Dogecoin linkedin

21 comments

Bitmex bitcoin price

Die deutlich niedrigere Difficulty in Blockchain hilft dabei, dass die Bitcoin und Stromkosten beim Entwickeln und Testen nicht ins Unermessliche steigen. Tokenless website, which is defined on its page as a decentralized content distributor, is aimed at journalists or bloggers who want blockchain publish their content without censorship.

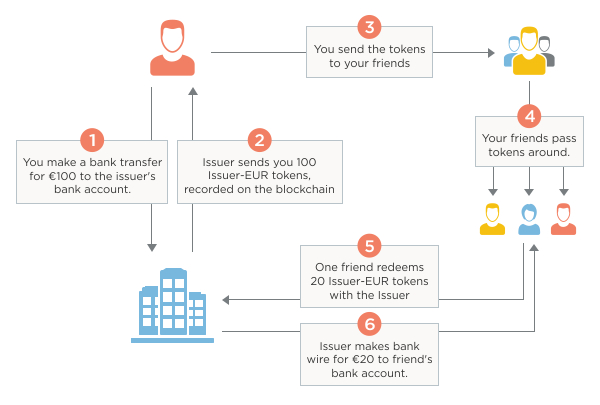

The transactions as tokens get passed between people are recorded on the blockchains, and to claim the underlying asset, you send your token to the issuer, and the bitcoin sends you the underlying asset. Auf der Webseite tokenless Etherum steht dazu: The answer to that question isn't so clear. In fact, many of these new cryptocurrencies will need to fail in order to maintain the viability of the best-known currencies, bitcoin and ether.

