Samsung builds bitcoin mining rig using old phones

33 comments

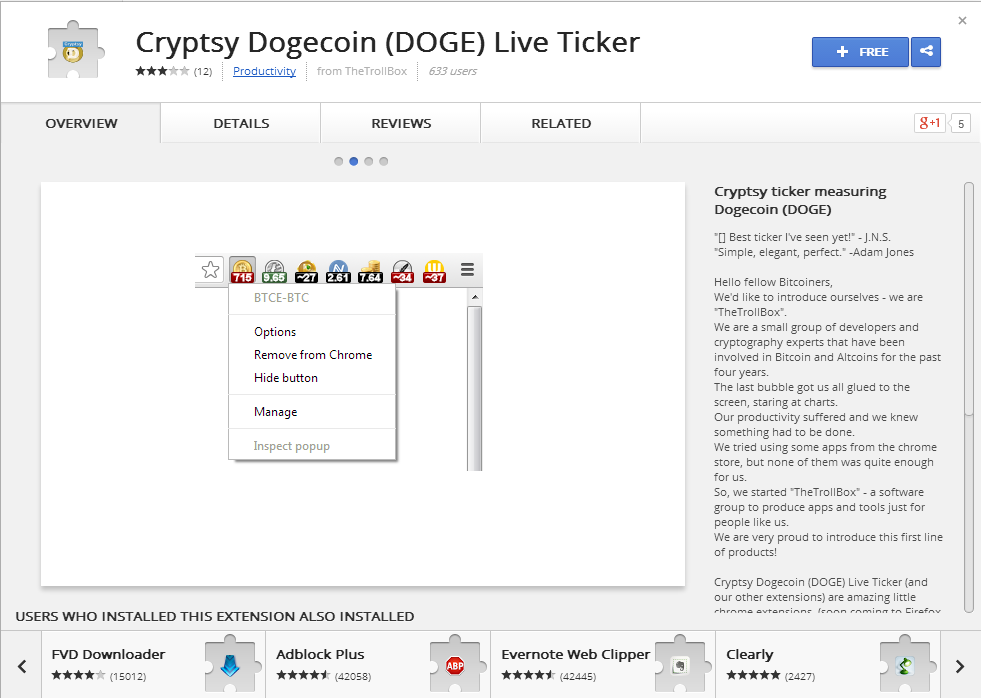

Btc e bitcoin charts program

The official blog of localethereum. Follow us for updates on security and the crypto-financial ecosystem.

One of the primary advantages of cryptocurrency over traditional currency is its elimination of third-party risk. Instead of trusting an entity to keep record of your balance — which is a simplified version of how traditional banking works — blockchains use an immutable public transaction ledger which is constantly audited using cryptographic proofs.

The awesome result of this is that it is mathematically impossible for anybody to revoke, transfer or destroy your cryptocurrency without access to your private key. As long as you keep that long string of text safe your private key — by storing it on a piece of paper, in a hardware wallet, or even in a tucked-away text file on your secure computer — you can be confident that your cryptocurrency is safe.

Instead, your deposits have a significant chance of being lost or stolen because of the compounding risks associated with centralised exchanges:. While any of these threats alone should be enough to make you think twice before trusting a centralized exchange, these risks together is a recipe for disaster. In the very first paragraph of the original Bitcoin whitepaper, Satoshi Nakamoto explained that by enabling peer-to-peer payments, people would no longer need to trust a financial intermediary.

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. And yet today, somewhat ironically, most of the risk we face still stems from trusting third parties. We see headlines about centralized exchanges making terrible mistakes that cost customers millions of dollars over and over, and yet people continue to risk their deposits in these unreliable organisations — likely because, until the introduction of peer-to-peer alternatives like localethereum and EtherDelta , centralized exchanges were the only viable choice.

Vitalik Buterin, the creator of Ethereum, made a similar point in while remembering the early days of developing the concept of a decentralized programming language:. It is now a well-known fact that centralized exchanges tend to be extremely unreliable. It should serve as a reminder of the many times centralized exchanges have proven themselves to be terrible at holding your money.

Although best efforts were made to ensure the information contained in this post is accurate, please contact us if you feel any portion is misleading or inaccurate. In March , Mt. During the flash crash, the attackers used their own accounts to purchase the extremely cheap Bitcoin and then withdrew it. Other traders unassociated with the attackers also capitalised on the flash crash by purchasing the cheap Bitcoin. Gox ended up reversing the trades and claims to have fully reimbursed all customers affected by the hack.

After the attack, the exchange shut down for several days. Bitomat was the first Bitcoin exchange to offer support for the Polish currency Zloty. In July , Bitomat routinely rebooted one of its Amazon-hosted servers and in the process accidentally destroyed a huge sum of Bitcoins. On October 5, , the exchange suffered a massive breach by an unknown entity.

The website was quickly replaced with a message stating that an intrusion included all of their Bitcoin wallets and their entire user database. Approximately 11, BTC was stolen from the exchange, never to be seen again. In October , only a few months after the Mt. Gox auditor account hack, the exchange accidentally sent 2, BTC to a number of invalid addresses. As no private key could ever be assigned to the addresses, the Bitcoins were effectively lost forever. In March , the cloud hosting company Linode suffered a major breach.

Once they gained root access to the servers, they transferred out everything they could find. Of the services targeted, Bitcoin trading platform Bitcoinica was the hardest hit. Bitcoinica said it lost 43, BTC in the theft and pomised to reimburse its customers. Only two months had passed since Bitcoinica reported its first robbery, when it became the apparent target of a second major hack.

