Bitcoin Mining: Is it profitable?

5 stars based on

37 reviews

There are many factors and variables that need to be considered to conclude and answer if bitcoin mining is profitable. The short version of answer would be " its depends on how much can you or willing to invest for mining".

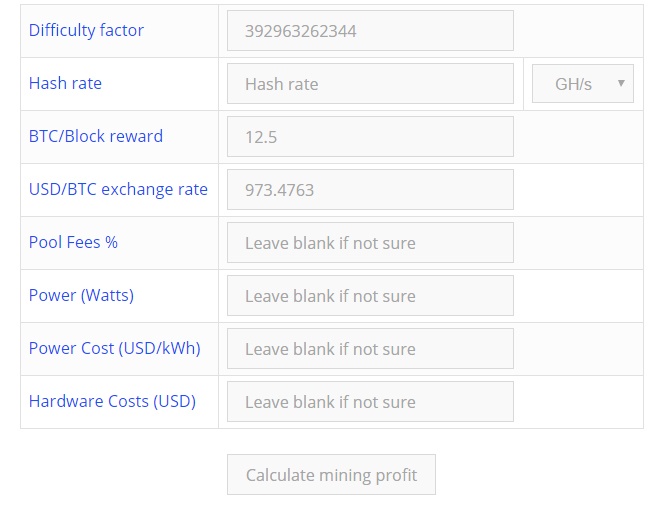

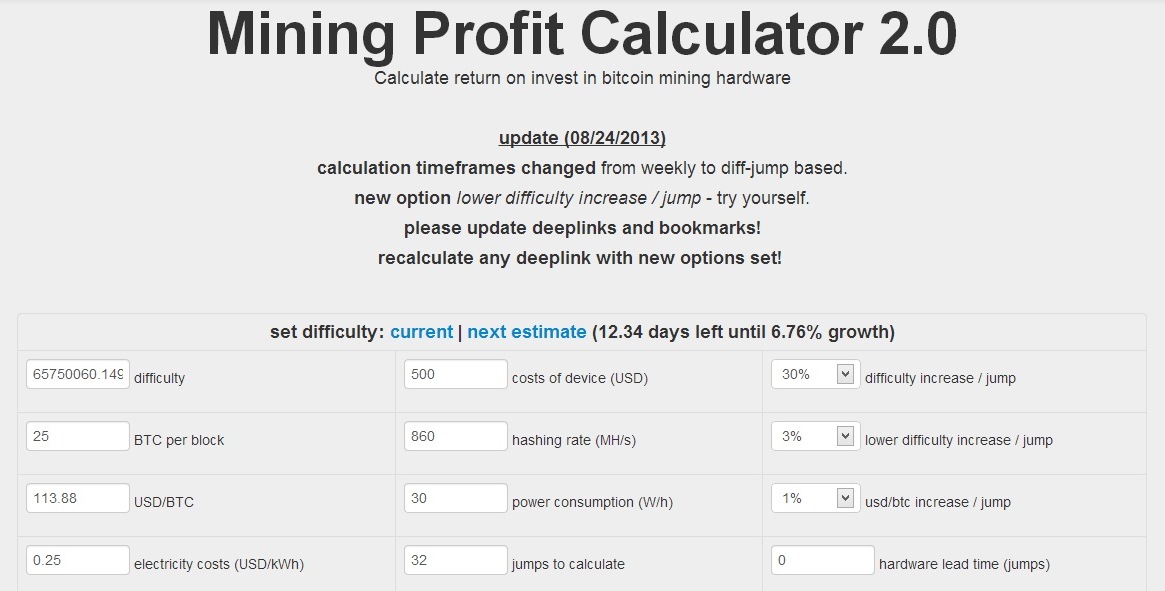

Well there is a way to calculate mining profitability when considering different bitcoin mining hardware profitability measures which is "Bitcoin Mining profitability calculator". I will explain everything in depth so its best we start from knowing a few basic technical terms from the world of Bitcoin mining:. The higher their relative power, the more solutions and hence, block rewards a miner is likely to find. Bitcoin coins have bitcoin mining hardware profitability measures block time of 10 minutes, In simple words a new block is created bitcoin mining hardware profitability measures average every ten minutes.

This halving process will continue in this fashion, bitcoins will be halved until all 21 million bitcoins are created. This is due to the ever-changing nature of the Difficulty modifier and the BTC price, in particular. To begin, we must select a suitable ASIC mining rig.

