Bitgood and mcmahon 1995 corvette

49 comments

Borewell pumps texmo submersible pumps

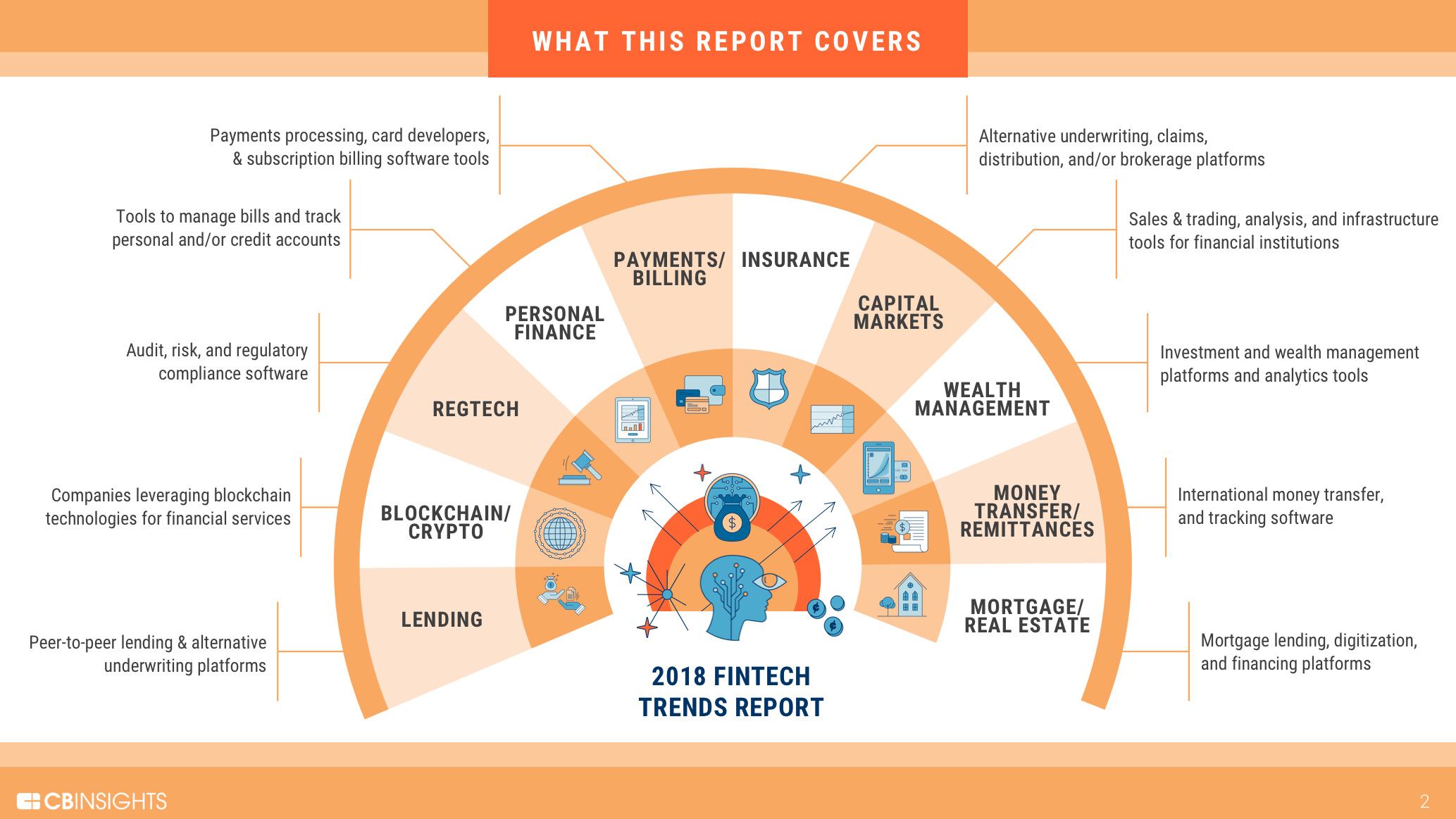

The research was commissioned by the global fintech provider Fraedom. The research firm Statista predicts U. Are we going to hit the use case next year? Tyrone Canaday, managing director at the consulting firm Protiviti, predicted the use of blockchain technology for identity and access management will gain momentum in the new year.

Up till now, many blockchain pilots have been about gaining back-office efficiencies, such as in clearing securities, Canaday noted. He said he expects the use of blockchain to shift to ways to make money. Institutional custody for crypto assets is the clearest use case for enterprise blockchain technology, argued Lex Sokolin, global director of fintech strategy at Autonomous Research.

Building out traditional finance infrastructure for crypto as an asset class is a very clear theme of Some venture capitalists have become bearish on artificial intelligence, considering it overhyped and a crowded field.

One is intense competition. And for AI systems to work well, they need to be trained on data, which is expensive to acquire, he said. Putting aside such challenges, applying AI to tasks such as fraud monitoring and monitoring large transaction volumes is compelling, Canaday said. The rise of blockchain technology will mean more transactions will need to be monitored, Canaday said, pushing financial institutions and even some regulators to use regtech tools.

Anti-money-laundering and know-your-customer rules, along with identity verification, will continue to be the hottest areas of regtech, he said.

Regulatory reporting by fintechs and banks will be another area of focus in the coming year, he said. Businesses need help managing their money and billing efficiently, she said. Though fintech apps that help people save, manage their money and invest abound, there are likely to be even more coming out in Grewal calls this the next generation of personal finance.

Fintechs that can provide banking, investing or payments as a piece of their broader offering, as Stripe has done in payments, can do well in this environment, he said. Grewal also sees a lot of interest in the cross-border commerce space — consumers from China wanting to make purchases in the U.

Many of the most innovative fintechs have been competing with banks and creating alternative financial brands. Now that the Consumer Financial Protection Bureau has been defanged, so to speak, banks can get back into student lending and mortgages without fear of reprisal, he said. He pointed out that in the U. They bought Whole Foods for that.

At some point, Amazon customers will be able to scan their produce through the image recognition on their phone. Along with investment, many observers expect to see more partnerships between banks and fintechs in We kind of need each other. Bank boards and C-level execs are starting to view partnerships with fintechs as vital to their success, allowing them to keep up with the pace of innovation and to better adapt business models to tech advances, Canaday said.

To be prepared for fintech partnerships in , he said, banks have been upgrading their tech infrastructure, moving from client servers to the cloud and revamping their data architectures. Editor at Large Penny Crosman welcomes feedback at penny. What Do Millennials Want from Banks?

Article Underwriting self-employed borrowers Freddie Mac helps lenders to better serve this expanding market segment. Partner Insights Sponsor Content From: Comment Start the Conversation, Login.

Like what you see? Make sure you're getting it all Independent and authoritative analysis and perspective for the banking industry.