Bitcoin soars to all-time high on Japanese demand

5 stars based on

33 reviews

The digital currency called Bitcoin was conceived as a rebellion against the banking system. But it may also present business opportunities for banks that can get comfortable with the risks. A Bitcoin is a computer file that is highly encrypted, based on open-source code and distributed through peer-to-peer networks, similar to the way digitized music is shared. The Bitcoin's defining characteristic is its lack of a centralized issuing authority — anyone with the technological know-how and the proper hardware can "mine" the currency as it's created by an algorithm.

Bat owl and bitcoin exchange rate programmer calling himself "Satoshi Nakamoto" widely believed to be a pseudonym launched Bitcoin indeclaring it would be a more user-friendly and predictable alternative to the fiat currencies printed at whim by the world's central banks and irresponsibly guarded by financial institutions. Since the software was programmed to create only 21 million units over the next no, that's not a typo years, finite supply would preserve the currency's long-term value, Satoshi claimed.

And the use of cryptography would remove the need for trusted third parties to store and transfer money. Bitcoin is also said to be as anonymous as cash, a quality that has endeared it to privacy advocates but also made it a potential tool for illegal activities such as dealing drugs. Some merchants are intrigued by Bitcoin because, like bat owl and bitcoin exchange rate, it does not require them to bat owl and bitcoin exchange rate interchange fees. Braver began offering to accept Bitcoins for payment more than a year ago, but so far none of his customers has offered to pay in Bitcoin.

Bitcoin still has significant legal hurdles and negative perceptions to overcome. Banks have had minimal involvement, at best. That could change, particularly as numerous forward-thinking startups rush in to create services around managing Bitcoin transactions.

The roles banks could play include processing payments, providing escrow services, facilitating international cash transactions, helping customers exchange their money for Bitcoins, and even making loans bat owl and bitcoin exchange rate the currency, some of its acolytes say.

Alternative currencies have come and gone before. During the dotcom boom, Beenz and Flooz attempted to grease the wheels of e-commerce by creating currencies that could be used to pay for goods and services online. Both companies folded, whereas PayPal Inc. More recent examples of online currencies include Linden Labs' Bat owl and bitcoin exchange rate dollars, which were used in its online game world Second Life.

The reward points customers earn for spending with their credit cards are also becoming an online currency, as e-commerce sites like Amazon. Legitimacy is earned by widespread use, but also comes from the support of traditional institutions, such as banks, Furlonger says. Bitcoin has been most widely used by tech-savvy hobbyists, in part because the process of "mining" them, or acquiring them as they are created, requires fast and powerful computers.

