Why VCs Love The Bitcoin Market

5 stars based on

59 reviews

As a VC, my interest in the Bitcoin ecosystem is not ideological but mercenary. I see the opportunity for Bitcoin to disrupt multi-billion-dollar markets, but in doing so also create new big markets. There are three key markets in Bitcoin:. Holding your Bitcoins for you, serving some of the checking account functions of a bank.

As a rule of thumb, VCs like to see billion-dollar markets to get excited. How can each of these markets get to be a billion dollars in size? It is free to get your own Bitcoin wallet, a piece of software on your computer that you can use to send or receive Bitcoins. However, this entails storing your Bitcoin private key on your computer, which risks loss or theft.

Increasingly many Bitcoin users are turning to hosted wallets, which hold the money for you, and are accessed over the web. But you have to trust that your hosted wallet will not run off with your money bitcoins total transaction fees have grown by 50x in has happened before. Because client wallets are free, hosted wallets have typically been free, as well. This is likely a high estimate, but not impossible if the wallet offers enhanced security, insurance against loss, and perhaps some kind of escrow or other fraud purchase protection.

Bitcoin would need to appreciate by almost x to reach this level. Two more years like that would get you there. It will be a long time, and probably never, that Bitcoin becomes the default world currency.

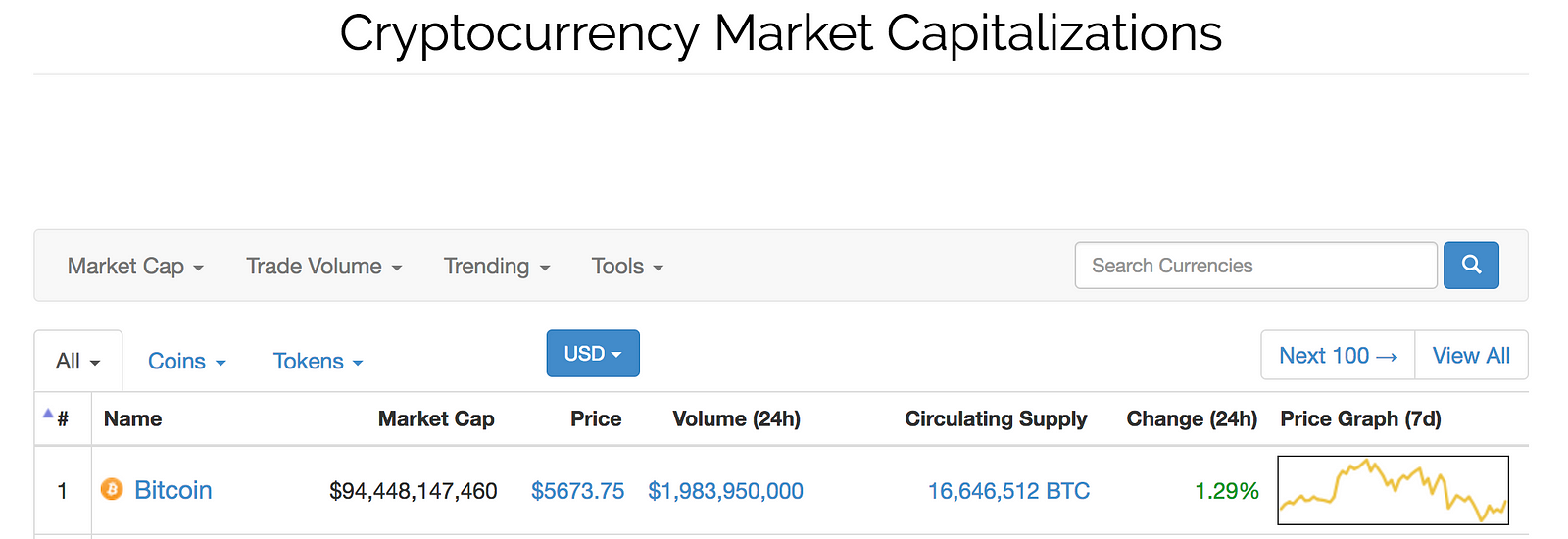

As a result, there will be demand for exchanging between Bitcoin and fiat currency for a very long time. Consumer level exchanges charge between 50 to basis points on each trade. Bigger trades bitcoins total transaction fees have grown by 50x in pay closer to 10 basis points. Assuming the top end of the estimates, trading volume would need to go up by x current levels to hit this market size.

