What is a blockchain

5 stars based on

63 reviews

Blockchain has been poised to disrupt financial services. But with the sheer interest and investment by insurers, banks, investment managers, and commercial real estate firms, is blockchain a transformative technology instead of a disruptive force? Broad adoption and integration enter the realm of the possible. Companies should look to standardize the technology, talent, and platforms that will drive future initiatives—and, after that, look to coordinate and integrate multiple blockchains working together across a value chain.

Read the report here. Few enterprise technologies today are as misunderstood blockchain enigma paradox opportunity blockchain. With this in mind, join us as we debunk tech myths and correct a few common misconceptions about blockchain and its enterprise potential. When two chains combine: Supply chain meets blockchain. In an increasingly digitized blockchain enigma paradox opportunity, emerging technologies, such as blockchain, afford organizations the opportunity to drive business value throughout their supply networks.

We now have safer and more efficient ways to connect with business partners as well as to track and exchange any type of asset. The ability to deploy blockchain technologies to create the next generation of digital supply chain networks and platforms will be a key element in business success. But what exactly are these events? Will they really disrupt venture capital as a means to fund development?

Are they a sign of an economic bubble, or is there something truly worth considering under the surface? In this paper, we review the fundamentals of ICOs that have blockchain enigma paradox opportunity the market by storm. Blockchain will be bigger than you can imagine, but getting there will be harder than everybody expected. In order to guide conversations, we have identified a series of considerations and found that there are 20 essential questions, as outlined in our Blockchain Readiness Framework, to help define a winning commercialization strategy.

Organized into six categories, each question serves as a mechanism to further evaluate the opportunity at hand. By addressing these questions early, the chances of successfully harvesting the benefits of blockchain can increase dramatically.

Blockchain is gaining traction today, but critics who question the scalability, security, and sustainability of the technology remain.

Deloitte member firms across the globe are collaborating to build blockchain capabilities to develop world class solutions and services for clients. More specifically, this global perspective piece reviews and addresses:. Risk functions need to play an active role in shaping blockchain strategy. Is your organization prepared for the new risks posed by the introduction of a blockchain framework?

The successful adoption and operation of any new technology is dependent on the appropriate management of the risks associated with that technology. Blockchain is being viewed as the foundational technology for the future re of risk management.

However, as the technology continues to mature and many theoretical use cases begin to get blockchain enigma paradox opportunity for commercialization, it behooves the financial services industry to start focusing on a less discussed question: And if so, what should blockchain enigma paradox opportunity do to mitigate these risks? Blockchain, the technology that will have the greatest impact on the next few decades, has arrived. The internet of value is here — are you ready?

Deloitte Digital Bank — Customer onboarding: The creation of a truly smart customer identity allows for a revolutionary onboarding process that is fast, cheap, and scalable. Blockchain enigma paradox opportunity Digital Bank — Cross-border payments: Check out our cross-border payments module.

To learn how financial institutions can leverage blockchain technology, click on the icon in the upper left corner of the video window and choose a video from the playlist above. Blockchain in commercial real estate: The future is blockchain enigma paradox opportunity.

Blockchain technology has recently been adopted and adapted for use by the commercial real estate CRE industry. CRE executives are finding that blockchain-based smart contracts can play a much larger role in their industry.

Blockchain technology can potentially transform core CRE operations such as property transactions like purchase, sale, financing, leasing, and management transactions. In particular, we have found that among the core CRE processes, leasing is well-suited for blockchain adoption. When we consider the processes and the need for smart contracts, leasing meets the prerequisites for using blockchain technology. Making blockchain real for customer loyalty rewards programs.

Customer experience and brand loyalty blockchain enigma paradox opportunity key for the success of financial services firms, and loyalty programs can make or break that success. Blockchain enigma paradox opportunity loyalty programs have been gaining popularity, they are also failing due to inefficiency and a lack of uniformity. Gained efficiencies, reduced costs, and enhanced brand loyalty.

Blockchain technology for investment management firms. Blockchain technology has the power to transform the asset management value chain—and blockchain enigma paradox opportunity firms that adopt it early will reap the rewards. This report examines unique blockchain developments and provides a six-step guide to implementing blockchain.

Position your firm for the future by advancing asset management technology. Turning a buzzword into a breakthrough for health and life insurers. Increasing costs, discerning customers, and innovative disruption are just a few of the challenges faced by health and life insurance companies.

How can a cryptocurrency technology like blockchain potentially solve these problems, and more? A crowdfunding research project—bringing together experts in blockchain, cybersecurity, health insurance, and life insurance—set out to discover how blockchain can help manage risks, cut costs, and improve customer satisfaction. The results are six realistic use cases that can positively impact health and life insurance companies. Turn concern into confidence by adopting blockchain. Blockchain shows promise in financial services.

Blockchain, the technology backbone behind bitcoin, has the potential to serve as an alternative to the current infrastructure necessary to create institutionalized trust. The distributed public ledger protocol can serve as a trusted intermediary, verifying transactions and providing confidence to all involved parties. While blockchain efforts are still in the early stages, some financial services institutions are already working toward using the technology to transform long-standing business processes.

Blockchain shows promise in financial services here. The transformation of the financial services industry is top-of-mind for everyone in the field. But how can this technology help financial firms? This report from Deloitte and. World Economic Forum takes a pragmatic approach to answering this question.