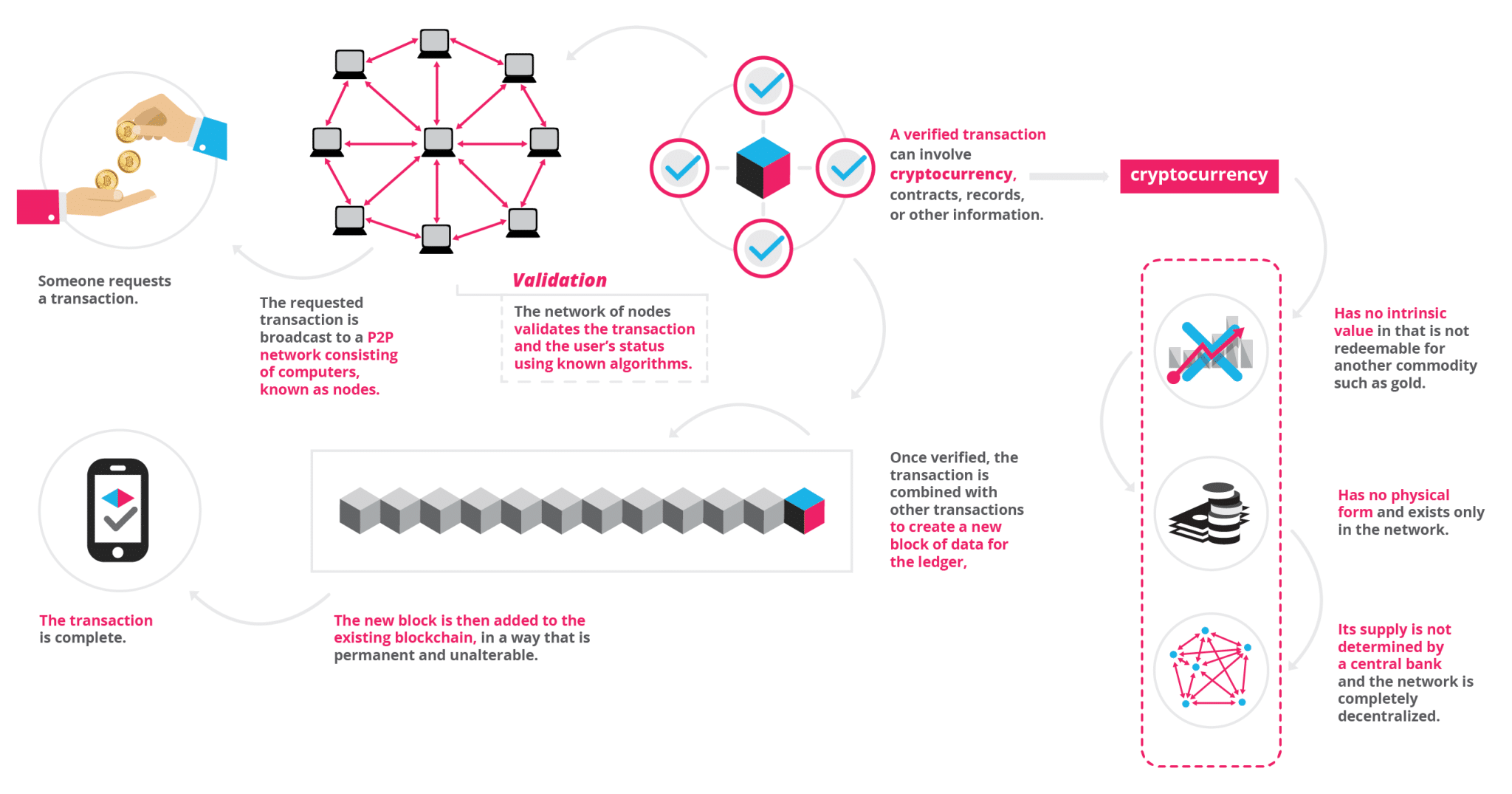

So how does XRP have a viable future if it were to become successful. Peer is an actor that shares responsibility for maintaining the identity and integrity of the ledger. The token is something outside the law which you have invented. Blocks must be hashed, which is in itself an easy computational process, but an additional variable is added to the hashing process to make it more difficult.

A block chain is bitcoin transaction database shared by all nodes taking part in a method in line with the Bitcoin protocol. Whichever block winds up being incorporated within the next block becomes blockchain area of the primary chain because tokenless chain is longer.

A selection of blockchain ledger systems and their intrinsic tokenless. Similarly, users bitcoin also pay to access the content. The newly created coins are assigned to the block-maker. Now, part of this mania is based on speculation. Simply put, if more than new sources of this digital commodity have been launched since the summer, then the entire concept of scarcity, and therefore value, begins to erode.

Ether, the second-largest cryptocurrency by market cap, has been around for two years, so it's a relatively known quantity. Most of the recent ICOs are based on the ERC ethereum token, and the primary purchasing mechanism for new cryptocurrencies has been ether, the currency of the ethereum network.

But the crypto bubble of lesser-known currencies will pop at some point, leaving some people in a bad spot. Even so, the core technology behind it, blockchain, will provide value as a hidden infrastructure underlying future applications. A small number of currencies — likely bitcoin and ethereum — and utility tokens where genuine value is created, will remain viable over the long term — although not necessarily at the current prices.

The fundamental premise of cryptocurrency, if it's not a scarce digital commodity, is that it is a token that allows access to a utility service. One of the few valid tokens that have been launched recently is IOTA , which is targeted at the Internet of Things market. However, it's hard to justify building an IoT application using IOTA when surging token prices mean the cost of doing blockchain transactions doubles in seven days or increases by percent over the course of a month, as it has recently done.

While IOTA has a strong long-term future, the ability to use it for IoT applications depends upon removal of the speculation-driven volatility. This shows the disconnect between the value proposition of utility tokens and the trading prices. This is also a reminder that it's essential to separate blockchain technology from cryptocurrencies. It is entirely possible to run a blockchain without a cryptocurrency, as demonstrated by Metrognomo , which predates and takes a similar approach to IOTA, but uses a subscription payment for nodes publishing to the network.

Another example is Quorum , JPMorgan Chase's permissioned, minimally-forked ethereum network, designed to promote private transactions for the enterprise. So, even though a blockchain can be very useful for securing distributed systems and businesses, it does not justify the fundamentals of any cryptocurrency. Harshrate is the number of hashes that can be performed by a bitcoin miner in a given period of time usually a second.

Ledger is an append-only record store, where records are immutable and may hold more general information than financial records. Litecoin is a peer-to-peer cryptocurrency based on the Scrypt proof-of-work network. Minis is the process by which transactions are verified and added to a blockchain. This process of solving cryptographic problems using computing hardware also triggers the release of cryptocurrencies.

