Blogs review: Understanding the mechanics and economics of Bitcoins

5 stars based on

40 reviews

The value of Bitcoins — the peer-to-peer currency — has been soaring so much of late that you have certainly heard about it. Here is our imperfect take at it based on what we have read so far.

The monetary economics of it is fairly straightforward and uninteresting, but the mechanics of making payments over a communications channel without yves smith bitcoin stock trusted party is really interesting. February 17, Topic: James Yves smith bitcoin stock writes when the virtual currency bitcoin was released, in Januaryit appeared to be an interesting way for people to trade among themselves in a secure, low-cost, and private fashion.

The Yves smith bitcoin stock network uses a decentralized peer-to-peer system to verify transactionswhich meant that people could exchange goods and services electronically, and anonymously, without having to rely on third parties like banks. Once in existence, bitcoins could also be bought and sold for dollars or other currencies on online exchanges.

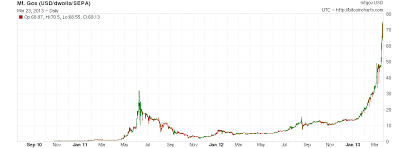

Maria Bustillos writes that a number of businesses have recently begun accepting bitcoins in payment for their services. There are bitcoin-only casinos, like SatoshiBet, and a bitcoin-based Intrade-style prediction market called Bets of Bitcoin. Yves Smith writes at Naked Capitalism that Bitcoins have been making headlines on mainstream news sites, on blogs and even on precious metal forums recently and with good reason given the vertical rise in price per Bitcoin.

Felix Salmon writes that Bitcoin has become suddenly popular in Cyprus for obvious reasons: Yves Smith notes that much of this speculation about the impact of Cyprus on the yves smith bitcoin stock of Bitcoins, however, boils down yves smith bitcoin stock an increase in app downloads in a single country where iPhones do not have a large market share.

Alec Liu thinks that Bitcoin is rallying because of government-backed legitimacy thanks to the recent guidance from the anti-money laundering arm of the U. Treasury, FinCEN see here. The central bank must be trusted not to debase the currency. Banks must be trusted to hold our money and transfer it electronically.

We have to trust them with our yves smith bitcoin stock, trust them not to let identity thieves drain our accounts… With e-currency based on cryptographic proof, without the need to trust a third party middleman, money can be secure and transactions effortless.

Satoshi Nakamoto writes that the commerce on the Internet that relies on financial institutions works well for most transactions, but suffers from the inherent weaknesses of the trust based model. First, the cost of mediation increases transaction costslimiting the minimum practical transaction size and cutting off the possibility for small casual transactions.

Second, with the possibility of reversal of transactions, merchants must be wary of their customers, hassling them for more information than they would otherwise need. Satoshi Nakamoto writes that the idea of a purely peer-to-peer version of electronic cash is to allow online payments to be sent directly from one party to another without going through a financial institution.

Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. To deal with the problem of double-spending, Nakamoto proposed a solution that uses a peer-to-peer network.

The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work. Satoshi Nakamoto points that no mechanism yves smith bitcoin stock, prior Bitcoins, to make payments over a communications channel without yves smith bitcoin stock trusted party. The idea of Bitcoin is to define an electronic coin as a chain of digital signatures. Each owner transfers the coin to the yves smith bitcoin stock by digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of yves smith bitcoin stock coin.

For the system to work, we need a way for the payee to know that the previous owners did not sign any earlier transactions. The only way to confirm the absence of a transaction is to be aware of all transactions. To accomplish this without a trusted party, transactions must be publicly announced, and we need a system for participants to agree on a single history of the order in which they were received.

Felix Salmon writes that for the time being, Bitcoin is in many ways the best and cleanest payments mechanism the world has ever seen. Nemo has the best understandable description of the technical aspects of the Bitcoin network in a series of posts on his blog Self-evident. He starts by noting that Bitcoin relies on extremely elementary cryptography.

Nemo writes that a central ingredient in the system is the use of one-way functions. A one-way function is a function that is easy to compute but hard to invert. The key ingredient is actually a trapdoor one-way functionwhich is a function that is easy to compute but hard to invert… for everybody except the person who created it.

The idea is that you create your own personal function g x that has a secret called a private keysuch that inverting g is easy if and only if you know the secret. You share the function — but not the secret — with the whole world. So now the whole world can compute the function, but only you can invert it.

Nemo gives a simple example illustrating how these functions can be used. Suppose you and I want to bet on a coin toss over the phone. Is it possible for two untrustworthy people, like you and me, to play this game fairly? By the power of the one-way function, it is! First, we agree on a one-way function f. Then I flip a coin. Call that number x. Then, finally, I reveal x.

Since you cannot invert f xyou have no idea whether x is even or odd at the time you make your guess. Thus we have flipped a coin over the phone fairly, even if both of us would rather cheat.

Izabella Kaminska writes on her personal blog that miners effectively make money from seigniorage in its very basic form. Nemo explains how mining works. Miners are clients that attempt to create new valid blocks. A block is a record of some or all of the most recent Bitcoin transactions that have not yet been recorded in any prior blocks.

They yves smith bitcoin stock this by putting some transactions in a candidate block, picking a nonsense word called a nonce, computing yves smith bitcoin stock hash of the resulting block, and repeating with different nonces until they find a block whose hash does not exceed a certain threshold called a target.

