Why is Ethereum different to Bitcoin?

4 stars based on

34 reviews

Great thread from just a month ago. It bet the increase in difficulty and decrease in profitability is even worse than many of us expected. At this current level, the law of large numbers really ethereum vs bitcoin mining difficulty the upside in ETH. The difficulty is increasing at a faster clip though. The difficulty is increasing so rapidly now that they better be prepared for either POS to happen this year, a rollback of the difficulty algorithm, or a hard fork. I expect the difficulty curve to flatten a bit, but still keep trending higher.

I'm hoping, probably stupidly, for a change in the algorithm. If the cards yield less your payout wont increase. Also most miners buy low quality mobos, cpus, and ram to get everything working.

You obviously ethereum vs bitcoin mining difficulty understand that if Eth takes a dump then all that hardware you are trying to sell will be met with others doing the same. In finance we call that a 'dirt nap'. I can say this, I haven't mined for long and I have already seen the decrease in yield over my time frame, I spoke with a few more experienced miners including some that make a living doing it and they seem to share my thoughts.

The thoughts being that the profitability of Eth is going to decrease substantially this year. Lastly, if they go PoS then you literally can't mine and your hardware will be worthless. You are definitely welcome to your opinion though. The point of this thread is for opinions. I hope you are right cause were both miners together. Anyways I am still ethereum vs bitcoin mining difficulty and making profit but will definitely be pulling out of the game.

