Personal tax - when is income tax and capital gains tax payable?

5 stars based on

35 reviews

Even though cryptocurrencies were created in part as an alternative to our centralized fiat money system, governments around the world are still wanting to keep their cut. As governments start to regulate cryptocurrenciescrypto-earners need to pay close attention. Cryptocurrency is an exciting—and oftentimes lucrative—investment opportunity.

While we can offer guiding advice, be sure to consult with professional accountants to determine how exactly you should best file your cryptocurrency earnings. Whatever transaction you make with cryptocurrencies, be sure to record it. Even crypto-to-crypto transactions should be diligently recorded. Alexia Hefti, dash capital gain tax tax lead at Deloitte, notes that it is dash capital gain tax common misconception that you only have to report your gains when you convert your cryptocurrencies back into Canadian dollars.

Dash capital gain tax reason is because the CRA classifies cryptocurrencies as commodities, meaning they are subject to barter rules. Every time you exchange your cryptocurrency for something else, including another cryptocurrency, it is considered a barter transaction.

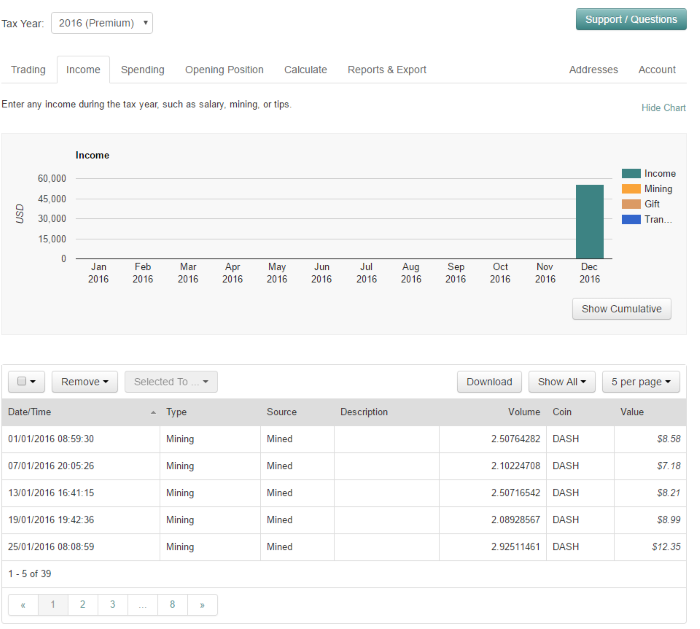

So, whenever you make a transaction involving crypto, record itand be sure dash capital gain tax note the exchange rate to Canadian dollars on the day of the transaction. Next, you have to determine which of your crypto earnings can be classified as capital gains. Typically, unless you are in the business of trading or mining altcoins, you can report earnings as capital gains. This is no different than an investor holding a complex stock portfolio.

Note that no crypto-fiat exchange occurred. A more complex scenario would be a crypto-crypto transaction. Your gain would be the fair value of the Dash bought, expressed in Canadian dollars on the day of the transaction. As for reporting capital gains on your tax filings, use the Schedule 3 form. You can find more information about completing the Schedule 3 hereand calculating capital gains and losses here. In certain scenarios, you would have to report your crypto earnings as income instead of capital gains.

Broadly speaking, these scenarios would be if: In the case of the latter two scenarios, you will be able to dash capital gain tax any trading losses or mining-related electricity costs from your income. For the cryptocurrency mining business, income will be determined based on inventory valuation rules. The third scenario can also give rise to some confusion. When are you considered to be holding cryptocurrency for capital dash capital gain tax capital gains or trading it as a business?

She expects that the law will be better defined in 10 to 12 years down the road dash capital gain tax avoid this ambiguity. We are very much in the early days of cryptocurrency, and governments and regulatory agencies are still playing catch up. That being said, it is highly likely that tax regulation for cryptocurrencies will keep evolving for long.

The federal government is already looking at updating its money laundering and terrorist financing laws to take crypto and blockchain technologies into account. At present, experts recommend that taxpayers record every single crypto transaction they make. For more frequent traders, this can be onerous.

There is still quite a bit of uncertainty surrounding Canadian tax regulation on cryptocurrencies, but the best bet is to play it safe: Do you find all of these a bit too complex? Consider gaining crypto exposure in your portfolio through investments in blockchain companies like Neptune Dash. Get in touch to learn more.