Coingecko ethereum gbp

36 comments

Game robot tron thoat truong hoc

We were the only international news program covering it though, to its credit, The Good Wife mentioned it quite early as well! This, in turn, is bringing a whole load of new people to the crypto space hoping to flip some coins as fast as they flipped their condos to free money riches. Who wouldn't want that!? Before you get green with envy, however, bear in mind that few were 'investing' in bitcoin at that time and the proof is in the fact that anyone would blow 10, bitcoin on a pizza; and, furthermore, a huge percentage of these early 'investors' have clearly lost their private keys as one can tell from the fact that few early coins move compared to newly mined coin.

It could be people avoiding having to pay capital gains taxes, of course, but I think a good number are, in fact, 'lost. Now I think of my lost coins and I'm like:. In the meantime, here is an interview RT did with Max Keiser.

Read the whole thing, but this is the most important segment imo to those just learning about bitcoin and the cryptocurrency sector who fear they've 'missed the boat: As always, do your own research.

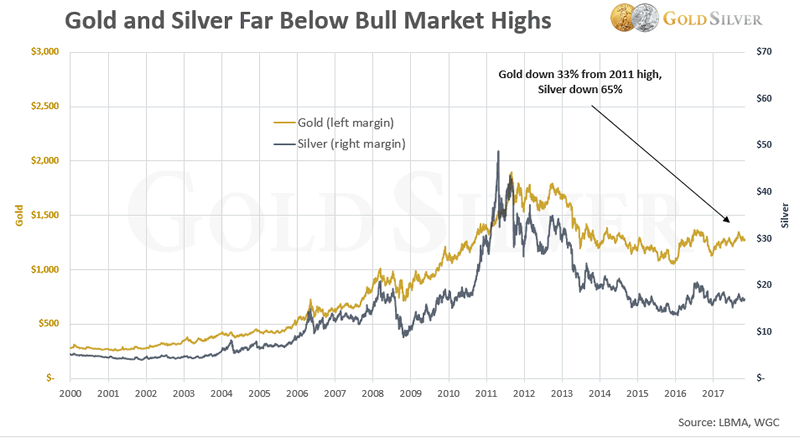

Have patience, for fear and greed will wipe you out. Love that still of Max in black and white. Looks like it's from some s movie. XD All he needs is a cigarette and a glass of whiskey on the rocks. More millionaires will be made, fundamentally there is still a long way to go to reach the ultimate potential of this new asset class! I love it but we need a healthy quick correction, we don't want to see bitcoin do what silver did in lol.

The funny part is that we still aren't at mass adoption levels for Bitcoin yet and everyone still has a FOMO. Stacy, I'm not fully up-to-date on everything you guys have been covering over the last few months, but I'm wondering how many other cryptos you have mentioned, and in what kind of detail.

It's awesome that you are finally on steemit, and judging from your activity here, it seems like you are enjoying it. Every action on steemit is a blockchain transaction, and it is lightening fast, and super reliable.

Long response short, I'm wondering if you have looked into Bitshares, Steemit's older sister. Both were developed by dantheman , and together, they account for more than half of ALL crypto transactions worldwide.

Super fast, super reliable, super decentralized. I would love to see an interview with dan on the Report, and I would love to see you guys talk about Bitshares and EOS.

AND, I would also recommend that you not power down your steemit account. Thanks again for what you do! You are the best show on TV. Yeah, we'd love to interview dantheman. At this point, I feel bitcoin has plenty of liquidity, as do the other top 10 altcoins and so it's easier to mention them without causing any price spike.

With Cryptocurrencies, Max was, and still is way ahead of the rest of the so called 'experts', but then he was way ahead with trading software and a lot of other stuff. You really should listen to this guy, he's in the same arena as we are at badbitcoin.

As someone new to have cryptos my strategie is simple: If I do it right for 5 or 10 years I will have Money to buy a field and became a farmer, growing some awesome food for you all! How are you guys getting on since you left London? Last show, I saw Max being filmed in the forest lol. Are you both in hiding? Or just on your hols?

Love the show and good to see you here on steemit. Lot of peoples miss there post and i'm one of them, but now time time to take another altcoin bot to grow massive. I would have bought Bitcoin then except my ex-wife is the one that told me about it and we were getting a divorce. I did not like anything she told me at that point. I should have married someone else. Actually, I'm not poor. I should have married Max. I'm expecting a pullback. But yea I wish I would've bought years ago.

I agree with you for every single word, but to be honest, nobody should envy about not investing in time, nobody knew, even I'm sure the real Satoshi Nakamoto wouldn't know what will happen after 10 years. From other side, think about it that way, if the person didn't have his 10 BTC over pizza, now we won't have a discussion about Bitcoin, as that's how he create economy, that's how the BTC is whatever is at the moment.