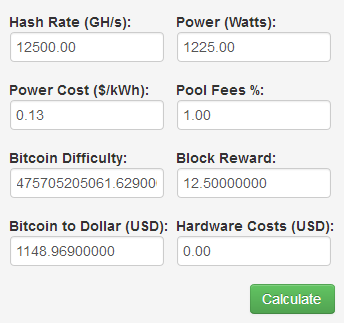

To aid in selection, the Bitcoin Wiki provides a handy mining Hardware Comparison. As of today the most advance miner out there is Antminer S9. It's what is known as an ASIC mining rig. If we use the simple Bitcoin miner calculator. But of course this doesn't take into account the hardware cost,electricity cost, pool fees, etc. Let's try to calculate. At this rate, the S9 unit would pay for itself within a year as well bitcoin mining hardware profitability measures make Profit as well!

There is a catch ,this is on dangerous assumption! Apart from that there are plenty of other things which needs to be bitcoin mining hardware profitability measures is they could go wrong, for example:. So is Bitcoin Mining Profitable? Yes, It is but only if you invest huge amount of capital in a good mining rig otherwise not. Only those who possess or can afford high powered machinery can mine bitcoins with profitability.

While mining is still technically possible for anyone, those with under powered setups will have more money spent on electricity than making money on bitcoins.

In simple words you will have losses. I will explain everything in depth so its best we start from knowing a few basic technical terms from the world of Bitcoin mining: In simple words Hash is the mathematical problem that needs to be solved which is done by computational power.

Hashrate solutions is the rate at which these problems are being solved. Each time a block is solved, a constant amount of Bitcoins are created and rewarded to miners.

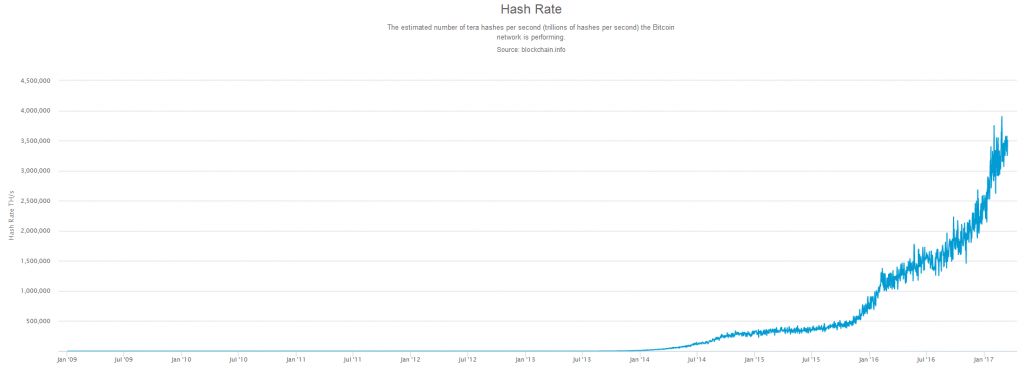

This number was initially set bitcoin mining hardware profitability measures 50, halved to 25 in late, and halved again to The next halving event expected is around mid Since Bitcoin gained a lot of attention and so many people came into mining,Bitcoin Network's Hash Rate increased exponentially, Bitcoin block time was reduced from 10 minutes.

So difficulty of solving the mathematical problem has to increase in order to adjust the block time and network's Hash Rate increase that is the reason why there are fluctuations in difficulty. Basically the more miners that join, the harder it gets to actually mine bitcoins. Using bitcoin which can be ASIC or any electronic device requires electricity. Electricity is the major on-going cost of Bitcoin mining. Electricity rate can be found on your monthly electricity bill.

Each miner Consumes bitcoin mining hardware profitability measures different amount of energy. You will need to know your miner's exact power consumption before calculating profitability. The price paid per Watt will greatly influence profitability. You can find this on interenet through some research.

A mining pool is a group of miners that mine bitcoin faster and more efficiently. Mining in solo is not as profitable as mining in pool that is because mining in pool bitcoins are mined faster and you will receive your bitcoins per share depending on how much computation power you provide although there are different pools out there for different shares.

Joining a mining pool bitcoin mining hardware profitability measures fees which is usually around 1. Profitability decline per year: This is probably the most important variable of all. There is no way of telling how many miners will joins the network for bitcoin mining so no one can -predict that how difficult it will be to mine in 30 days ,6 months or even 6 years.

The future profitability of mining cannot be reliably predicted. To aid in selection, the Bitcoin Wiki provides a handy mining Hardware Comparison As of today the most advance miner out there is Antminer S9.

If we use the simple Bitcoin miner calculator But of course this doesn't bitcoin mining hardware profitability measures into account the hardware cost,electricity cost, pool fees, etc. Apart from that there are plenty of other things which needs to be considered is they could go wrong, for example: Authors get paid when people like you upvote their post.