How to make money with bitcoin arbitrage trading

12 comments

Dish liquid bottle cover

Mining metals and minerals like nickel, gold, copper and zinc helped shape Canada into the nation it is today—and a new kind of mining may help the country enter a technology-focused future. Quebec has become a potential destination for the establishment and relocation of Bitcoin and other cryptocurrency mining centres, particularly from Chinese companies looking to leave the country due to regulatory pressure.

AntPool is the largest Bitcoin mine in the world right now, accounting for 56 per cent of global bitcoin miners, and currently resides in China. However, the country has been notoriously fickle with cryptocurrency, first banning ICOs , then banning trading altogether, then reenabling trading with strict regulations. Mine operators in China have been worrying about how the continued crackdown may affect their ability to operate and have explored new options, including Quebec. Countries like Iceland and Sweden are mine destinations as well, but Quebec is doing its part to woo potential suitors to the province.

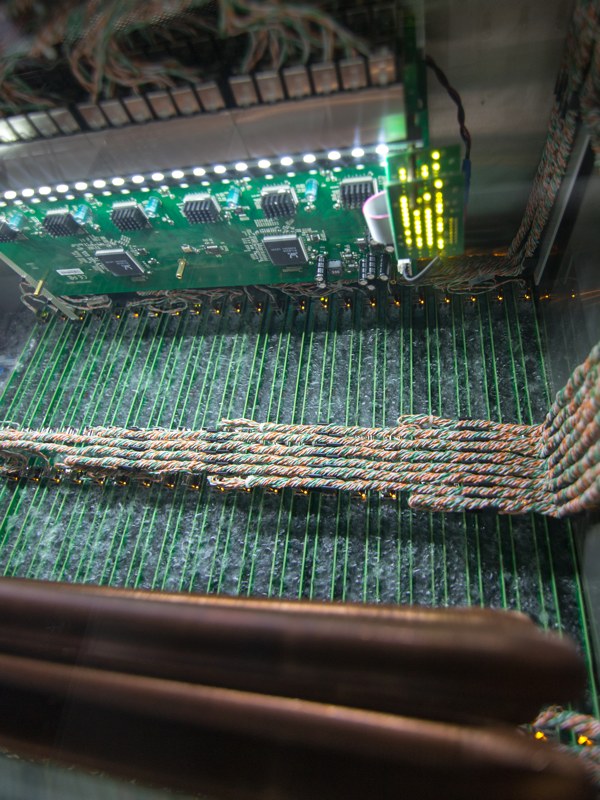

The more processing power a mine controls, the more cryptocurrency it can access. A computer in a mine may perform millions of calculations per day, using enormous amounts of energy to produce just fractions of a Bitcoin.

Put hundreds of them together though, and suddenly it becomes a lucrative business. Cryptocurrency mining centres coming to Canada would mean a few different things. Firstly, it would be a boon in terms of investment in electronics, energy, and at least a few new jobs.

But how those numbers—particularly energy-related figures—translate to costs in Quebec is hard to judge. According to recent statistics, China has some of the cheapest energy costs per kilowatt-hour in the world, but Canada is right behind them. The final amounts are difficult to estimate though, as many variables factor in: Quebec is also very cold for a large part of the year, which works wonders for an operation that runs electronics all day every day.

New centres could save on cooling costs and reduce the number of fans and coolant needed. In addition to the tens of millions in energy costs that Quebec would collect each year from mining centres, one important aspect of cryptocurrency mines coming to the country would simply be a better understanding of how the technology works. Just recently, the Canada Pension Plan Investment Board discussed the option of investing in cryptocurrency. They said it was not worth investing yet, but in the future it could be viable.

Uber has halted their autonomous driving tests after a fatal accident. The ride-hailing company said today that a woman was…. Andre Haddad is a master when it comes to connecting a person with what they need. That might involve helping…. Max Greenwood Nov 22 Thousands of these mini-computers make up a single Bitcoin mine.

Matt Odynski Oct 31 Max Greenwood Mar 27 Max Greenwood Mar 19 Nav Dhunay Mar 16 Max Greenwood Dec 12

(1).jpg)