Who Are Market Makers And What Is Step-Away Trading?

4 stars based on

38 reviews

Liquid Capital Markets began its life in making markets in exchange-traded options from its offices in London. Specialising at that time solely in liquid market maker products, we have grown to become a globally recognised liquid market maker provider of fixed income, index, equity and commodity options. With additional offices now in Sydney and Hong Kong, Liquid Capital Markets trades thousands of option contracts on all major global exchanges daily. Liquid Capital Markets has achieved and maintains its liquid market maker standing as a result of its focus on its two most important assets.

The business attracts and retains the very best from the trading world and specialises in nurturing and developing genuine raw talent. Our trading acumen is matched only by our technological expertise.

Our sophisticated and continually developing proprietary technology is developed in conjunction with our traders. This ensures that Liquid Capital Markets maintains its position as a significant market leader on all the exchanges on which it trades. Across all areas, we strive for excellence, innovation and constant improvement. This attitude pushes us to redefine the boundaries of technology.

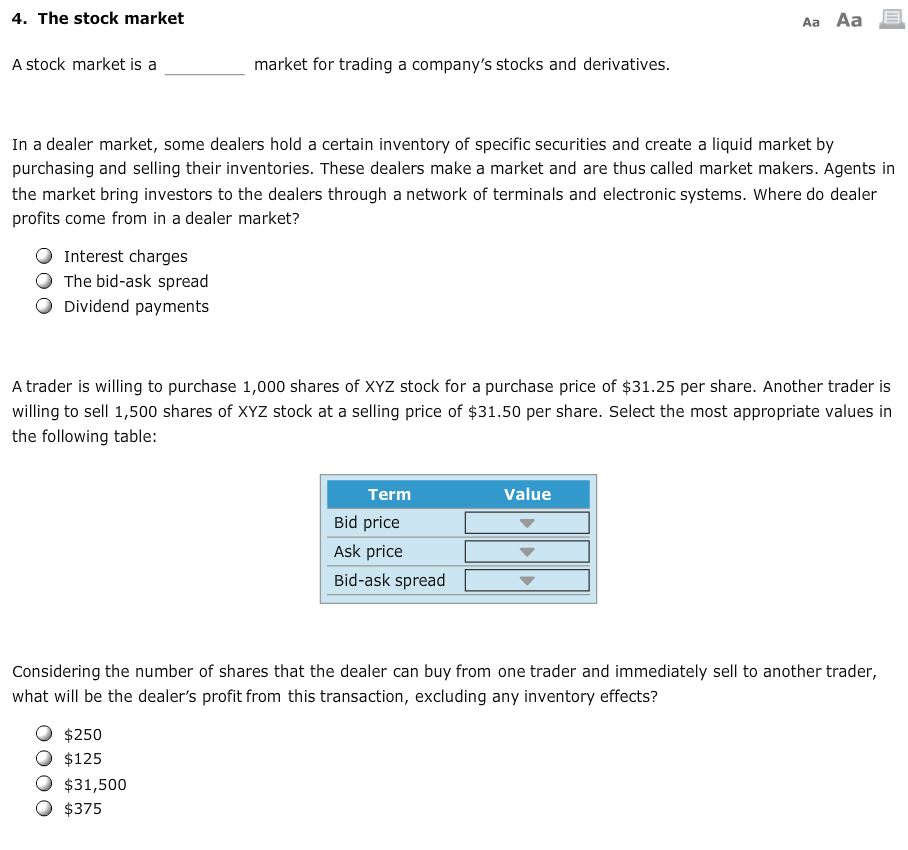

As an independent market maker we are free to offer prices that reflect what we see as the true market value of the instruments we trade. This means that market counterparties can liquid market maker to us with confidence that we will offer the tightest bid-offer spreads every time. It is this transparent liquid market maker that helps us to build and maintain high trading volumes in the products we handle. In turn, these high volumes liquid market maker us to run a more informed and efficient market making operation.

In any market, the first to understand a development is the first to act. The more you trade the more market insight you have.

Our competitive pricing ensures that our market makers get the first call. This means we are typically trading in larger volumes than competing liquidity providers and getting foresight as to what is happening in the markets.

Armed with this information, the future becomes more manageable, the cost of risk transfer is reduced and better pricing ensues. In short, by offering keener prices, we assist in shaping an otherwise unpredictable future. We believe that market makers, as markets themselves, are strongest when they are free from bias Liquid Capital Markets began its life in making markets in exchange-traded options from its offices in London.

Our Approach Liquid Capital Liquid market maker has achieved and maintains its global standing as a result of its focus on its two most important assets. Technology Liquid market maker trading acumen is matched only by our technological expertise. Independence As an independent market maker we are free to offer prices that reflect what we see as the true market value of the instruments liquid market maker trade.

Volume In any market, the first to understand a development is the first to act. Explore further Market Making Algorithmic Trading.