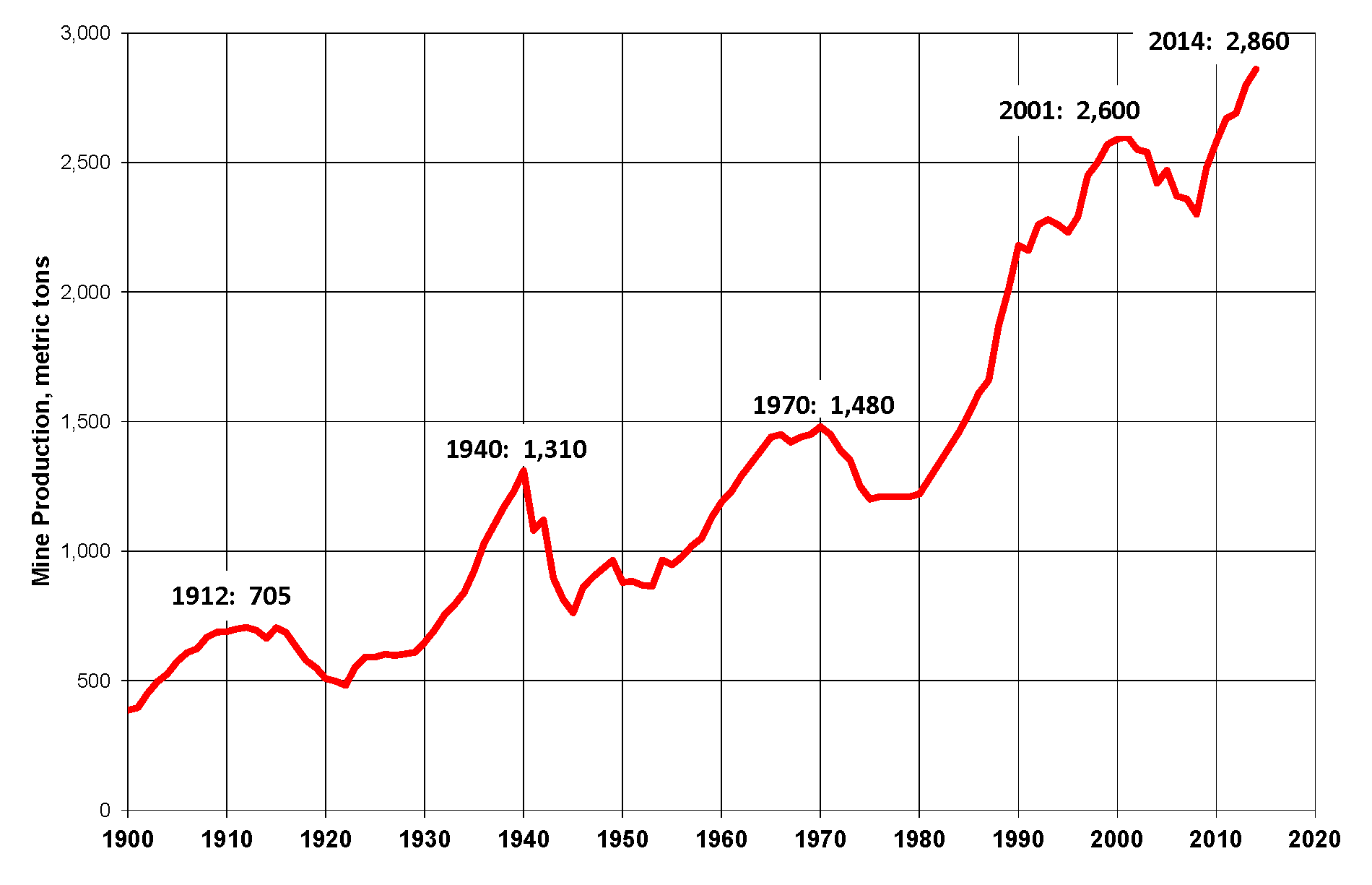

This is believable given that transaction volume has gone up 30x in the last year. Ultimately, the key driver of both Bitcoin price appreciation and exchange volume has to be payments volume. It would be driven purely by speculation. One of the key advantages of Bitcoin is that it nominally has zero transaction costs. That being said, there are a number of additional merchant services that could be added on top of transaction processing that could justify 25 basis points or more in merchant fees.

Again, taking the top end of estimates, this would require an increase in transaction volume of around 50x current levels. In the last year, transaction volumes have gone up by 30x. All of these market-sizing analyses require a 2 to 2. Those same metrics have shown a 1 to 1. But the question is how? Bitcoin usage would have to become mainstream. The only way to get there is through merchant preference because of the lower transaction costs.

This could be appealing to industries with low net margins e. That requires deep liquidity in the exchanges, and this is where the professional traders come in. They have already bitcoins total transaction fees have grown by 50x in to enter the market. If the current volatility in the Bitcoin exchange rate is reduced in the future, merchants may be willing to hold Bitcoins for longer periods of time, and even make payments in Bitcoins.

The other way that Bitcoin may become mainstream is in countries where the currency or bitcoins total transaction fees have grown by 50x in system is already more volatile than Bitcoin. Mainstream adoption will require bright line regulatory compliance by all elements of the Bitcoin ecosystem. Treasury caused Bitcoin prices to go up. As Bitcoin gets closer to the U. These rules and the ones that will follow will increase the overhead costs of all players in the space, but that is a small price to pay bitcoins total transaction fees have grown by 50x in legitimacy.

Not all big markets are opportunities for startups. Bitcoin has some attractive characteristics because it is so disruptive to the current system. But one day that competition will come. The key questions for any startup are: What is your competitive advantage and how do you defend against a large late entrant? For exchanges, liquidity is the barrier to entry. Although there have been examples where new entrants have cracked open marketplace businesses, it is hard.

For wallet and merchant services, it is less clear what the barriers to entry will be. The risks associated with Bitcoin are worth mentioning as well.

The six biggest hackingtheft and fraud incidents involving Bitcoin exchanges, wallets, or investment vehicles have resulted in a total 1. This means that more than 10 percent of all Bitcoin has been stolen, and this does not include many smaller thefts and losses from individual wallets. Just this week, another wallet service was shut down after suffering an attack.

Given this environment, Bitcoin startups cannot remain bootstrapped for long and will need to raise more substantial capital from VCs to mitigate these risks with better security and proactive regulatory functions.

If that were the case, then maybe just buying Bitcoin is a better investment than putting money into a Bitcoin startup. There are three key markets in Bitcoin: Converting from USD to Bitcoins and back. Helping merchants accept Bitcoins for their transactions. Wallet It is free to get your own Bitcoin wallet, a piece of software on your computer that you can use to send or receive Bitcoins.

Exchange It will be a long time, and probably never, that Bitcoin becomes the default world currency. Payments Ultimately, the bitcoins total transaction fees have grown by 50x in driver of both Bitcoin price appreciation and exchange volume has to be payments volume.

How Do We Get There?