Set up an online bitcoin wallet

14 comments

Where to buy bitcoin cards

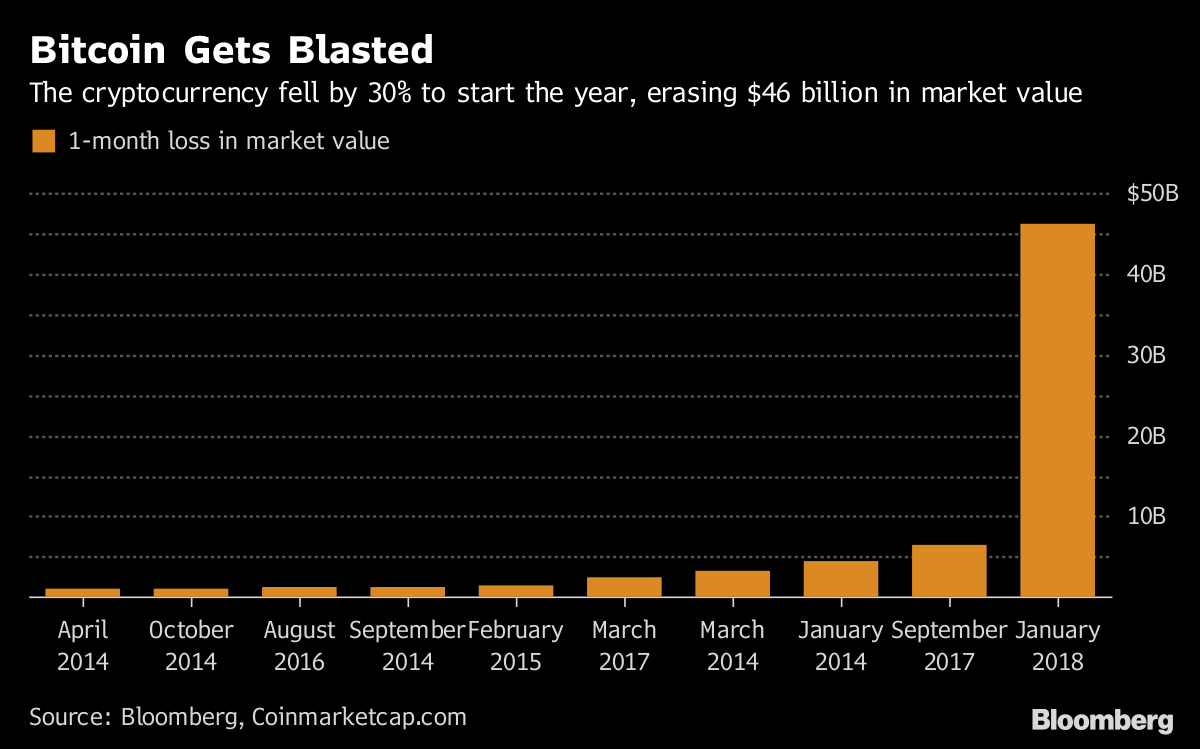

Tuesday, April 17, , was the tax deadline for most taxpayers to file their tax returns. With the price of Bitcoin hitting record highs in , many Bitcoin holders cashed out not realizing the impact it could have on their tax bill. Many people, for example, did not understand that it was a reportable transaction and found themselves with a hefty tax bill—money they may have been hard-pressed to come up with at tax time.

Others may have been unaware that they needed to report their transactions at all or failed to do so because it seemed too complicated. Tax season may be over, but you still need to hang onto your tax returns and other tax records for at least three years. However, if the IRS believes you have significantly underreported your income by 25 percent or more , or believes there may be an indication of fraud they have the authority to go back six years in an audit.

Furthermore, some documents including those related to real estate sales should be kept for three years after filing the return on which they reported the transaction. Air Force, and U. Coast Guard who performed services in the Sinai Peninsula in Egypt can now claim combat zone tax benefits.

As such, eligible service members may be able to exclude part or all of their combat pay from their income for federal income tax purposes. These combat zone tax benefits are retroactive to June Deductions , Expat Taxes. You can use Form Employers — Social Security, Medicare, and withheld income tax. File Form for the first quarter of This due date applies only if you deposited the tax for the quarter in full and on time. Employers — Nonpayroll withholding. If the monthly deposit rule applies, deposit the tax for payments in April.

IRS audits are conducted either by mail e. Here are five ways to do just that. If you purchased a computer and use it for work-related purposes, you can take advantage of the Section expense election, which allows you to write off new equipment in the year it was purchased if it is used for business more than 50 percent of the time subject to certain rules.

In addition, if your name or that of a dependent changed during the tax year for which you are filing, then you will also need to report the name changes to the Social Security Administration. Choosing the Correct Filing Status. Choosing the correct filing status is important because it can affect the amount of tax you owe for the year.

It may even determine if you must file a tax return. Here are the five filing statuses you can choose from:. It applies if you are divorced or legally separated under state law.

The Bipartisan Budget Act of BBA retroactively extended a number of tax provisions through for individual taxpayers. Mortgage Insurance Premiums Homeowners with less than 20 percent equity in their homes are required to pay mortgage insurance premiums PMI. For taxpayers whose income is below certain threshold amounts, these premiums were deductible in tax years , , , and now, once again in Exclusion of Discharge of Principal Residence Indebtedness Typically, forgiven debt is considered taxable income in the eyes of the IRS; however, this tax provision was retroactively extended through As a first step to reflect the tax law changes, the IRS released new withholding tables in January A revised Form W-4 was released on February 28, These updated tables were designed to produce the correct amount of tax withholding.

Tax credits can reduce your tax bill or give you a bigger refund but not all tax credits are created equal. Understanding The Difference Between A Tax Credit And A Tax Deduction Tax credits reduce your tax liability dollar for dollar and are more valuable than tax deductions that reduce your taxable income and tied to your marginal tax bracket. If a lender cancels part or all of a debt, a taxpayer must generally consider this as income. However, the law allows an exclusion that may apply to homeowners who had their mortgage debt canceled in Here are seven things you should know about debt cancellation:.

They must have used the loan to buy, build or substantially improve their main home to qualify. Their main home must also secure the mortgage. While many of these scams peak during the tax filing season, they may be encountered at any time during the year. Everyone wants to save money on their taxes, and older Americans are no exception.

Standard Deduction for Seniors. There is an additional increase in the standard deduction if either you or your spouse is blind. While obtaining a 6-month extension to file is relatively easy — and there are legitimate reasons for doing so — there are also some downsides. Blog Open Mon-Fri, 9am-5pm Office: