Trust-less governance is the killer app of blockchain technology

4 stars based on

62 reviews

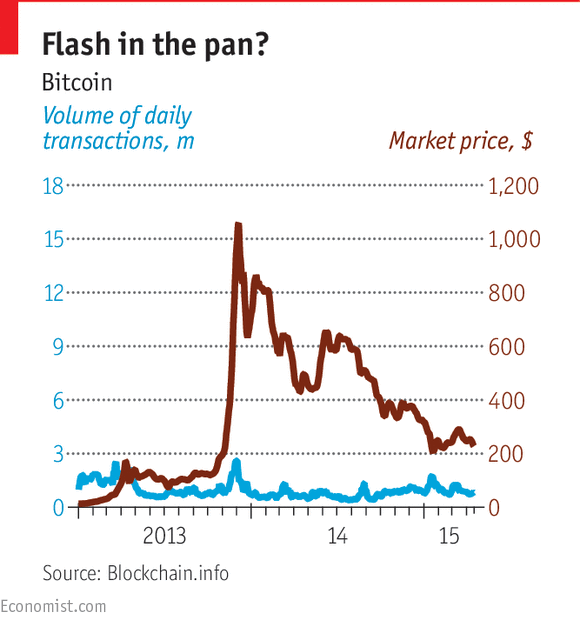

There are many applications that could benefit from decreased transaction costs, a neutral shared database, and the superior security of a shared ledger. Here are a few. There are seven other potential "killer apps" for blockchain technology. They exploit low transaction costs, elimination of duplicated record keeping, the neutrality of a shared data base, and the superior security of a distributed ledger. The disruptive potential of tokens and blockchains initially surfaced with payments thanks to the controversy over and curiosity about their application in Bitcoin.

But these two technologies could have much broader application. The technologies can undergird any number of applications that bring together many different parties that often have no reason to trust one another.

They can eliminate duplicative and error-prone transactions, and they can help create digital identity. Assuming and it is a big assumption that the tradeoffs among security, functionality, and scale will be largely resolved within five years, a range of radically new blockchain applications are possible.

Here are seven potential killer apps. Most current IoT applications connect devices with a common owner, so they only need to exchange information or instructions. When devices have different owners, however, they must transact. Today, when device owners lack a shared intermediary and the sums involved are minuscule, transacting is not economically worthwhile. But with a blockchain, especially one that enables smart contracts, transactions between devices become possible on a direct, peer-to-peer basis.

A car can purchase parking simply by driving onto a space: Streetline is already deploying such transponders. The German company Slock. In one application, the computer negotiates a room rental as a smart contract and instructs the smart lock on the front door to open when the renter arrives. The blockchain holds the deposit in escrow and releases funds on fulfillment of the contract.

This disintermediates not only PayPal and the banking system but also Airbnb. Today, internet content is funded by either subscription or advertising. But with cheap, blockchain-based transactions, it would be possible to meter media consumption by the page or the minute. An extension of this idea is using a blockchain to register and protect intellectual property. It allowed fans to download, stream, remix, and sync the song, distributing royalties directly to the creators—and entirely bypassing the complex and costly web of music intermediaries.

Some banks are already registering letters of credit on a blockchain so that importers, exporters, and their respective financiers can share common data and release funds without delay or error.

By extension, the item itself—like a bitcoin—can carry a continuous identifier that accesses digitally signed data entered on a blockchain by freight forwarders, customs authorities, shippers, wholesalers, retailers, and trusted independent certifiers.

This can replace the bill of lading, but it can also certify that a good was handmade in Firenze, manufactured by a Fair Trade Federation member, or is free of genetically modified organisms.

Paperwork is eliminated and the locus of trust shifted from intermediaries to the originator of the claim. In mature economies such as the US, land registries are riddled with incomplete paperwork requiring manual inspection and expensive title insurance to protect against residual errors. In many emerging economies, registries are radically incomplete or corrupted, depriving poorer citizens of basic property rights. A land registry lodged on a blockchain would be public and incorruptible.

Honduras and the Republic of Georgia have launched such initiatives, but with mixed results so far. The long-term potential, however, is immense: Peruvian economist Hernando de Soto has powerfully argued that establishing clear title to land would give poor people access to credit and the motive to invest. Governments or some broad coalition of service providers can play a crucial role by giving their citizens digital identities, thereby enhancing peripheral trust in all peer-to-peer transactions.

A digital identity would be data with provable ancestry from the authority, universally verifiable, just like a bitcoin. It is not obvious that such data would need to be stored on a blockchain. Over time, legally binding digital signatures, passports, licenses, security passes, key cards, certificates, log-ins, ownership documentation, voter registration, and a panoply of other legal information could be built on that foundation. Health care is characterized by duplicative, incompatible, and inconsistent medical records, while patient data is subject to stringent security and privacy requirements—a perfect application for a permissioned blockchain.

These new systems will record patient data and ultimately, complete genomic mapssymptoms, treatments, and above all, outcomes. Mere anonymization does not work. Access would be controlled through smart contracts and digital identities. But in the US, because of institutional fragmentation, even such a relatively straightforward innovation as electronic medical records has proved extraordinarily difficult to implement.

Scandinavia, not the US, will be the pioneer in these approaches. At least a half-dozen central banks are considering this step. Regulatory and compliance costs would be substantially reduced across the financial system. Justin Brickell and Vitaly Shmatikov demonstrated a severe tradeoff between the degree of anonymity and the utility of the resulting information.

See "The Cost of Privacy: Transacting on the Internet of Things. Transforming the Economics of Digital Content. Making Supply Chains Cheap and Transparent. Streamlining Health Care and Revolutionizing Research. Minting Digital Fiat Currency. Philip Evans Senior Advisor Boston. More From Perspectives Borges' Map: Navigating a World of Digital Disruption.

From Reciprocity to Reputation Trusting Transactions.