The environment needs cryptogovernance

5 stars based on

32 reviews

This unit provides students with an overview of the algorithmics and economics of economist blockchain briefing books internet and their role underpinning modern financial economist blockchain briefing books. On successful completion, you will be able to: For each session, we indicate the lecturer using our initials. This may be subject to some slight variation as the course runs.

The most effective way to contact one of us is via email, and you are likely to get a reply quickly. If you want to meet face to face, you can make an appointment by email, or try your luck and drop round to our offices.

If you have a query which economist blockchain briefing books likely to be of interest to the whole group, please use the forum. Again, in most cases you will receive a reply quickly from one of us. This page contains all public links including slides, and handouts. Further material, which is not intended for the public domain can be found in Blackboard and this requires Single Sign-On. Lectures are on Tuesdays 2: The following table gives you an overview of economist blockchain briefing books intended flow of lectures.

Please note that there may be some variation as the course economist blockchain briefing books. For reading materials follow [R] links, for slides follow [S], for video follow [V].

In the past 20 years, the internet and world-wide web have had a dramatic and transformational effect on many aspects of life in economist blockchain briefing books economies.

In this unit we take a tour through the economics and the algorithmics of the internet, of the web, and of cloud computing. Fromthis unit included several lectures on cloud computing. The importance of cloud computing grew significantly over those five years, and it became difficult to accommodate everything we wanted to cover about cloud computing, as a subset of lectures within this unit.

Economist blockchain briefing books the academic yearwe started a brand new unit on cloud computing, COMSM, which covers cloud computing in detail.

For that reason, the amount of coverage of cloud computing in this unit has now been reduced, and more attention can be given to other algorithmic and economic issues. If you decide to take both units, you will notice a small degree of overlap, roughly one or two lectures-worth and a few of the recommended readings.

Above you will see the list of lecture-titles, and the links and readings for each lecture. You might economist blockchain briefing books how it all fits together. There is a story that we tell in the first lecture of how it all links up, but here it is for the record and for anyone who's reading this because they're wondering economist blockchain briefing books they want to take this module All of this can be viewed from the wider perspective of the ICT economist blockchain briefing books revolution" being the latest in a series of surprisingly similar technology "surges" that have characterised the past years.

That's what we look at in the first lecture. In the last 15 years successful internet-based companies have grown to immense value, making their founders very rich. Economist blockchain briefing books are socio- economic explanations for some of these successes, but in some cases the company grew successful because of technology innovations too: To set up the motivation for the rest of the module, in Lecture 2 we briefly remind ourselves of the stories behind the successes of Amazon, Google, eBay, Skype, and Facebook.

In Lecture 3 we have a minute rapid tour through the world of cloud computing. Because of their major economic significance, and because of their dependence on innovative algorithmic solutions: However, there is so much to say about cloud computing that it is now the topic of a separate unit: Then in lectures 4, 5, and 6, we study market systems. This includes some introductory economics, where we explore how the competitive interactions between buyers seeking to purchase some scarce resource "demand"and economist blockchain briefing books willing to supply units of that resource, can lead to efficient allocations that balance supply and demand.

Market-based mechanisms can be used for balancing supply and demand of scarce resources within engineered systems such as large-scale data-centers and this requires automated trading algorithms. Once the web had enabled e-commerce, it became obvious that it was possible to have automated software trader-agents or "bots" do the buying and selling.

Such automated trading algorithms have also been a significant development in real-world financial markets in recent years, and we survey those developments too and return to that theme again, but at the systemic level, in Lecture Successfully writing a trading algorithm and evaluating it against existing algorithms invariably requires running multiple experiments, generating enough data for statistically rigorous conclusions to be drawn: After the mock exam in Lecture 8, we move on in Lectures 9, 10, and 11 to focus on broad economic principles and how they apply to the information technology industry and e-commerce.

We consider a number of microeconomic ideas in this context, including market structure, pricing strategies, technological lock-in and network externalities. Lecture 12 deals with the web as a social and environmental phenomenon. In Lectures 13 and 14 we explore social networks, and the field of sentiment analysis which attempts to extract information on the views of groups of economist blockchain briefing books, e.

