One more step

4 stars based on

40 reviews

If you are planning to buy Ethereum or already have then it would also be useful to know how best to sell the cryptocurrency. Whilst a large number of investors choose to buy and hold Ethereum for the very long term, taking profit as the asset increases in value is a great way to reduce risk and recover an original investment.

Selling Ethereum can be done at a multitude of online exchanges — some of which are listed below. The ease at which Ethereum can be sold varies some online exchanges have a very poor user experience and we have ranked the following with the easiest at the top.

You can also use the navigation menu on this page to skip ahead. Cryptocurrencies can widely fluctuate in prices and are not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework.

Your capital is at risk. CoinFalcon supports dozens of altcoins as well as Ethereum, Bitcoin and Ripple. Note that bank deposits are not accepted; cryptocurrencies only. Launched on October 20thlocalethereum is a new but popular place to purchase Ether from anywhere in the world.

To sell Ethereum at any of the above exchanges you must have Ethereum in your exchange wallet. If you have chose to store Ethereum on an exchange we do not recommend this then you will already have access to selling it.

If you store your Ethereum in a wallet where you control your private key, then you will need to transfer your Ether to your exchange wallet in order to sell it. We provide further details on Ethereum transactions here however a quick overview can be found below. The method for selling Ethereum varies from exchange to exchange however the general process remains the same.

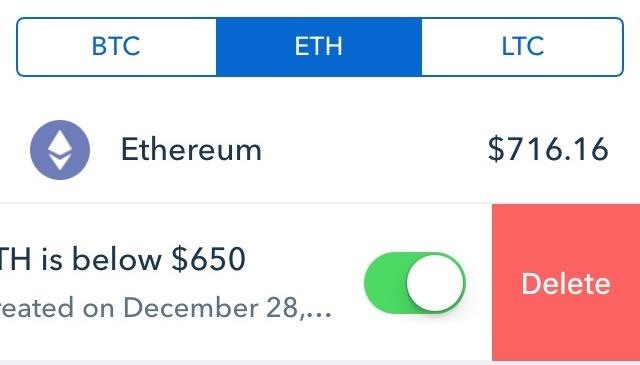

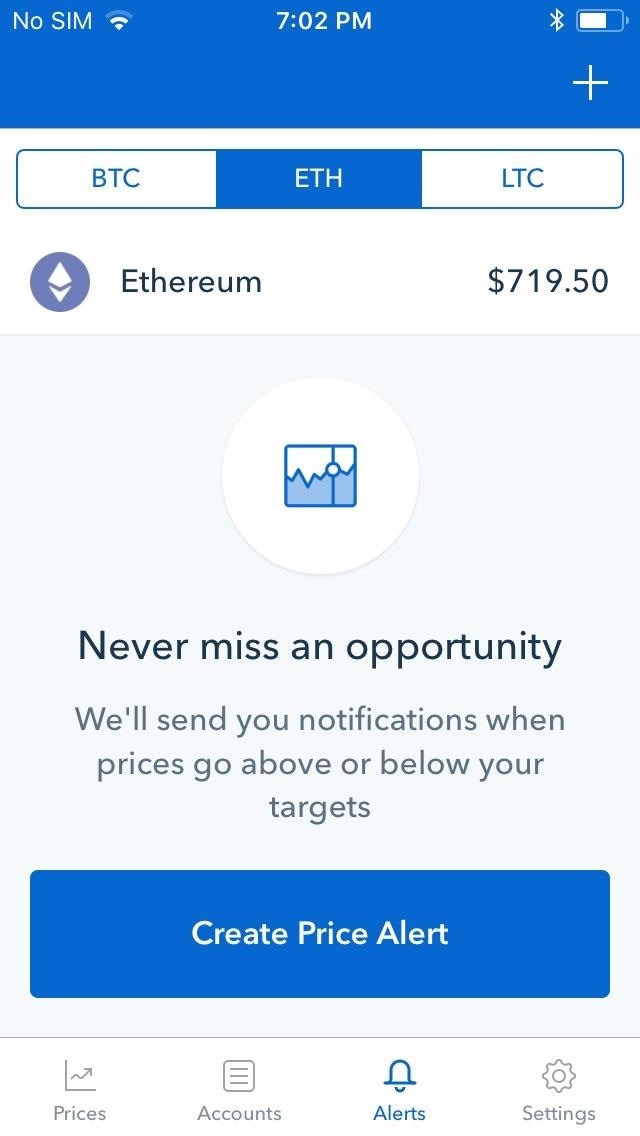

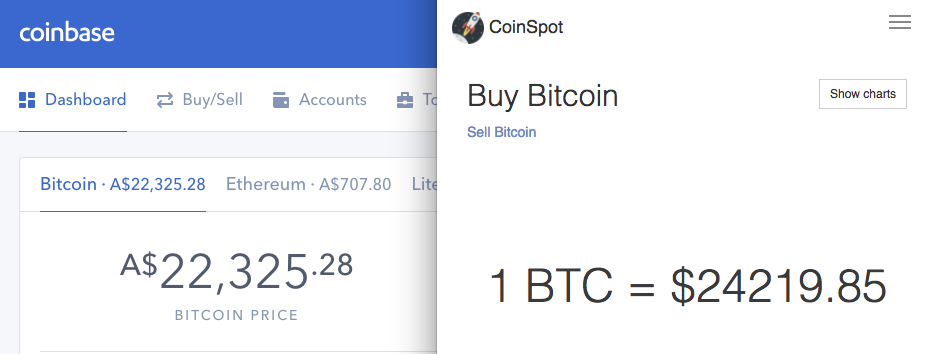

If you are using a platform like Coinbase recommended for beginnersliquidity is provided by the exchange and ETH sales are done directly between the seller and the platform. If you are using an exchange marketplace like Kraken or Poloniex then the sale of ETH is done between yourself and a matched peer s. There are advantages to selling Ethereum directly to an exchange platform like Coinbase. Two of the key advantages are speed and simplicity; the platform will guarantee to purchase your Ethereum at a set rate.

