Four Killer Blockchain Use Cases for Insurance

4 stars based on

75 reviews

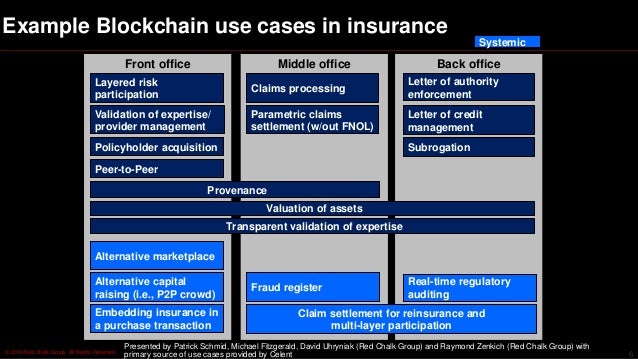

Is blockchain really a solution in search of a problem? At first glance, it may appear that way. Aside from developments in the industry loss warranty ILW marketclear use cases have been slow to emerge.

Index-triggered contracts certainly stand to streamline the risk-transfer process for both reinsurance and retrocession, and if sufficient cost efficiencies are attained, they may even bring such covers back into vogue, despite the abundance of capacity available in the global insurance and reinsurance market right now.

Complex commercial claim handling and settlement: Insurance enterprise systems remain heavily influenced by the manual processes they were sought to replicate. Automating manual activity can lead to incremental increases in operational efficiency, but they sacrifice the possibility of truly transforming a business to fully capitalize on the capabilities of the technology they adopt. Think about simple problems that can have profound implications in the commercial claim management space—problems that arise nearly every day.

A disagreement about when a phone call occurred or what the latest data in a valuation assessment contains can drastically extend life cycles and result in considerable increases in costs. And the benefits to commercial claim management could be applied to layered traditional reinsurance as well.

Internet of Things IoT blockchain use cases for insurance cover: Connected devices could identify a loss event and report it to the insurer before the insured even knows about it. For example, if the sprinklers in a home are activated, the loss is assumed to be of a certain magnitude based on readings from water sensors and data indicating how long the sprinkler was active.

The cost and duration of the claim life cycle could decline profoundly. New types of insurance protection: The combination of blockchain and smart contract features could change how even consumer insurance products are bought and sold in the coming years.

Still something of an experiment in the primary commercial insurance market—talk of parametric covers has gained momentum in recent years. Parametrics could be adapted to cover property damage through the use of IoT technology, with fixed payments based on certain damage readings. And in the commercial market, parametrics could solve problems ranging from catastrophe protection to terror or cyber cover.

Currently, Tom is spearheading initiatives in global terror, global energy and marine, and regional property-catastrophe loss aggregation. Previously, Tom held insurance industry roles at Guy Carpenter where he launched the first corporate blog in the reinsurance sector and Deloitte.

We use cookies on this blockchain use cases for insurance to enhance blockchain use cases for insurance user experience. By continuing to use this site you are giving us your consent to place cookies on blockchain use cases for insurance device. Proactive data management key to handling EDI reporting challenges. Continue Give Me More Information.