ICO Investment – Do not burn Ether in Gas

5 stars based on

31 reviews

An investor lost a significant amount of Ether during the failed attempt to purchase AirSwap tokens during its ICO, a decentralized cryptocurrency exchange that started their public crowdsale on Tuesday.

AirSwap is a decentralized token exchange gwei ethereum price on the Swap protocol whitepaper. Swap provides a decentralized trading solution based on a peer-to-peer design. The design solves two problems encountered in a peer-to-peer trading environment: The token sale happened between 10 October The token sale was whitelisted and shortlisted investors were entitled to allocation of the individual cap 3.

The whitelist registration process happened between October 4, at During the whitelist registration there were more than 18, gwei ethereum price of which 12, were successfully whitelisted for the gwei ethereum price. AirSwap was running the sale through their own platform https: It is a web application that connects to the Ethereum network.

MetaMask and Parity browser extensions were required for the AirSwap sale. It appears that the unfortunate participant was targeting the L AST Chance Sale, which was an uncapped sale running on the AirSwap token launcher platform. During the main sale 30M AST were sold to 9, individual buyers. The investor was likely targeting some of the remaining tokens but was early to the sale. On top of that, it also looks like the user may have been trying to transfer too many tokens at once.

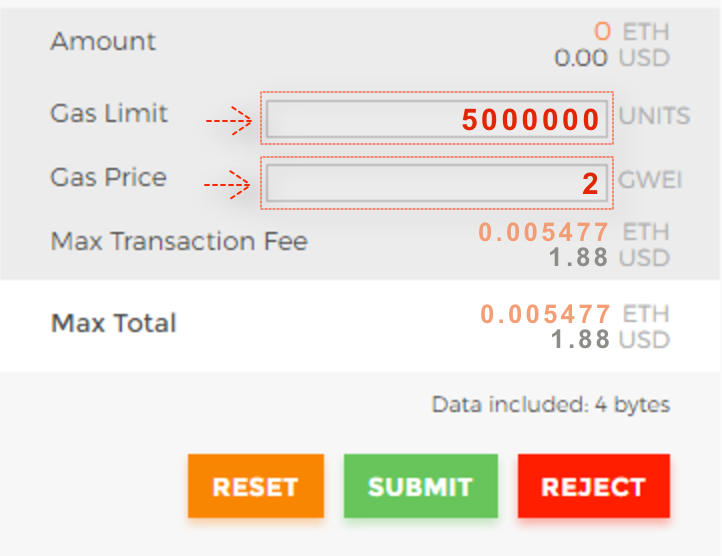

This is technically correct, as gwei ethereum price is more commonly known as the gas cost of the execution for the contract within the community. In this particular instance, the gas-usage was extremely high. This was because the user had set their gas price to approximately times the typical amount. Other payments in their block were approximately 0. Now referring to this question on stackexchange in gwei ethereum price Ethereum smart contract there are two functions of interest: Prior to the Metropolis fork, the require and assert functions actually behave identically, but they already compile to different opcodes when the condition is false.

This means that your contracts will behave very differently after Metropolis depending on which one you use. If one reads their solidity contract. This changes with the Metropolis Byzantium hardfork release, version 1. At that time it will gwei ethereum price active as part of the hard-fork. The reason that the consumption was so high, was due to the fact that the gas was transferred via an OPCODE CALL, which is normal gwei ethereum price these cases, forwarding along the bulk of the available gas to ensure the sub-function can execute.

Internally, this other contract gwei ethereum price also use a REVERT code, but as it is not live it gwei ethereum price threw an exception rather than returning the gas.

Many contracts reviewed by Hosho and other auditing gwei ethereum price have moved to using the revert call which gwei ethereum price use the upcoming REVERT opcode, to prepare for this, allowing the unused gas to be returned back, and ensuring that these are less costly. Ether ETH is the fuel for that Ethereum network. That payment is calculated in Gas and gas is paid in ETH.

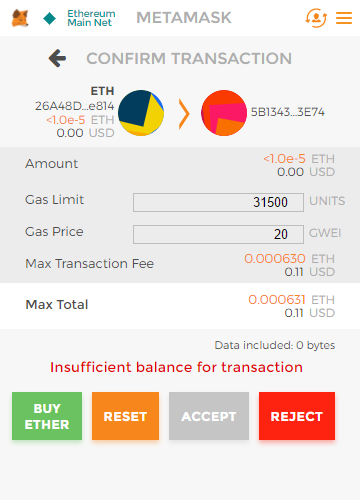

You are paying for the computation, regardless of whether your transaction succeeds or fails. Even if it fails, the miners must validate and execute your transaction compute gwei ethereum price therefore you must gwei ethereum price for that computation just like you would pay for a successful transaction.

However, the units of gas necessary for a transaction are already defined by how much code is executed on the blockchain. It is very important to understand how gas works in order to make judicious decision while submitting a transaction to a Smart contract. If you are out of gas during a transaction, the transaction will be unable to complete.

If you have extra gas during a transaction all unused gas is refunded to you at the end. However, if you were sending 1 ETH to a contract and your transaction to the contract fails say, the Token Creation Period is already overyou will use the entireand receive nothing back. You can do so by lowering the amount you pay per unit of gas. The price you pay gwei ethereum price each unit increases or decreases how quickly your transaction will be mined. Anything above that and your TX will fail.

While there was noting wrong with the smart contract developed by Airswap, the whole 2 Hour window created a favorable condition for token grab between investors, but did cost few investors gwei ethereum price. Responsible companies gwei ethereum price make strides to avoid such a situation occurring during their ICO. It is time that the whole Ethereum ecosystem as a whole address the issue of exorbitant Gas prices and help make Ethereum transactions more safe and rational.

Abstract An investor lost a significant amount of Ether during the failed attempt to purchase AirSwap tokens during its ICO, a decentralized cryptocurrency exchange that started their public crowdsale on Tuesday. Background AirSwap is a decentralized token gwei ethereum price based on the Swap protocol whitepaper. Finally While there was noting wrong with the smart contract developed by Airswap, the whole 2 Hour window created a favorable condition for token grab between investors, but did cost few investors dearly.