There will be a maximum amount of ETH that can be sold at any one time, however the order will be fulfilled immediately. Adversely however, the exchange will often buy Ether at a less favorable rate, charging a small premium to cover the added risk of providing liquidity to their entire userbase. Exchanges like these will also cap the amount of Ether that can be sold in any single time period.

A marketplace simply connects willing buyers and sellers together. Sales on a marketplace have two key advantages over sales to an exchange platform: If a marketplace has low liquidity i. To find the most liquid exchange for your chosen currency pair, see the Ethereum markets at CoinMarketCap.

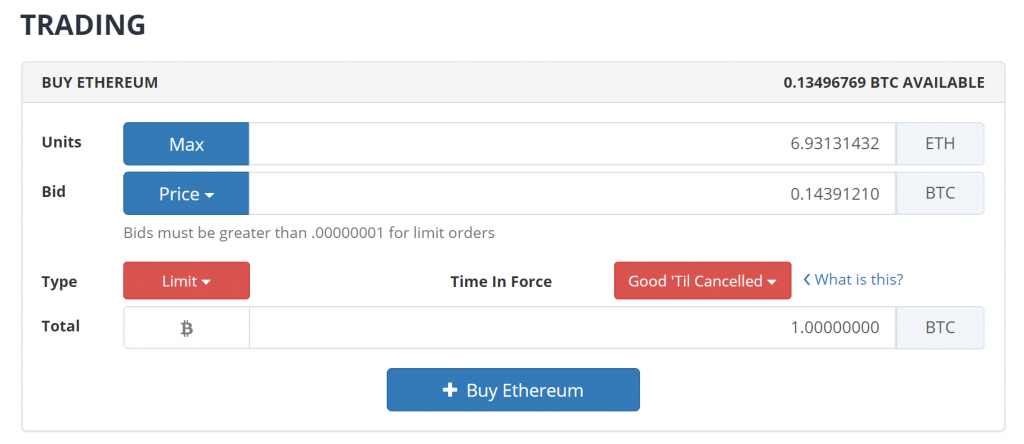

Selling Ethereum on a marketplace is more complex than selling directly to a platform. When selling ETH the seller has two options for how they wish to sell. Either the seller creates the market market maker and specifies the price at which they are willing to sell, or they sell to an existing buyer who has listed a buy Bid price. These markets are then matched with willing buyers. However, with a market order there is a danger that the seller may get an unfavorable price as explained below.

Sellers who act as a market maker are often rewarded with lower trading fees than market takers. By creating a limit order, the seller guarantees the price at which their Ether will be sold. Placing a market order in the example above may be acceptable for many sellers. However, consider an example where the seller wished to sell 10, ETH. The market would be liquidated at a lower and lower price, potentially selling some ETH tokens for just a few dollars.

Generally speaking, a seller will be better off selling using a limit order, however the mechanics of this should be understood properly before placing a sell order. One disadvantage of a limit order is that the sale may take hours or days to be executed in full.

If the price moves negatively, a limit order may need to be closed and reopened at the lower price. A market order will guarantee a fast sale on a highly liquid exchange and is often preferable for those willing to sacrifice profit in return for speed. Note that the short seller does not actually own Ether, instead the cryptoasset is borrowed and thus creates a liability. For this reason, shorting Ethereum is very high risk, and positions are typically opened and closed over the short term with stop-loss limits put in place automatic closure of a position if losses exceed a user-specified amount.

For this reason, to short Ethereum the trader would require a margin account. If the margin account is not maintained that is to say, if there is not enough of a bufferthen the position may be closed automatically by that platform. It is anticipated that these same futures markets will be opened up to Ethereum.

There are several cryptocurrency exchanges which allow users to open margin accounts. One of the easiest ways to short Ethereum today is through a CFD broker. An advantage to using CFDs is in the highly regulated nature of the broker see the top Ethereum brokers above and the simplicity of setting up an account makes this option highly appealing to new traders.

This list will expand over time, providing specific details about buying Ethereum from within different countries. This website is intended to provide a clear summary of Ethereum's current and historical price as well as important updates from the industry. I've also included a number of ERC20 tokens which can be found in the tokens tab at the top right. Please note, weighted average exchange prices update very slowly for some ETH and token pairs. Investors should seek professional financial advice.

Sell Ethereum Last Updated February 19, If you are planning to buy Ethereum or already have then it would also be useful to know how best to sell the cryptocurrency. Kraken has the world's largest cryptocurrency volume in EUR.

Do not use a Bitcoin or other cryptocurrency wallet as sending Ether to these addresses could result in permanently lost funds. Go to the wallet where your Ethereum is stored and send your Ether to your exchange wallet using the copied address above.

Further details of selling Ethereum at an exchange can be found below. How to sell Ethereum? Sale to an exchange There are advantages to selling Ethereum directly to an exchange platform like Coinbase. Sale on an marketplace A marketplace simply connects willing buyers and sellers together. Ethereum can be shorted through 3 different avenues.

Cryptocurrency exchanges There are several cryptocurrency exchanges which allow users to open margin accounts. Buy Ethereum by Country This list will expand over time, providing specific details about buying Ethereum from within different countries. We use cookies to better provide our services. By using our services, you agree to our use of cookies.