Blue lips fish and chips exmouth market

11 comments

Thottbot ethereum prison key

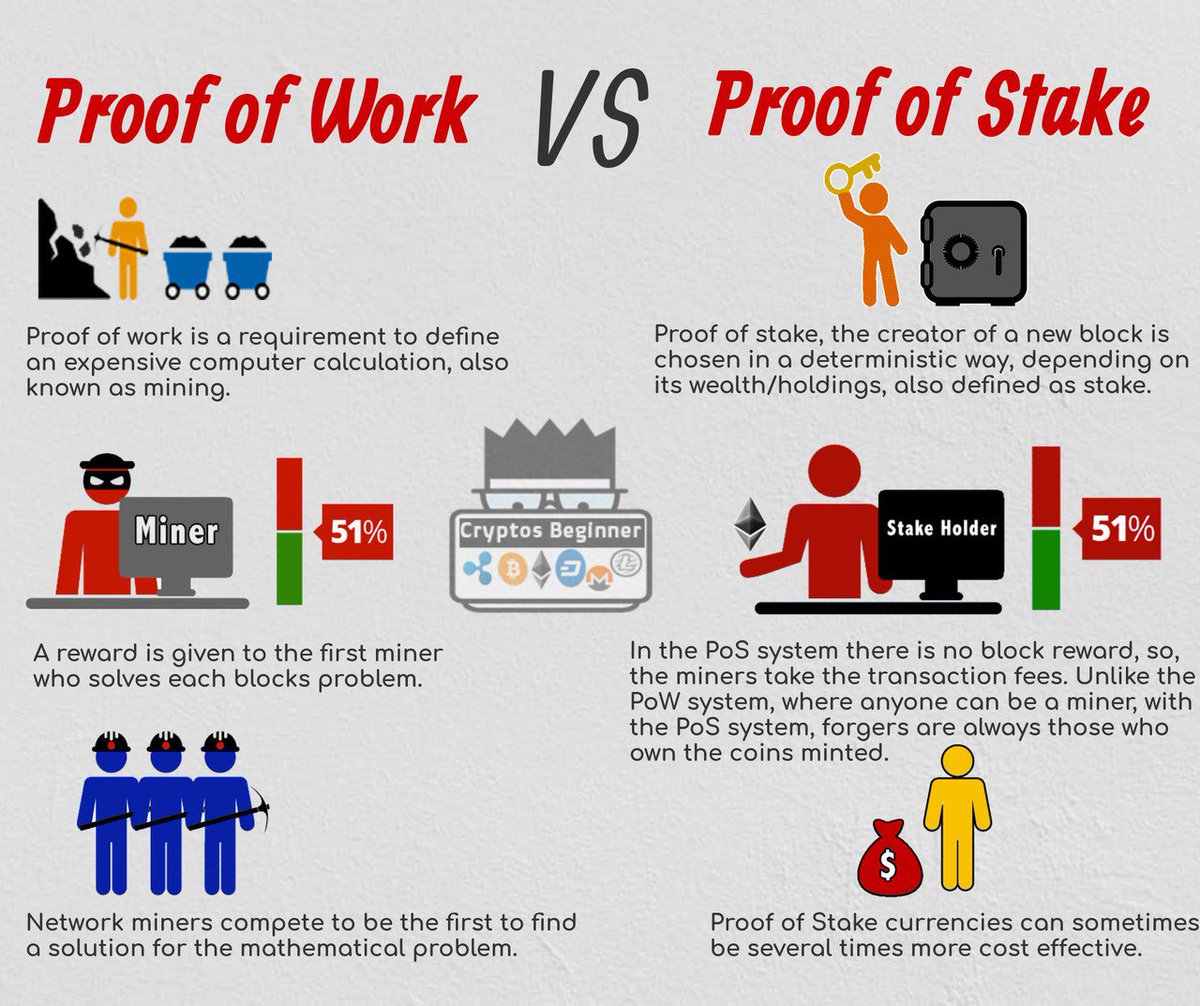

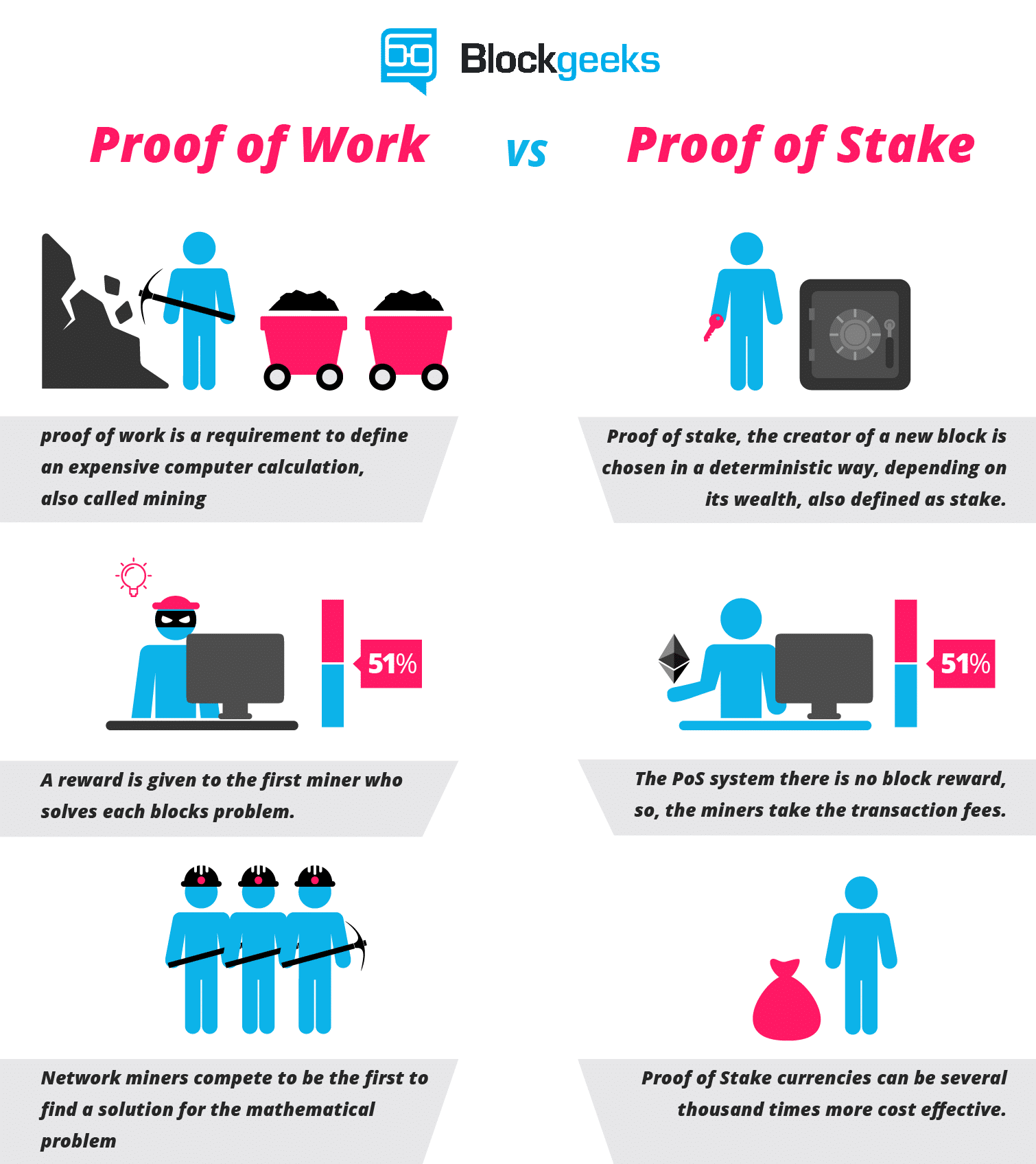

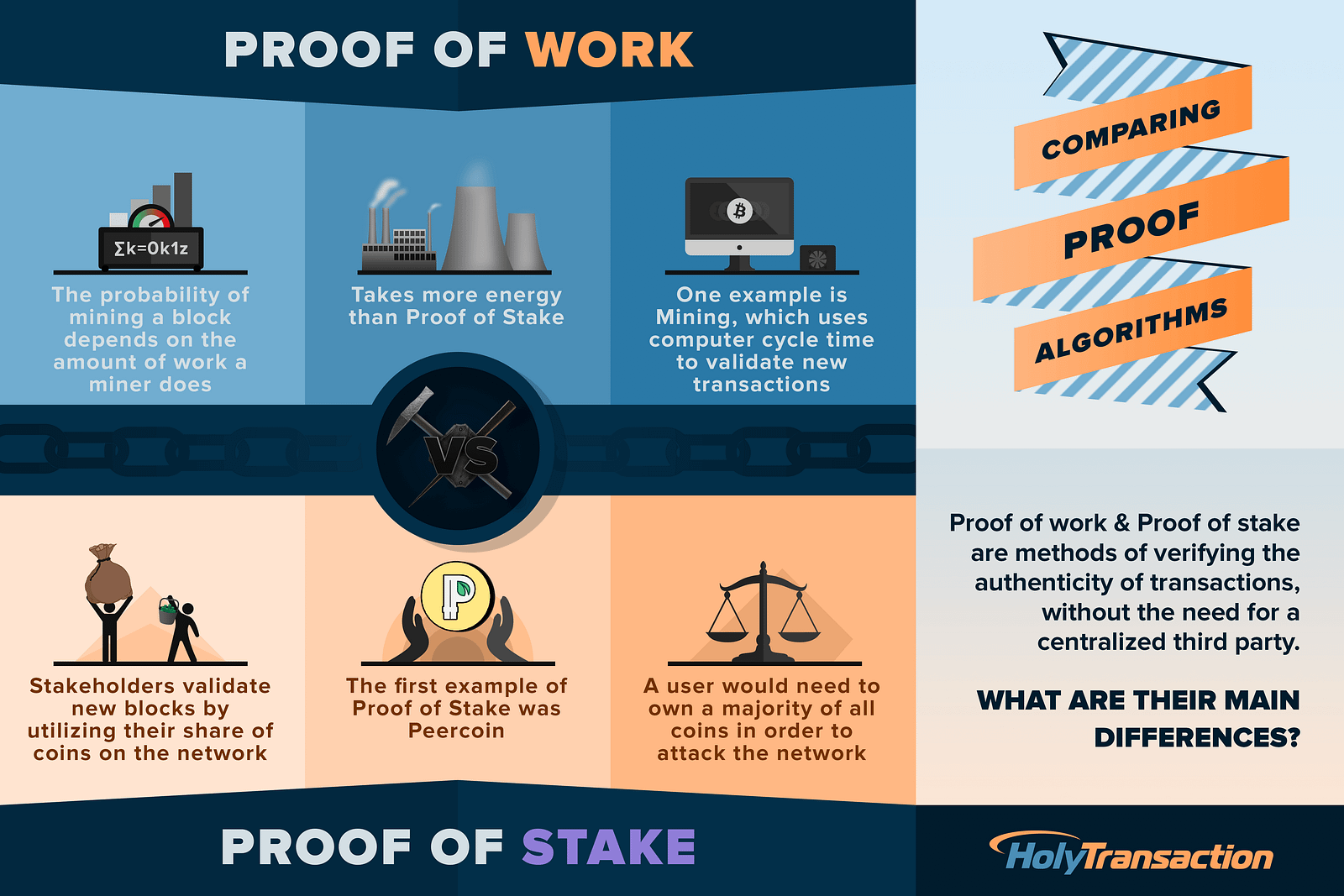

It's a newer and some think better method of achieving consensus among distributed parties in a cryptocurrency network. Staking is where coin holders put their coins in a PoS compatible cryptocurrency wallet and earn more coins as a reward. It has the same effect as mining in Proof of Work systems but the stakers don't expend exorbitant amounts of electricity and computer power, so it's considered an eco-friendly alternative.

Instead of coins being mined, they are "minted" and distributed much in the same way. Other than saving holders' electricity and the purchase of expensive mining equipment, PoS also avoids centralization of network power into the hands of few powerful individuals, companies, and mining conglomerates, which is one of the biggest problems of Bitcoin.

Today, there are hundreds of cryptocurrencies using various versions of Proof of Stake. Below are some of the best of them:. Divi -- is the inventor of a novel 5-tiered masternode system, with the first level requiring investment of 1, DIVI. Divi is also working a super-user-friendly wallet that geared for mass adoption. This is the type of cryptocurrency in which it's good to buy a masternode early.

