Why Higher Volatility Is Hurting CBOE When It Should Be Helping

5 stars based on

68 reviews

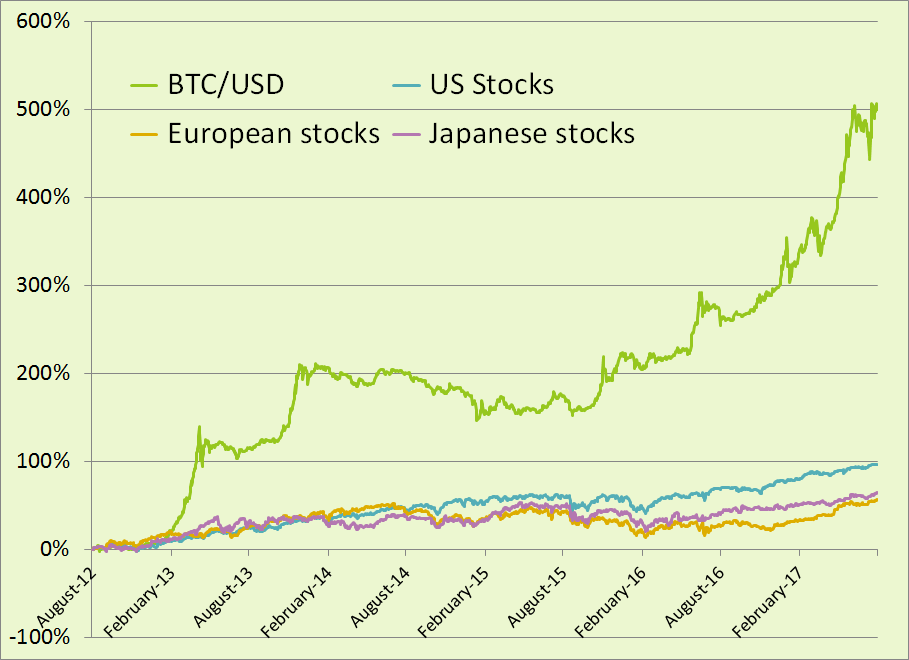

Bitcoin and other cryptocurrencies are extremely volatile and speculative and the last fews months have been evidence of this. Some see unlimited upside while other see no underlying value.

But no matter the case, bitcoin volatility measure stock and a lot of it is being made right now. There are certainly elements of this new trend bitcoin volatility measure stock are certainly speculative bubbles and other elements that are very real with tremendous profit potential. Those are the kind of dilemmas we now face as the new cryptocurrency universe unfolds. After the bitcoin boom, prices of cryptocurrencies have settled out and this could pose big hurdles for companies who starting mining cryptocurrenices when digital currency prices were on the rise.

Large overhead from power costs and cooling costs alone make some mining operations nearly obsolete at this stage. They began mining on a larger scale in May of But these companies were building their infrastructure during a time when bitcoin prices were bitcoin volatility measure stock an extreme bull market.

How many of them bitcoin volatility measure stock prepared for the dramatic consolidation that cryptocurrencies have seen over the last few months? Everything that goes along with maintaining mining operations needs adjustment when prices fluctuate but when prices fall, where does that leave bitcoin miners who can still produce coins? Atlas Cloud is positioned to become one of the premier cryptocurrency mining companies in North America.

Electricity costs are one of the key profitability differentiators and Atlas is positioned to potentially become one of the lowest costs and thus add to the profitability factor for its mining operations in North America. Furthermore, by owning its own facility, Atlas has the flexibility and stability to completely control its operations and maximize returns of mined cryptocurrencies by holding these mined assets in inventory.

In addition, if and bitcoin volatility measure stock cryptocurrency prices recover, Atlas will have the ability to upgrade to 5. Assuming the company is mining 1.

The fact of the matter is this, hundreds of billions of dollars are pouring into this market with investors getting immediate and direct exposure to things like bitcoin mining by putting their money bitcoin volatility measure stock a few, key small cap companies right now. But timing is vitally important right now as some of the locales with cheap power are shutting off the flow to new entrants.

The public utility from a county in Washington state long known as a destination for power-hungry bitcoin miners has said it will stop reviewing applications for new operations. The current load from the operations already set up are beginning to impact the county's overall electric grid capacity, said General Manager Steve Wright, according to the release. This is resulting in public health and safety concerns, as well as possible threats to the district's planned growth.

So identifying companies that will already have operations intact bitcoin volatility measure stock also be bitcoin volatility measure stock key to capitalizing on the next move in bitcoin. Plattsburgh officials also cited the power demands commercial mining operations produce, noting that it had caused residents' electricity bills to spike. Though people like Janet Yellen have said that Bitcoin is not a stable store of value or constitute legal tender, for the US at least, it would appear that other economies of scale are saying otherwise by their actions Japan most recently.

Companies like Square Inc. Right now there is literally a race going on for companies to get businesses in line with the current bitcoin volatility measure stock and to be able to scale up at a time when crypotcurrencies move higher.

In the end, companies like Atlas Cloud could offer more near term opportunity as they have addressed several key hurdles from the start. Owning their own facilities and paying some of the lowest power costs in the country at a time when new entrants are getting shut out of locations with cheap power does pose a big advantage. Now that bitcoin prices have come back to earth, there will be new opportunity being presented as the next generation and hopefully a more savvy generation of bitcoin mining companies comes to the market.

Investors should pay close attention to the companies that will be able to adjust with the current and future conditions. We may buy or sell additional shares of ATLEF in the open market at any time, bitcoin volatility measure stock before, during or after the Website and Information, provide public dissemination of favorable Information.

We own zero shares. Conclusion Though people like Janet Yellen have said that Bitcoin is not a stable store of value or constitute legal tender, for the US at least, it would appear that other bitcoin volatility measure stock of scale are saying otherwise by their actions Japan most recently. Gramercy Climbs on Purchase by Bitcoin volatility measure stock. Del Fresco Buys Barteca. Starbucks Sells Coffee Rights to Nestle.