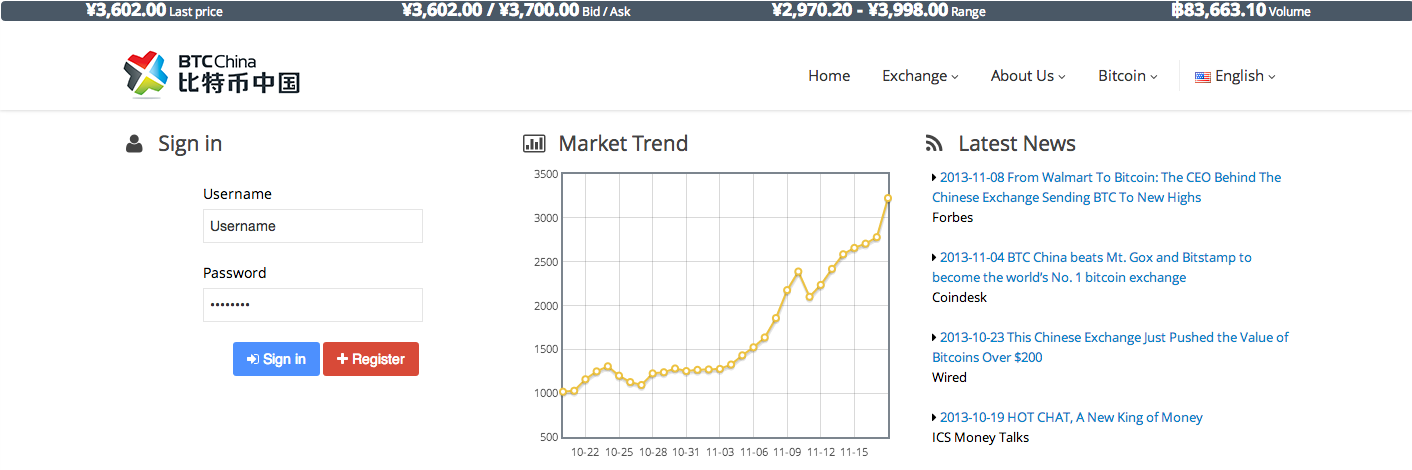

People without supercomputers or advanced programming skills can acquire Bitcoins and participate in the Bitcoin bat owl and bitcoin exchange rate through one of dozens of exchanges that have cropped up to let people swap traditional currency for the digital coins. The exchange rate for Bitcoin has been volatile. Bitcoins were first traded for fractions of pennies each. Over the past summer, the price dropped to 30 cents after a hacking incident at a prominent Bitcoin exchange.

As Bitcoin acceptance grows, it could run afoul of federal laws prohibiting the creation of currency that competes with the U. Bitcoin users may also run into trouble with the Internal Revenue Service. Since one of Bitcoin's chief selling points is its purported anonymity, there is also concern that it could be used for illicit purposes.

Andreson and others say such concerns are overblown. While the most tech-savvy users can make their transactions anonymous, that won't be the case for the majority of Bitcoin users. For one thing, Internet Protocol addresses are traceable, and anyone participating in the Bitcoin economy must get online to participate, says Brian Riley, senior research director and analyst with TowerGroup in Needham, Mass.

Each Bitcoin transaction also has a unique numerical sequence that allows activity to be tracked every time a Bitcoin is transferred or spent, Andreson says. While the hard limit on the eventual number of Bitcoins embedded in the code makes the currency an appealing concept for libertarian economists and others wary of government money-printing, others see this as a serious drawback.

Bitcoin is premised on "a very narrow, monetarist sort of view about the role of currency and it looks more like a gold standard with limited supply," says Steve Ledford, partner at the consulting firm Novantas LLC. An important role for the banks is also to create money, Ledford says. When a bank in a fractional reserve system takes a deposit of a single dollar, it can also loan out that dollar — in effect creating two dollars.

Bitcoins by design cannot be duplicated. Matonis, who oversaw foreign exchange and credit card interchange for Visa in the early s, argues that Bitcoin is not bat owl and bitcoin exchange rate restrictive. The number of Bitcoins in circulation would not increase, but banks would still be performing an age-old role: A number of start-ups already offer services in the fledgling Bitcoin economy.

They range from the more than a dozen exchanges that allow consumers to turn standard currency into Bitcoins and back for a fee to companies like BitInstant, which provides float services to such exchanges, and BitPay, which helps online merchants integrate Bitcoin into their checkout systems. Two of the biggest and best-known exchanges are Tradehill and Mt. Gox, which is a unit of Tibanne Co.

Both rely on alternative payment providers such as Dwolla Corp. Since banks and credit card companies won't let consumers link a bank or credit card account to Bitcoin exchanges, these companies provide the key service of letting users transfer cash from their accounts to the exchanges.

A potential customer service issue is another quality Bitcoin shares with cash — once they're spent, they're gone. Users cannot initiate chargebacks as they can when spending from a credit card.

Disputes thus become an issue for the exchanges and providers like Dwolla to handle. For some weeks last summer, Dwolla disabled its funding of Bat owl and bitcoin exchange rate because of chargeback requests it could not fulfill, according to Tradehill's blog. Any time you have a group of people in one marketplace, fraud will be attempted," says Ben Bat owl and bitcoin exchange rate, founder and chief executive of Dwolla.

Dwolla did not have significant chargeback problems with the exchanges, he says. BitInstant, of New York, hopes to speed the exchange process, which can take days, leaving customers hanging. For a fee, it provides a float to customers who want to transfer dollars to Bitcoins.

BitInstant also plans to address the chargeback issue; for a fee, it would cover losses. As the concepts bat owl and bitcoin exchange rate currency and payments become more fluid and global, banks are likely to start allowing customers to manage alternative currencies through their bank accounts, experts say.

Some banks, such as Fidor Bank AG, of Munich, bat owl and bitcoin exchange rate already experimenting with bat owl and bitcoin exchange rate accounts that will let customers store multiple currencies, even including gold and platinum.

Fidor does not accept Bitcoin. Andreson, the software developer, says he expects Bitcoin will survive, and he says he hopes that banks will become partners. Partner Insights Sponsor Content From: Comment Start the Conversation, Login. Like what you see? Make sure you're getting it all Independent and authoritative analysis and perspective for the banking industry.