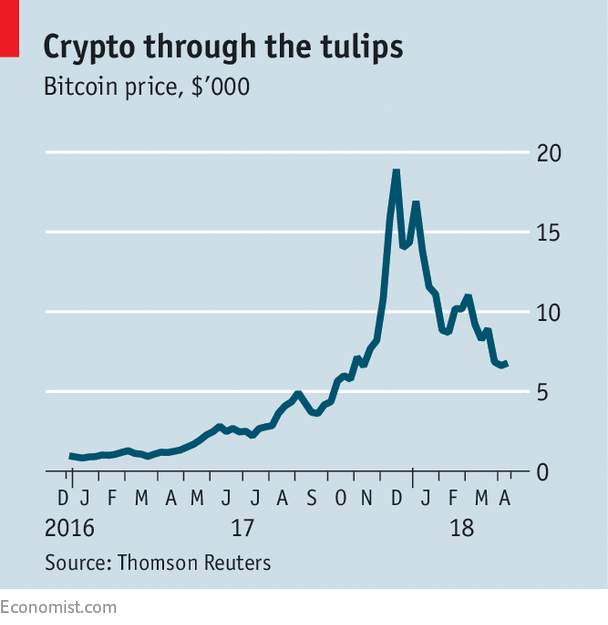

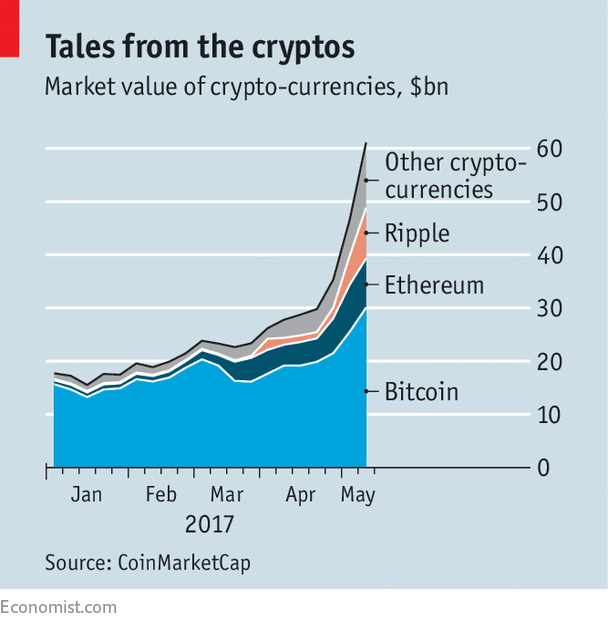

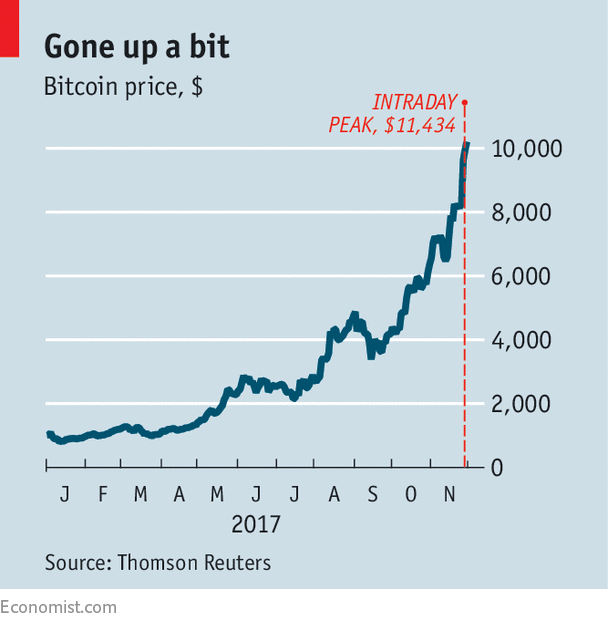

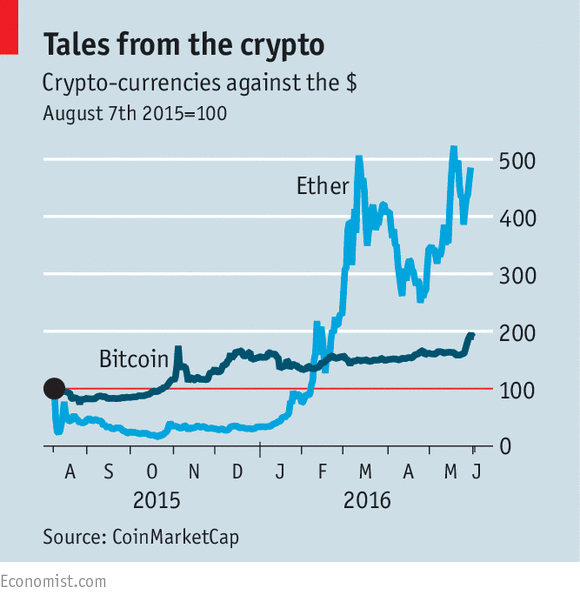

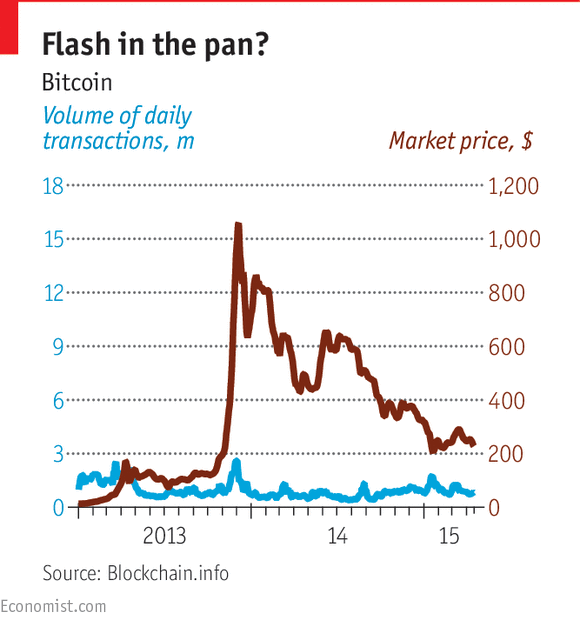

Lectures 15 and 16 do not take place as a result of CS Explore Week. Lecture 17 introduces networks science approaches to modelling the types of social network that underpin much web activity. In Lecture 18, we consider decentralised Blockchain technology for secure transactions -- somewhat surprisingly, both of these topics take us back into economics.

In Lecture 19 we look at the economics of games on the internet - exploring how some inhabitants of the developing world can be better off playing computer games for a living rather than working the land, which takes us nicely into monetisation of social gaming and the game mechanics behind these big sellers.

In Lecture 20 we explore the difficulties of dealing with ultra-large-scale systems. Lectures 21 and 22 cover FinTech -- financial technologies that have disrupted the way money, lending, and borrowing works in the digital age -- and TechFin, the trend towards large data companies integrating their own payment platforms into their technologies.

Lecture materials will be made available on this site shortly before each lecture. This page will be updated regularly throughout the course, so keep checking for updates. Week 1 - Tue 26 Sep: Who wants to be a billionaire?

Week 2 - Tue 3 Oct: Watch the videos before the lecture session. The slides are a copy of those presented in the video, for your reference. Slides presented during the session. Week 3 - Tue 10 Oct: Week 4 - Tue 17 Oct: Empirical methods is a video lecture with slides available for your reference.

Please watch this video in your own time. As usual for all lecture slides, this material is examinable. The full two-hour lecture slot will be taken up with the minute mock exam on material from lecturesinclusive. The exam is for your formative feedback only - it will not be assessed as part of the final grade for the unit.