Digital Cash is one of the pioneers of the Proof of Stake algorithm and built on the core Bitcoin platform or system, but with additional privacy and quick transaction features such as PrivateSend and InstantSend. It is however one of the best ways to earn with PoS because it has an annual return of 7. It means only the top delegates are able to stake coins on this network. The delegates are voted on a rolling basis by the community.

Anyone can register a delegate account and that account can collect votes from any coin holder. Those who do not get voted are listed as on standby but since the voting is dynamic, their status can change.

Voters can earn by voting for delegates with the size of earning depending on the amount of LISK in the wallet. You can calculate returns here. NAV Coin , which was formed in , uses dual blockchain for private transactions and is based on the core Bitcoin code. A transaction takes only 30 seconds to complete. You can opt for privacy with dual blockchains.

NAV Coin offers up to 5 percent yearly return in investment for staking using a desktop wallet. The returns will be reduced to 4 percent. The system maintains consensus even when some nodes bare malicious intentions. The GAS generated depends on the amount of coins in your wallet. GAS can be claimed every 5 minutes and can also be traded and converted to other cryptocurrencies as well.

You earn about 5. OkCash started in in and facilitates fast microtransactions. It provides a return of 10 percent per year. The staking wallet is a desktop wallet and after moving the coins to the staking wallet, they mature and start earning after 8 hours.

