Transaction Processing and Account Balances

5 stars based on

63 reviews

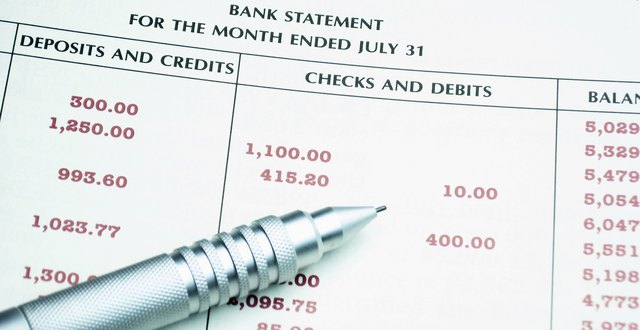

Your checking account has two kinds of balances: You can review both balances when you pending transactions and available balance vs ledger your account online, at an ATM, by phone, or at a branch. It is important to understand how the two pending transactions and available balance vs ledger work so that you know how much money is in your account at any given time.

While it may seem that the actual balance is the pending transactions and available balance vs ledger up-to-date display of the funds that you can spend, this is not always the case.

Your account may have purchases, holds, fees, other charges, or deposits made on your account that have not yet posted and, therefore, will not appear in your actual balance. The available balance takes pending transactions and available balance vs ledger account holds placed on deposits and pending transactions such as pending debit card purchases that the credit union has authorized but that have not yet posted to your account.

It is very important to understand that you may still overdraw your account even though the available balance appears to show there are sufficient funds to cover a transaction that you want to make.

This is because your available balance may not reflect outstanding checks and automatic bill payments that you have authorized or other outstanding transactions but have not yet posted to your account. Transactions will be processed against the available balance in the account at the time of processing. Importantly, the actual balance and available balance may differ as the available balance may be reflective of any pending ATM or debit card transactions that have not posted to the account or due to check holds.

We use the available balance when determining whether a transaction will cause your account to overdraw and for charging overdraft fees. Transactions may not be processed in the order in which they occurred and the order in which transactions are received and processed may impact the total amount of fees incurred. There are many ways transactions are presented for payment by merchants and we are not necessarily in control of when transactions are received.

We may receive multiple deposit and withdrawal transactions on your account in many different forms throughout each business day. This means you may be charged more than one fee if we pay multiple transactions when your account is overdrawn. Please call for rates on other amounts. There may be a penalty for early withdrawal. Fees may reduce earnings. Checking Account Balance Your checking account has two kinds of balances: Transaction Processing Transactions will be processed against the available balance in the account at the time of processing.

Change City Something is wrong please try again. Contact Us Thank you for contacting us.