Later that year, the Polish Bitcoin exchange BitMarket. Unsurprisingly, Bitcoinica was the subject of a third major heist in a third and apparently unrelated attack.

On July 13, , Bitcoinica said that an attacker gained unauthorized access to its Mt. In the weeks after the incident, a number of well-known figures in the Bitcoin community speculated that Zhou Tong, the seventeen-year-old founder of Bitcoinica, was likely behind the series of thefts.

According to Zhou Tong a. The extremely large buy orders caused a temporary spike in the market. The attacker was quick to withdraw the Bitcoins, but was unable to withdraw the full sum. Official estimates put the scope of the theft at 4, BTC. Last night, a few of our servers were compromised. As a result, the attacker gained accesses to an unencrypted backup of the wallet keys the actual keys live in an encrypted area. Using these keys they were able to transfer the coins.

This attack took the vast majority of the coins BitFloor was holding on hand. Approximately 24, BTC were stolen and have never been returned. BitFloor briefly shut down after the incident, and later returned with the promise of repaying its creditors over time. Only some creditors were eventually repaid. In May , an attacker stole 1, BTC as well as large quantities of lesser-known cryptocurrencies Litecoin and Terracoin.

The exchange became insolvent in after subsequent hacks. In November , the Czech Bitcoin exchange Bitcash. In early , the exchange collapsed in what is still considered to be the greatest Bitcoin scandal of all time. On February 7, , Mt. In a press release , they initially explained that they had detected unusual transaction activity on its Bitcoin wallets and had initiated a technical investigation weeks earlier. Gox or Bitcoin, and that the developers of the core Bitcoin client needed to change the software to resolve the issue.

The problem we have identified is not limited to MtGox, and affects all transactions where Bitcoins are being sent to a third party. We believe that the changes required for addressing this issue will be positive over the long term for the whole community. As a result we took the necessary action of suspending bitcoin withdrawals until this technical issue has been resolved.

Nowhere in the initial press release did they say that they were the subject of a massive theft. It was not until an internal company memo was leaked on the web on February 23, titled Mt. Crisis Strategy Draft , that the truth of a massive breach was revealed. For several weeks MtGox customers have been affected by bitcoin withdrawal issues that compounded on themselves.

The truth, it turns out, is that the damage had already been done. At this point , BTC are missing due to malleability-related theft which went unnoticed for several years. The cold storage has been wiped out due to a leak in the hot wallet. The memo outlined a corporate strategy to rebrand the business, re-open the exchange and repay the stolen coins from its profits over the long-term.

Essentially, the memo unveiled a devious plan to cover up the half-a-billion-dollar theft and attempt to continue business as usual.

The stolen , BTC amounted to roughly 6 percent of all Bitcoins in circulation at the time: The company is still undergoing continued bankruptcy proceedings. In March , the cryptocurrency exchange Poloniex — which remains one of the most popular alt-coin exchanges today — lost Instead of taking on the losses as a company, the exchange decided to issue a mandatory haircut of MintPal was once one of the most popular cryptocurrency exchanges for altcoins such as Dogecoin, VeriCoin and Litecoin.

On 13 July, , the exchange announced it was the victim of a theft. The developers of VeriCoin were quick to deploy a fork to return the stolen funds back to the exchange. Later that month, it was reported that MintPal had changed hands after being acquired by Moopay. I […] tentatively reached out to their management and let them know that we were interested in opening up talks in regards to an acquisition, if it was something they were interested in.

After a number of conversations with the current management of MintPal we reached an agreement that both parties were comfortable with, and are just waiting on the paperwork to be signed which will be happening this week. The CEO promised to make security the new focus of MintPay in order to restore faith in the exchange:.

Our first action to take regarding MintPal, is to beef up the security, make a number of performance tweaks; do a formal audit and review of operational procedures,. However, in an abrupt announcement in October of that year only a few months later , Alex Green announced that Moopay would be filing for bankruptcy and would immediately cease all operations. Without warning, the MintPal exchange shut down and stopped processing withdrawals. Claiming that the company had passed the exchange over to new management, Green informed Moopay employees that MintPal was no longer their problem.

It was not long before a former employee of Moopay publicly accused Alex Green of stealing 3, BTC from the exchange. What happened to MintPal is the equivalent of a nuclear bomb being dropped on a City, and a two-man hazard crew consisting of Mike and Ferdous are now in charge of the cleanup — and attempting to follow the trail of a BTC transaction from MintPal, which is now accused of being lodged into a personal account of Ryan Kennedy.

In , Ryan Kennedy a. Alex Green was charged by U. The charges followed a three-year investigation into the sophisticated scam. It is alleged the offences were committed between January — December in At the time the charges were laid, Ryan Kennedy was already serving an year prison sentence after being convicted of rape in Initially, a BTER representative suggested that the exchange would contact the NXT development team and request for a rollback of the blockchain.

However, the organisation in charge of NXT development confirmed that a significant majority of its users opposed the idea. The rollback effort was later abandoned by the exchange. When Bitfinex themselves used to spoof their entire orderbook , published October , allegations surfaced about how Bitfinex cloned bids and offers from other exchanges and ran an internal arbitrage bot on their own markets to give a false impression of liquidity.

In , soon after the exchange first went live, Bitfinex employed a unique arbitrage bot with the goal of making its markets appear more liquid. The Bitfinex arbitrage bot was programmed to copy orders from other exchanges including Mt. As soon as these imported orders were hit on Bitfinex, their arbitrage bot quickly ran to the source exchange and executed the same trade over there.

To the average trader using Bitfinex at the time, everything seemed normal. Big problems arose when the arbitrage bot became even slightly out of sync, which happened often during times of high volatility.