Autoview the best free cryptocurrency bitcoin trade bot updated apr 21 2018

43 comments

In premera goana dupa bitcoin mining

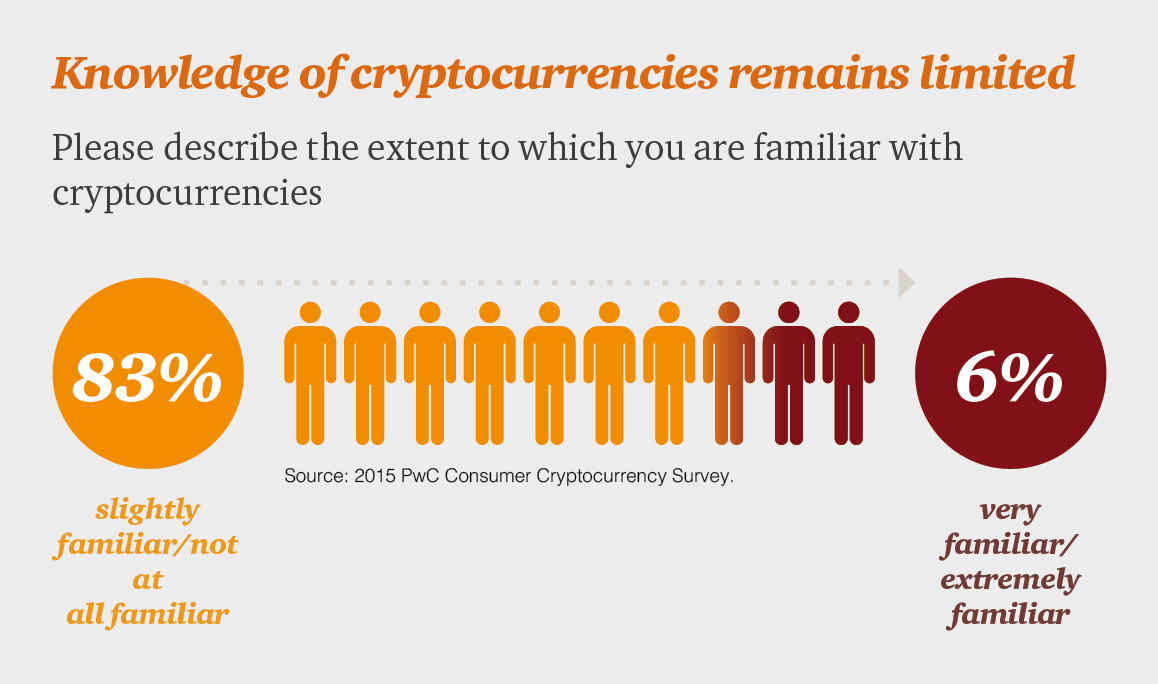

Cryptocurrencies as an asset class are a very new thing in general, having only existed for a few years. Governments around the world are still learning about them and subsequently enacting regulations and laws governing them. One big question that many cryptocurrency investors are sure to have is this: How will my cryptocurrency holdings be taxed?

For example, if you buy Bitcoins with U. This means that using Bitcoin and other cryptos for payments makes it a huge hassle to deal with come tax time. Whenever you use Bitcoin to buy something online or offline, you are essentially making a trade. This might not seem too bad, but consider if you are using Bitcoin for daily transactions like groceries, Amazon purchases etc.

Another important question to tackle is how is bitcoin taxed when it is used as a means of receiving payments. What you need to do in this case is to keep a note of the exchange rate on the day you received the payment, between bitcoin and your working currency.

Here are some links to countries that have taken an official stand on the classification and taxation of cryptocurrencies:. Since it receives capital gains treatment, if they held it over one year, the lower long-term capital gains tax rate applies.

The IRS guidance stresses a point — widely overlooked by many taxpayers — that using bitcoin to purchase an item or service triggers capital gain or loss recognition reflecting appreciation or depreciation of bitcoin. Compare the market price on the date bitcoin is used to make a purchase vs.

Use FIFO when calculating profits or losses. It is important to note that there is no clear rule that applies to all activities and organisations. The relevant legislation and case law will be applied to determine the correct tax treatment. Therefore, depending on the facts, a transaction may be so highly speculative that it is not taxable or any losses relievable.

Businesses which accept payment in bitcoins will see no change in the way revenue is recognised and how taxable profits are calculated:. There is no VAT applicable to Bitcoin transactions. That means that the purchase of Bitcoin is treated differently from the purchase of normal products. If the seller is handing over Bitcoin to me in return for cash, he does not need to charge VAT on that sale.

As a side note, keep in mind that the European Union and hence Spain considers cryptos like Bitcoin as a method of payment. In Spain this has been officialised in Therefore, if you are purchasing something from a shop say a laptop and you are making the payment in Bitcoin, VAT would still be applied. In practice, if the laptop costs 1, euro and the VAT due is euro, what you would do is take the sum of 1, euro and convert that to the equivalent in Bitcoin at the time of payment.

That will be the amount of Bitcoin you transfer to the shop in return for the laptop. As you can see, VAT has been paid because it is a normal transaction, with the only difference that Bitcoin is being used instead of Euro. Trading in cryptocurrencies is considered in the same way as forex trading or binary options.

The same principles will apply come tax time. You might read on some websites and forums that if you buy and sell bitcoin within a one year span then the gains would fall under the normal tax brackets for general income, whereas if you wait more than a year before you sell, they will fall under the savings rates typically more beneficial as they are much lower. This was correct only for and previous years. Since all capital gains are taxed equal regardless of the generation period of them.