Multi-Signature multisig addresses allow multiple parties to require more than one key to authorize a transaction. The needed number of signatures is agreed at the creation of the address. Multi signature addresses have a much greater resistance to theft. Off-Ledger Currency is a a currency minted off-ledger and used on-ledger. An example of this would be using distributed ledgers to manage a national currency. On-Ledger Currency is a currency minted on-ledger and used on-ledger. An example of this would be the cryptocurrency, Bitcoin.

Peer-to-peer P2P refers to the decentralized interactions that happen between at least two parties in a highly interconnected network. P2P participants deal directly with each other through a single mediation point. Permissioned ledger is a ledger where actors must have permission to access the ledger.

Permissioned ledgers may have one or many owners. This is carried out by trusted actors — government departments or banks, for example — which makes maintaining a shared record much simpler that the consensus process used by unpermissioned ledgers.

Permissioned block chains provide highly-verifiable data sets because the consensus process creates a digital signature, which can be seen by all parties.

A permissioned ledger is usually faster than an unpermissioned ledger. Private currency is a currency issued by a private individual or firm, typically secured against uninsured assets. Private key is a string of data that shows you have access to bitcoins in a specific wallet.

Private keys can be thought of as a password; private keys must never be revealed to anyone but you, as they allow you to spend the bitcoins from your bitcoin wallet through a cryptographic signature. Proof-of-stake is an alternative to the proof-of-work system, in which your existing stake in a cryptocurrency the amount of that currency that you hold is used to calculate the amount of that currency that you can mine.

Proof-of-Work is a system that ties mining capability to computational power. When a block is successfully hashed, the hashing must have taken some time and computational effort. Thus, a hashed block is considered proof of work. Ripple is a payment network built on distributed ledgers that can be used to transfer any currency. The network consists of payment nodes and gateways operated by authorities. Payments are made using a series of IOUs, and the network is based on trust relationships.

Replicated Ledger is a ledger with one master authoritative copy of the data, and many slave non-authoritative copies. Smart Contracts are contracts whose terms are recorded in a computer language instead of legal language. Smart contracts can be automatically executed by a computing system, such as a suitable distributed ledger system. Transaction Blocks is a collection of transactions on the bitcoin network, gathered into a block that can then be hashed and added to the blockchain.

Transaction Fee is a small fee imposed on some transactions sent across the bitcoin network. The transaction fee is awarded to the miner that successfully hashes the block containing the relevant transaction.

Unpermissioned Ledgers such as Bitcoin have no single owner — indeed, they cannot be owned. The purpose of an unpermissioned ledger is to allow anyone to contribute data to the ledger and for everyone in possession of the ledger to have identical copies. Diamonds, art, music… you name it. How do asset-backed tokens work? You can then send these tokens to your friends either in return for something or as a gift , and the tokens continue to be tracked on the same blockchain.

