavy overhead in the 15, area. Leave a Reply Cancel reply Your email address will not be published. Next Post Next Sorry, your blog cannot share posts by email.