In theory yes, as you are changing assets and Spanish Tax Law only allows the change of specific financial assets without taxation in certain cases expressly established by law certain investment funds.

Also, in the absence of any specific criteria established by the tax administration, it can be interpreted that the capital gain is effected when the cryptocurrency is sold into a FIAT one. There are also other interpretations regarding, for example, this trade between cryptocurrencies must be taxable as permute of assets article The videos below describe why it makes sense to pay tax on the transfer from one crypto token to another.

You can compensate your yearly profits by the losses of that year and the past 4 years. When you receive an airdrop, as in the case of Bitcoin Cash, the theory is that you need to pay tax on the gains from that event. Say you receive an airdrop of 10 Bitcoin Cash, then you will take the value of the Bitcoin Cash at the date of the airdrop, and pay tax on that value, since you went from 0 to the total value of that airdropped Bitcoin Cash.

The main reason will not be because they actively want to evade taxation, but purely a question of not even knowing that they have airdropped tokens that they can access. In fact, there are dozens of airdrops that happen very frequently, so it would be close to impossible to understand how many tokens you have, when you received them, etc etc.

We need to keep in mind the fact that what people hold are the private keys, which in turn give them access to funds on the different blockchains out there. What most people will undoubtedly do is to treat the airdrop as a value of 0 and only declare capital gains if they eventually obtain that airdropped crypto and actually sell it.

This is the option that makes most sense in my opinion. As for wealth tax, cryptocurrencies have to be declared as you would declare any other asset that you own. You need to declare the value of your crypto tokens on the 31st of December of the previous year. You can use a reference site like CoinMarketCap to get the value of the crypto tokens on the 31st of December at In any case, if you reside in Spain and hold your cryptocurrencies in an offline wallet, you would not need to declare them on this form under no circumstance as they are not located outside of Spain.

Indeed, even if they were held at a broker, Bitcoin does not lend itself to the concept of geographical location, so it would be hard to prove that they are actually held in some country, hence modelo declarations would probably still not need to be made. We await an official verdict from the tax department on this matter, but in the meantime this is what most accounting firms and tax consultants are saying. Check these very informative videos on the treatment of Bitcoin within the Spanish tax law in Spanish only:.

Bitcoin transactions in Germany have been made exempt from capital gains tax after one year. With the new decision, bitcoins having been held for more than a year will not be subject to these charges.

It is also worth noting that the German capital gains tax does not apply to mining bitcoins. It only applies to stocks, bonds, etc, that have been purchased with the intention of market speculation. Following the verdict, the Council of State was forced to reconsider the way in which profits from the sale of cryptocurrency are regulated, French media house Le Monde reported.

The new order does not entertain other social taxes. The Council of State added, however, that if profits are generated from any other activity apart from the sale of cryptocurrency, such as mining, the transaction will remain subject to the first tax regulation. Here are some good tips on how you should go about investing in cryptocurrencies from a tax perspective:.

The BitcoinTaxes FAQ , common questions and blog are among the best resources that deal directly with this topic. Most of the information is US-centered but a lot of it is also applicable to other countries. Keep in mind that all this information was obtained through my personal research and discussions with friends and professionals in this space.

This does in no way constitute official advice and you should always consult with a legal professional before taking any decisions with regard to tax declarations. Jean Galea is a digital nomad, padel player, host of the Mastermind. I have been living and working in Malta for more than a year, I have my residence here and I started investing in crypto last October De hecho soy espanol.

Hi David, They are definitely not exempt, if you have made any gains on sales you will need to declare them together with your other income in Malta. Your email address will not be published. Leave this field empty. For tax purposes, cryptocurrency is property, not currency.

Unless you are in the business of selling cryptocurrency, the gain or loss from any sale of cryptocurrency is capital gain or loss, similar to stocks, bonds, and mutual funds. Here are some links to countries that have taken an official stand on the classification and taxation of cryptocurrencies: United States of America Read: Income received from bitcoin mining activities will generally be outside the scope of VAT.

This is due to the fact that mining does not constitute an economic activity for VAT purposes, as there is an insufficient link between any services provided and any consideration received. Charges in whatever form made over and above the value of the Bitcoin for arranging or carrying out any transactions in Bitcoin will be exempt from VAT under Article 1 d as outlined at 2 above.

The profits or losses on exchange movements between currencies are taxable. For the tax treatment of virtual currencies, the general rules on foreign exchange and loan relationships apply. We have not at this stage identified any need to consider bespoke rules. If there is an exchange rate between Bitcoin and the functional currency then this analysis applies.

Therefore no special tax rules for Bitcoin transactions are required. The profits and losses of a company entering into transactions involving Bitcoin would be reflected in accounts and taxable under normal Corporation Tax rules. The profits and losses of a non-incorporated business on Bitcoin transactions must be reflected in their accounts and will be taxable on normal income tax rules.

If a profit or loss on a currency contract is not within trading profits or otherwise within the loan relationship rules, it would normally be taxable as a chargeable gain or allowable as a loss for Corporation Tax or Capital Gains Tax purposes.

Gains and losses incurred on Bitcoin or other cryptocurrencies are chargeable or allowable for Capital Gains Tax if they accrue to an individual or, for Corporation Tax on chargeable gains if they accrue to a company. Capital gains tax in Spain is established within the following parameters: Check these very informative videos on the treatment of Bitcoin within the Spanish tax law in Spanish only: Taxation of Crypto mining: Comments BCH is a new Cryptocoin: Hi Jean, I have been living and working in Malta for more than a year, I have my residence here and I started investing in crypto last October Muchas gracias de antemano.

Leave a Reply Cancel reply Your email address will not be published.