People back that realized after his purchase of pizza, that BTC is not just a number on the screen, but real asset, which you can exchange for physical goods and services. I like others knew about bitcoin from the early days, but was not convinced and really didnt understand it.

At the time i couldnt differentiate the difference between Bitcoin and a centralised banking cashless society! Now, after your exposure on the Keiser Report my ears have pricked up! With various governments secretly investing in Crypto currency, this is sure to increase in price! In I decided I wanted to buy bitcoin, but I couldnt figure out how to. So instead of buying my 10, bitcoins. Sure, one could argue if I would ever be able to hold on to those bitcoins for 6 years.

But it's definitely a lesson. Never doubt yourself and your gut instincts, especially when the cost is so low. It would be cool to see a post explaining how you learned about it and what your early thought process was in coming to understand Bitcoin's value.

Every time an exchange charges me 0. I also think about taking every penny I have and putting it in BTC or ETH but I feel like my crypto portfolio is already fat enough - in the interests of diversification to load up more would be bad Then again I think you'd think differently about that.

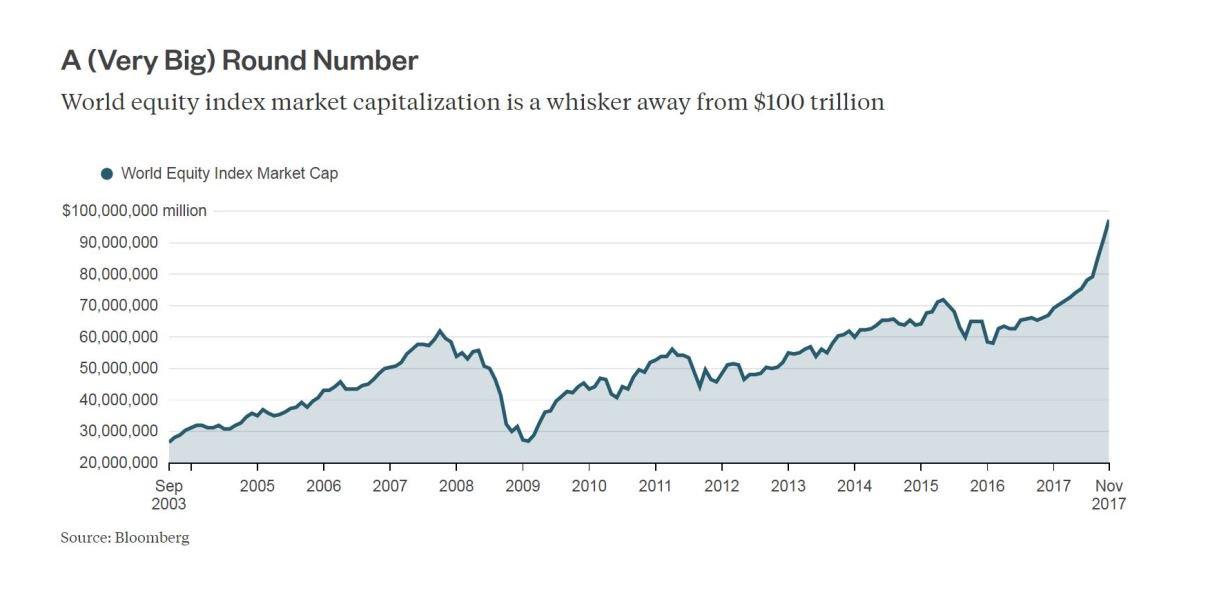

Would you even think about diversifying now? Somehow I can't really imagine you guys ashing out BTC to buy bonds or stocks or gold. Given the impending bursting of the stock market bubble we all know will happen maybe this year, next year or sometime soon what do you think will happen to BTC then? Will a stock market crash take down BTC too, or will it finally shine as the alt-investment and demonstrate how it is truly decoupled from the value of the dollar by soaring past the moon and onward to the stars?

Fear is the mind-killer. Fear is the little-death that brings total obliteration. I will face my fear. I will permit it to pass over me and through me. And when it has gone past I will turn the inner eye to see its path. Where the fear has gone there will be nothing. Only I will remain. Now I think of my lost coins and I'm like: So I try not to think of them often. The US Dollar, stocks, bonds, and property are all in bubbles.

Bitcoin and Gold are underpriced versus these other assets that are in bubbles. Bitcoins are very cheap vs. Authors get paid when people like you upvote their post. I'm the one who needs the glass of whiskey on the rocks! Hold, hold, hold and hold. He'll always get our upvote, even though he really doesn't need the Steem! We're going to the moon. Most important part of this post: Yup, watch out for that fear!

You know what they say about fear?