There are new and emerging opportunities for organizations in all sectors to create and deliver compelling services to their customers using the power of disruptive innovation.

As organizations formulate their plans for the coming months, this paper aims to help business and public sector leaders understand the cultural and organizational challenges that are inevitably brought by the use of blockchain technologies and provides them with the insights they need to overcome them.

Reading the blockchain enigma paradox opportunity payments radar: Scanning for opportunities and potential threats in the payments market, Ninth edition. Economic recovery coupled with rapid innovation is redefining payments as an engine for growth. Continued improvements in credit quality and encouraging employment numbers signal increased demand for Payments related services and continue to further our optimism for growth for the industry.

While rising interest rates will continue to define the economic climate in the forthcoming months, it is imperative that leading issuers approach an encouraging growth environment cautiously. This underlying technology for cryptocurrencies may be the lasting innovation that will revolutionize the payments landscape.

Blockchain technology enables the transformation of a typical bank facilitated ledger system into a distributed ledger system, making value transfer and settlement more transparent, faster, cheaper, and safer. Please click on the image to enlarge or click here to download the infographic.

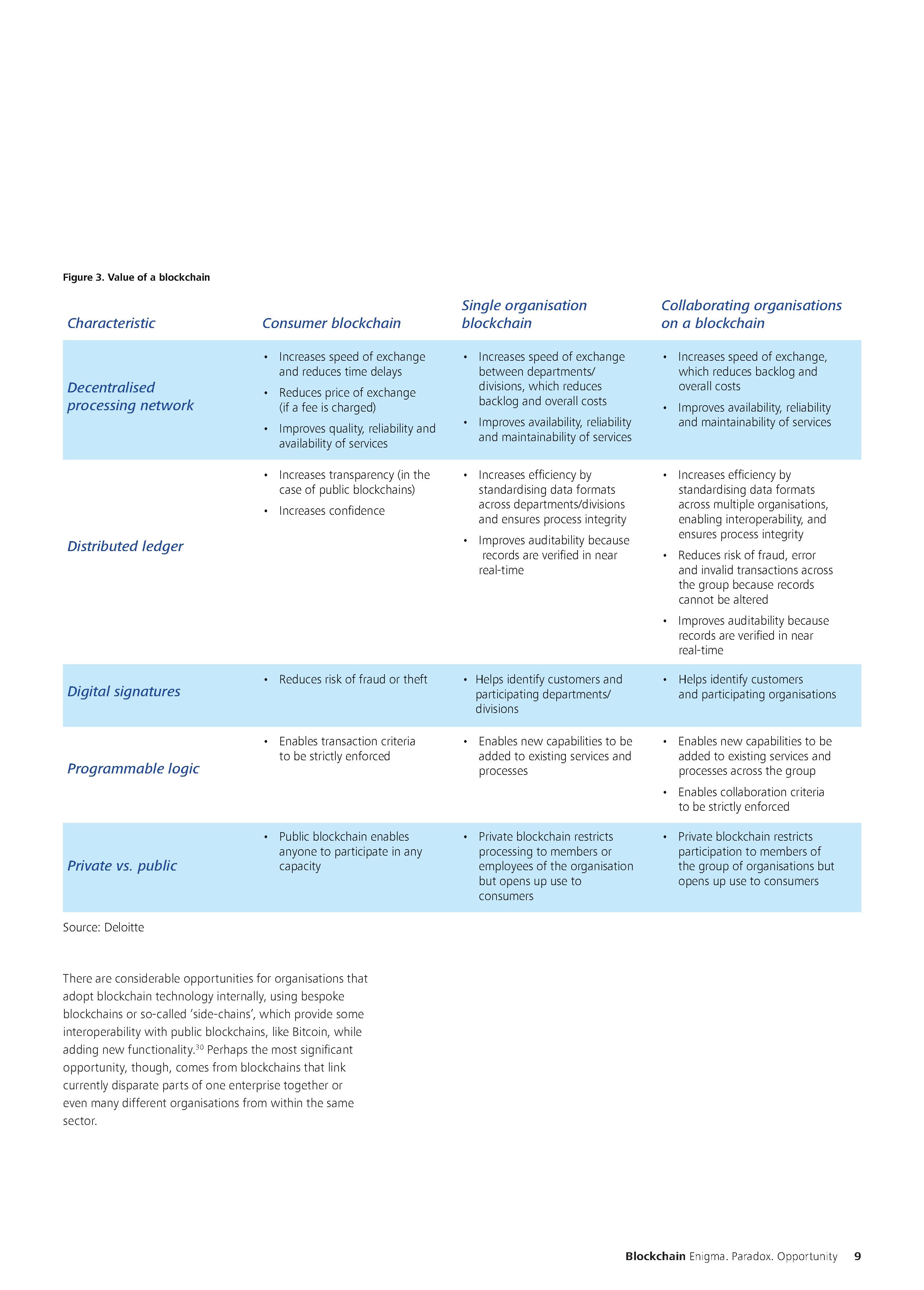

Blockchain enigma paradox opportunity allows for the secure management of a shared ledger, where transactions are verified and stored on a network without a governing central authority. Blockchains can come in different configurations, ranging from public, open-source networks to private blockchains that require explicit permissions to read or write. For blockchain enigma paradox opportunity information, please contact: More specifically, this global perspective piece reviews and blockchain enigma paradox opportunity