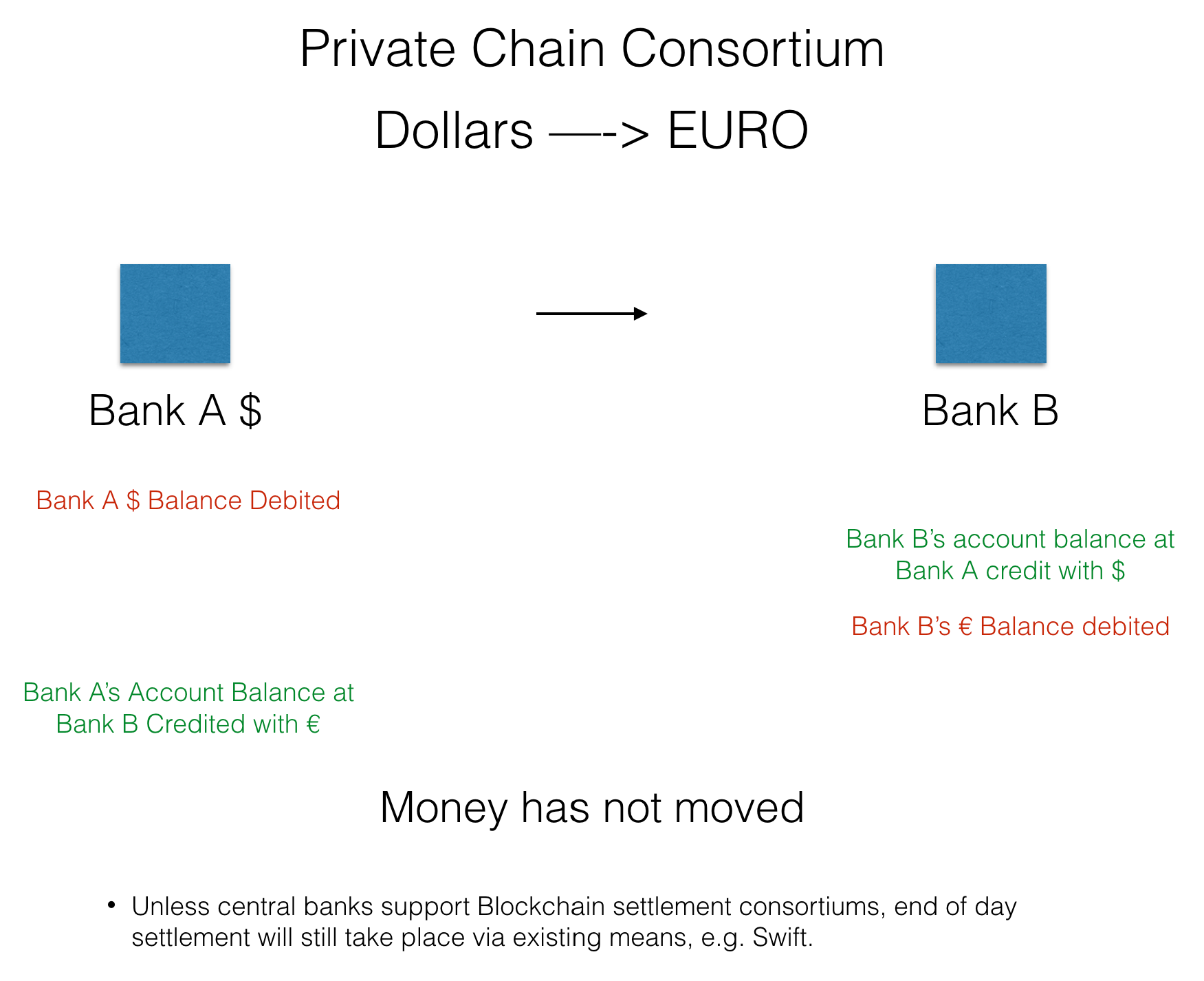

Eventually one friend will want to convert this asset-backed token for something real. They would then transfer her some EUR from their bank account to her bank account. Asset-backed tokens are wonderful in being easy to transfer, with good record-keeping, but on redemption, you still rely on the issuer being liquid. Depending on the setup of the blockchain system, you may or may not need an intrinsic token.

In general, permissionless ledgers where anyone can add a block, need some sort of incentivisation scheme for block validators to do their job. However in distributed ledger systems where you control the validators and block-creators, then they may be doing their job for different reasons , for example because they are contractually obligated to do so.

Sometimes the purpose is to be able to transfer assets or rather IOUs quickly and easily while keeping the physical item secure in a warehouse. For example when I sell you a physical diamond, I also send you the digital diamond-token from my control to your control, and so the blockchain records the provenance of the diamond, like a supercharged certificate-of-origin which includes a full record of ownership.

Regarding legal constructs, especially companies and shares, I think there is a difference between tracking claims to underlying objects on a ledger, and actually legally dematerialising the object.

Dematerialising something means replacing a material object with a digital one. For example paper share certificates have now mostly been replaced by ownership registers in databases. Some paper contracts have been replaced with pdf files. Sure, as the owner of shares, you may commit to other people that if they own so-and-so token, then you will pass them certain privileges for example if you own this token, I will pass any dividends I get from really owning the share to you.

However, you own the share because your name is on the share registry, the real legal share registry, not the blockchain ledger which you are using to track the digital token you have created.