Therefore, the mock exam is not compulsory. If you do not wish to take the mock, then do not attend the session this week. Following the lecture, the mock exam and model answers will be available on this page. Week 5 - Tue 24 Oct: There has been a slight reshuffling of lectures. In week 10, Chris will deliver lectures originally scheduled for week 7. Online Games and Gamification is a video lecture with slides available economist blockchain briefing books your reference.

During the lecture session, we will cover material in Lecture Week 8 - Tue 14 Nov: There is no lecture this week. Week 9 - Tue 21 Nov: As usual, this material is examinable. Week 10 - Tue 28 Nov: Social Networks CP L Note, there is only one slide set covering both lectures.

Week 11 - Tue 05 Dec: No lecture Week 12 - Tue 12 Dec: This was previously scheduled economist blockchain briefing books a revision and mock exam session. After feedback from the first mock exam, we will not run an in-class mock.

Rather, the mock paper and solutions are online. You should economist blockchain briefing books make your own notes during lectures: The slides on their own economist blockchain briefing books not be adequate for your learning. In all of your units and this unit is economist blockchain briefing books exception economist blockchain briefing books, you should be making your own notes to complement the slides economist blockchain briefing books are given.

This unit had a name and code change in Previously, the unit was named: In it was rebranded as: The reason for the rebranding was to make the link to recent developments in financial technology more economist blockchain briefing books. When the unit started, use of the term financial technology was rare. However, the content of the unit is economist blockchain briefing books unchanged.

For this reason, you will see mention of the previous unit code and name in some of the slides - particularly in the video links. Do not be worried by this, the content is correct for this unit. Back to top Back to timetable.

The final exam is three hours long. It contains two parts. In Part A, there is a series of short questions. Answer all for a total of 40 marks.