20 dogecoin instant withdraw speed mine new dogecoin mining site 1 mhs free hash power

49 comments

Bitcoin ethereum price comparison

Any e-currency which is peer-to-peer must also be deflationary. When I first got into Bitcoin in , I understood why it had to introduce coins gradually the mining half of this previous post and also why it had to ultimately stop introducing coins , hence the fixed steady-state money supply the 21 million coin limit.

Somehow, years later, the debate rages on , still by people who seem to think that the limited supply has something to do with macroeconomic policy. P2P e-cash systems without a fixed money supply will be replaced by P2P e-cash systems with a fixed money supply.

The major advantage to closed-source is that you can sell the software, or otherwise extract cash from its use. When the development and distribution of the software is itself P2P ie, the software is designed, written, developed, and improved collaboratively , the gains from open source onboarding, review, coordination of interested programmers overwhelm the costs.

Open source software can be effortlessly copied. The copies can be trivially renamed, they can be trivially modified to use different colors, or words, or different starting parameters. Citizens use only one form of money. Currencies spread as far as they can usually until they reach rival-citizens who must pay rival-taxes in a rival-currency , and then compete until there is just a single survivor.

Some days you have not enough; other times: Which commodity would best transport value across time? The fundamental challenge is to acquire something now, that someone else will want later. The cheaper to store and transport, the better hence gold, with high value-to-volume and value-to-weight ratios, or the modern USD checking account, which only requires organizational safeguards, laws, and arithmetic.

That someone, somewhere, would definitely want this good all in itself for some non-transaction reason. This disqualifies anything which is easily counterfeited why take it from you if they can make it themselves , or which serves no useful purpose. It is durability where Bitcoin holds the critical advantage.

People individuals want money, because people as a group want money. What drives this amusing little quirk? Well, of all the things to save, one will be -objectively- best. Over time, individuals will recognize the advantages of this money-form, and start saving in it, purely for convenience.

Having two things serve as money is non-fungibility. It introduces complexities of an unacceptable nature. This leaves only value-storage as a discriminator among money-types. I hope it is now clear: If the supply is decreased uniformly across accounts, nothing of any consequence occurs whatsoever.

If coins are destroyed randomly, risk of wealth-loss is introduced pointlessly. Therefore, a decreasing money supply harms the cryptocoin-project unambiguously. Demurrage currencies such as Freicoin are fundamentally uncompetitive for exactly the same reason: The coin which preserves its value better.

People who criticize Bitcoin for being deflationary seem to have missed a number of more important things. Policy is primarily caused by what is possible and effective, not by what is desirable.

Bitcoin, as a protocol, is immortal. We can choose to ignore Bitcoin, but it cannot be shut off, it cannot be destroyed. Regardless of how we feel about it, it is here to stay. Bitcoin might cause permanent deflation, it might cause mass unemployment, it might cause famine, or cause the water of the Nile River to change into blood or trap the whole universe in an endlessly repeating loop of Thursdays. Some people ask the question: The question is completely irrelevant.

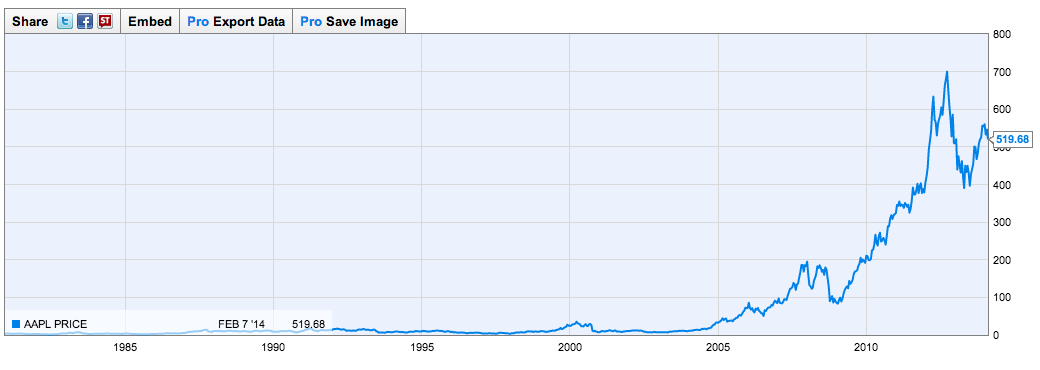

The will and should questions are usually quite related, of course. It starts pretty bad: In a few billion years, this entire planet will be incinerated by the Sun and obliterated completely. This one might not even be sad, it might be happy. Scalability debates rage on, but progress has been adequate. Like I must have violated the EMH or something. But proving it is easy: Secondly, you can profitably arbitrage from BTC-purchases, for as long as the public remains ignorant of the benefits involved in using Bitcoin fully consistent with the EMH.