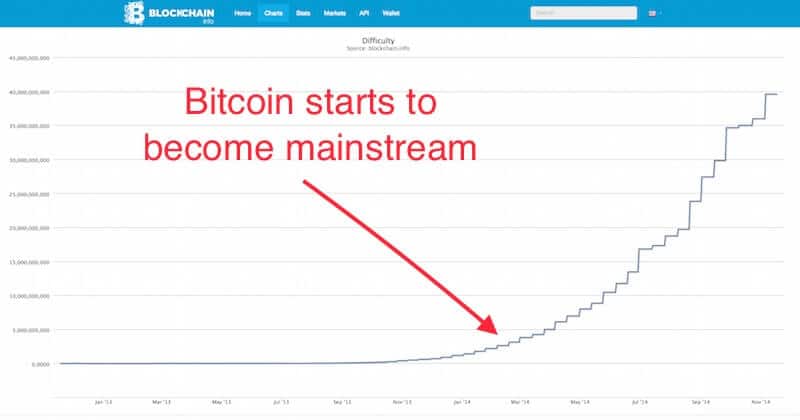

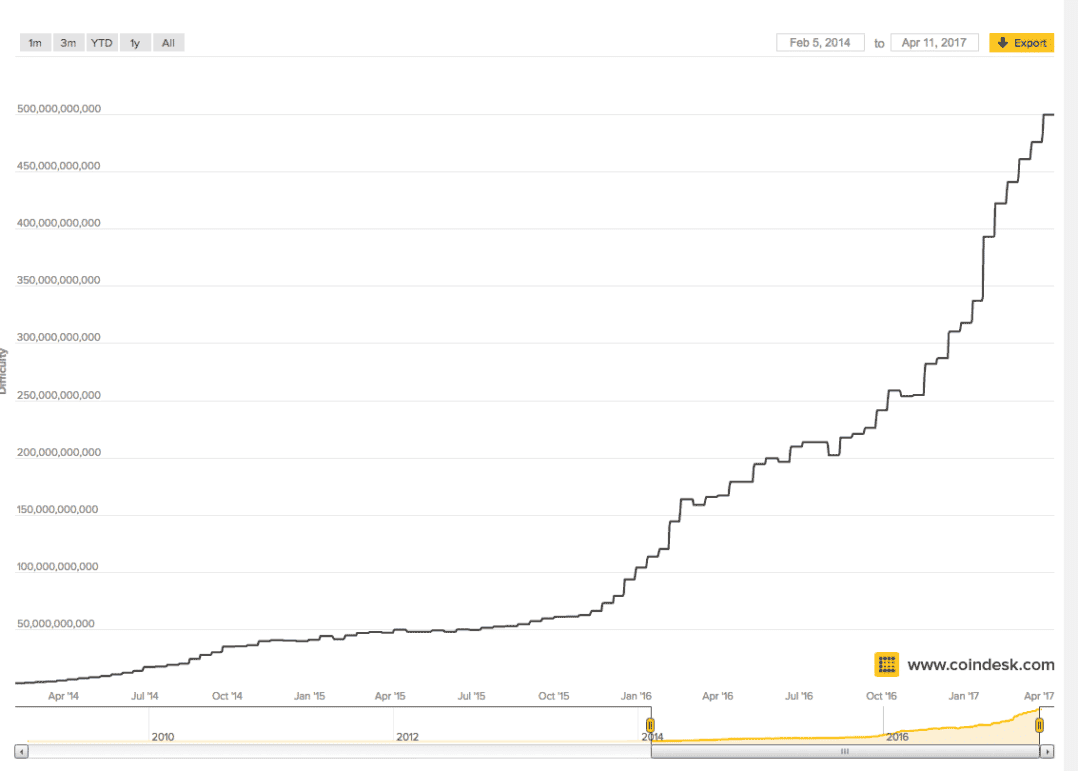

It looks like you're new here. If you want to get involved, click one of these buttons! June in Mining. I did some minor mining calculations yesterday and the results should be communicated. At the current rate of difficulty increase we will see the difficulty double itself every couple months and eventually plateau once mining is no longer profitable. There is a very real possibility that we hit the ex profit zone in just four months.

The difficulty doubled from February 3rd to March 30th, effectively cutting mining yield revenue by half. However the price kept up with the hash rate increase and this resulted in an impact that only experienced miners really noticed.

The difficulty then doubled again from March 30th to May 29th having a similar impact. What this means for you - If the coin value doesn't keep up with the difficulty, expect major decreases in profitability.

Realistically this ethereum vs bitcoin mining difficulty going to happen and it will happen this year. Another thing to consider is if you believe the coin value will keep up with difficulty then consider just buying the Eth outright and riding the curve. This method is significantly less risky and requires almost 0 level of effort. Alternatively, mining will still be a ethereum vs bitcoin mining difficulty business but require users to be more proactive in upgrading their rigs with new cards and selling their old cards for salvage value, or perhaps switching to a coin that is less difficult.

Ethereum vs bitcoin mining difficulty I was a miner of everyone who put in their. Hi Jamis, I don't know how ethereum vs bitcoin mining difficulty interpret what you said kind of confusing can you type it a little more clearly? That being said the major difference between then and now is that cards were still generating more profit than they were costing. The average RX will be operating at a loss in months if we continue at this rate and ethereum vs bitcoin mining difficulty price appreciation of Eth does not.

That being said, if you do the math ethereum vs bitcoin mining difficulty average person who started mining vs investing in Eth. Both when that post was made or even at the beginning the investors made out WAY better than the average miner.

You have four variables to consider. So really, as long as 1 keeps going up then 2 doesn't matter as much. That is actually not true at all, as long as 1 goes up the variable costs decrease. You are looking at this completely wrong. More pools form, more people will mine directly without using a pool and there is a dilution that occurs.

I would think that it will find equilibrium somewhere -- exponential growth can't continue forever. Scuba - I agreebut look at LTC and BTC, both are completely not mineable to someone who doesn't want to invest several hundred thousand. Basic economics, the profitability will drop until the point where it's not profitable to start. All the small players will be squeezed out and a group of large companies will remain. My estimation is that before year end you see a drop in the number of casual miners significantly.

I started mining in March. While of course difficulty has increased almost triple since, ETH price has increased even more over 5x. Ethereum vs bitcoin mining difficulty MrN1ce9uy, however I surely bet your profitability has dropped substantially. I would wager against anyone willing to take the bet that the difficulty increases significantly more quickly than the price Starting already and continuing on forward.

I am excited to see how it changes in the coming months. I am no longer increasing my mining rigs as I feel there aer plenty of other ways to get better returns on my investment. June edited June You can pretty much cut my ROI in half.

Third your though process on just investing in ETH doesnt make sense either. When you take hard cash capital that you own it is way more risky than investing into hardware to mine ETH. And im using the though process here of everything goes to shit and price of ETH dumps.

Youve invested into something you can actually sell. Investing directly in Eth is not more risky if you believe the value of Eth will rise, and if it falls then my statement is still accurate that is profitability decreases. As long as I get my ROI on my rig everything after that is money in my pocket Secondly in my eyes there will always be something to mine. There will definitely always be something to ethereum vs bitcoin mining difficulty. But unless you plan to sell the hardware in the next couple months that guy can get a way better card for cheaper.

It about halved in just days. Yes, it was zcash. Got 2 coins for the price of 1 when z-cash hit. August edited August Really not sure if I should sell my stuff as long as people are still willing to pay big money?! Or is a drop in difficulty likely to happen? A drop in difficulty is very unlikely. But I wouldn't sell stuff right now, as the prices are still high and it looks like they are staying high. The best time point for selling would be just before the hardware prices drop - which is ver hard to know in advance: Sign In or Register to comment.