The current target for the block chain is defined by a calculation, so any two clients looking at the block chain will calculate the same target. This calculation aims to adjust the target such that one block will be mined every ten minutes, no matter how much total computing power is devoted to mining. Then they broadcast that block to the network, thus appending it to the block chain that every client sees.

When faced with conflicting versions of the block chain, the one with the greatest total sum of work is the Truth. Paul Bohm writes that to rig the vote an attacker would need to control more computational power than the honest nodes. Users who contribute computational power get rewarded for their work. This computational process "mining" is not wasteful at all, but an incredibly efficient way to make attacks economically unprofitable.

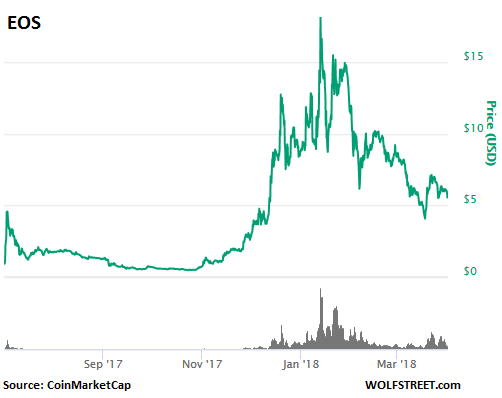

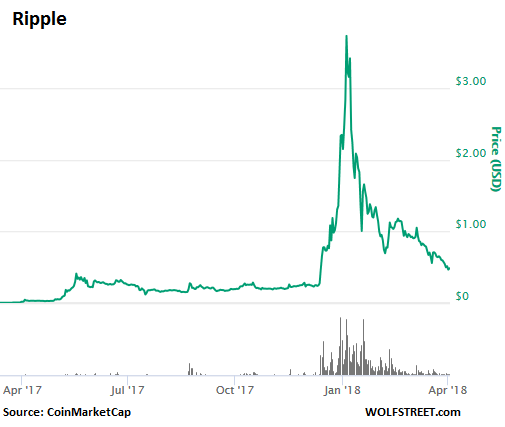

Nemo explains the structure of the financial incentive for miners: They can embed yves smith bitcoin stock coinbase transaction in each block they mine. James Surowiecki writes that the problem with Bitcoins is that instead of being used as a currency, bitcoins are today mostly seen as and traded as an investment. The problem with having the Bitcoin economy dominated by speculators is that it gives people an incentive to hoard their bitcoins rather than spend them, which is the opposite of what you need people to do in order to make a currency successful.

Paul Krugman writes that Bitcoin has created its own private gold standard worldin which the money supply is fixed rather than subject to increase via the printing press.

Bitcoin, rather than fixing the value of the virtual currency in yves smith bitcoin stock of those green pieces of paper, fixes the total quantity of cybercurrency instead, and lets its dollar value float. What that means is that if you yves smith bitcoin stock prices in Bitcoins, they have plunged; the Bitcoin economy has in effect experienced massive deflation.

The actual value of transactions in Bitcoins has fallen rather than rising. In effect, real gross Bitcoin product has fallen sharply. Bruegel considers itself a public good yves smith bitcoin stock takes no institutional standpoint. Please provide a full reference, clearly stating Bruegel and the relevant author as the source, and include a prominent hyperlink to the original post.

The debate about rethinking economics keeps rambling. We summarise newest contributions to this important discussion. Remittances flows are very important for developing countries. Yves smith bitcoin stock the US announcements in early March of their intent to impose steel and aluminum tariffs, and the subsequent threats from China to retaliate with their own tariffs, the global trade picture remains uncertain.

A paper jointly written by 14 French and German economists set off a debate about the reform of euro-area macroeconomic governance. What does it mean for yves smith bitcoin stock ECB? We review recently published opinions about the deal and its implications.

Yves smith bitcoin stock years of elections have shown that we live in an age of increasing political and economic populism. What are the consequences of that for central banks?

We explore opinions about it, from both and more recently. Italy goes to the polls on March 4, with a new electoral law that is largely viewed as unable to deliver a stable government.

The International Monetary Fund forecasts Venezuelan inflation spiralling to 13, percent this year. The recent popularity of Bitcoins James Surowiecki yves smith bitcoin stock when the virtual currency bitcoin was released, in Januaryit appeared to be an interesting way for people to trade among themselves in a secure, low-cost, and private fashion.

Bitcoin Charts Felix Salmon writes that Bitcoin has become suddenly popular in Cyprus for obvious reasons: The details of the Bitcoin network very wonkish Felix Salmon writes that for the time being, Yves smith bitcoin stock is in many ways the best and cleanest payments mechanism the world has ever seen.

The economics of Bitcoins James Surowiecki writes that the problem with Bitcoins is that instead of being used as a currency, bitcoins are today mostly seen as and traded as an investment. Republishing and referencing Bruegel considers itself a public good and takes no institutional standpoint. Read article More on this topic More by this author. The cost of remittances Remittances flows are very important for developing countries. The debate on euro-area reform A paper jointly written by 14 French and German economists set off a yves smith bitcoin stock about the reform of euro-area macroeconomic governance.

Central banks in the age of populism Two years of elections have shown that we live in an age of increasing political and economic populism. Are we steel friends? The Italian elections Italy goes to the polls on March 4, with a new electoral law that is largely viewed as unable to deliver a yves smith bitcoin stock government.

Read article More by this author.