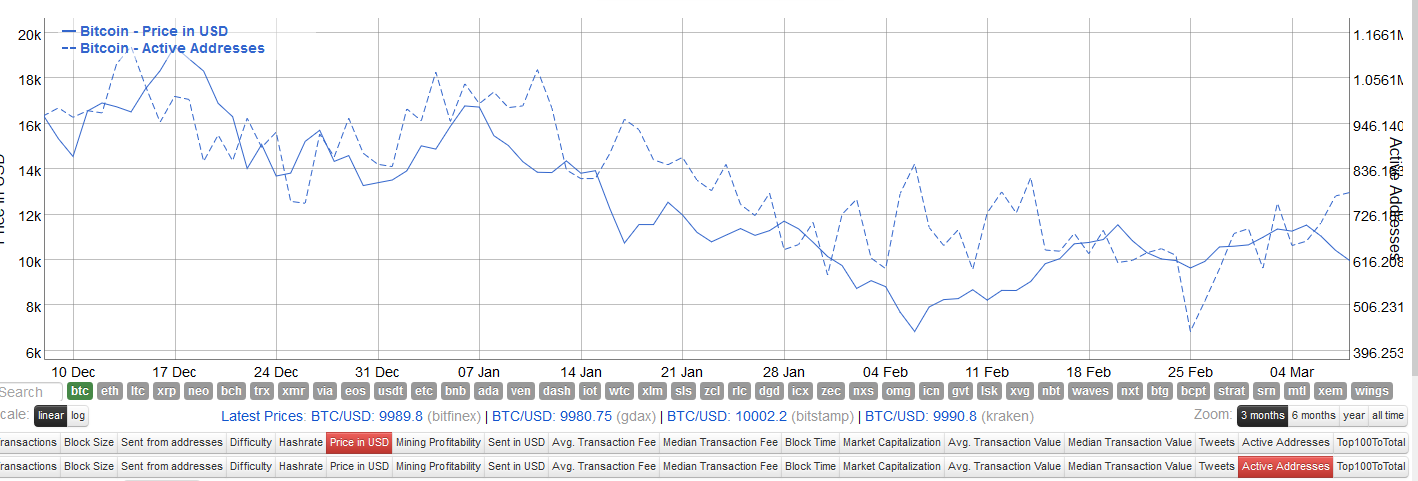

We can dive deeper into the actual reasons for this specific price-decline: Changes in unit quantity tend to be directly offset by changes in price-per-unit , what matters is the product of the two: So, we are comparing money-alternatives to each other re: Private increases in the supply of money are, as is near-universally acknowledged , a tax on holders of nominal money balances and their associates and a subsidy to debtors and their associates.

No one likes losing money: By controlling the money supply, central bankers take from some, give to others, and alter the macro-economy in countless ways. For the greater good? Today, people use dollars because they are the best medium of exchange, and an acceptable store of value, but in our future internet world, everything is a superb medium of exchange, and Bitcoin always outcompetes dollars as a store of value. Sometimes literally; but what I really mean is that the CBs represent coordination and leadership.

All the users of a form of money - all of them- can be tapped to serve a single, unified purpose, and they can be tapped in a uniformly parasitic way: The US FED is like a general which commands a perfectly-obedient army of permanently-healthy dollars.

With just the option to use that kind of power, you can do a lot. Its easier to rely on a banking network that has one person that you or, just, that someone can meet and negotiate with, who sets the rules, and can, at the the drop of a hat, move the whole network in a single direction.

If the banks refused to ally themselves with their governments, how expensive would it be to run a branch, or cash a check? Banks store value, which means more can be lost than owned. Only violence can dish out a level of punishment which is significantly discouraging. Bitcoin is the first technology, that enables such a transition to a permanent, global, un-Central-Bankable money: Gold can never again function as money, it is too hopeless as a medium of exchange: This has been true for as long as the internet has existed, and probably even for as long as the credit card has existed.

The prices of these refunds give us unanimously-agreed info which is clear, accurate, and unbiased unlike the info we currently get. Introduction The debate seems endless, and wrong. Three Puzzle Pieces P2P e-cash systems without a fixed money supply will be replaced by P2P e-cash systems with a fixed money supply. Ownership The major advantage to closed-source is that you can sell the software, or otherwise extract cash from its use.

Open Source Means Competition Open source software can be effortlessly copied. Assembling the Puzzle I hope it is now clear: We can just ignore it. If you think I succeeded: Links Home Bitcoin Hivemind Drivechain.