With OKCash, there is no limit to the amount of coins you can stake. You can also use this Staking Calculator to estimate profits. You can use this DIY guide to set up masternode or masternode services. Reddcoin is a tipping blockchain platform for social networks. Users can tip anyone for content they like on the various social media platforms. It uses Proof of Stake Velocity , an algorithm that encourages both ownership Stake and activity Velocity.

These are the main criteria of being a social currency according to Reddcoin. Coin age is calculated as a function of time and POSV can accommodate different forms of coin-aging functions. There is no cap for amount to be staked and the rate of interest is about 5 percent per year on the desktop staking wallet. Read more on the Staking Guide. Stratis is a blockchain-based platform that simplifies development, testing and deployment of C applications on the dot NET framework.

In comparison to its peers, the cryptocurrency offers returns of only 0. You can calculate the profits here. Ethereum has been using Proof of Work from the word go and being one of the popular cryptocurrencies, it is one of the early cryptocurrency projects that have been considering PoS.

The announcement said Casper will soon be available on the Testnet. PeerCoin was the first coin to use PoS but stakers earn 1 percent annually, which is considered low rewards.

Coins are eligible to mint 30 days after they are transferred to the wallet and their chances are maximized at 90 days of age. You can calculate returns here and read more on SetUp guide here. January 2, April 9, David Kariuki.

Below are some of the best of them: