Bitcoin Price manipulation by Cartel?

4 stars based on

63 reviews

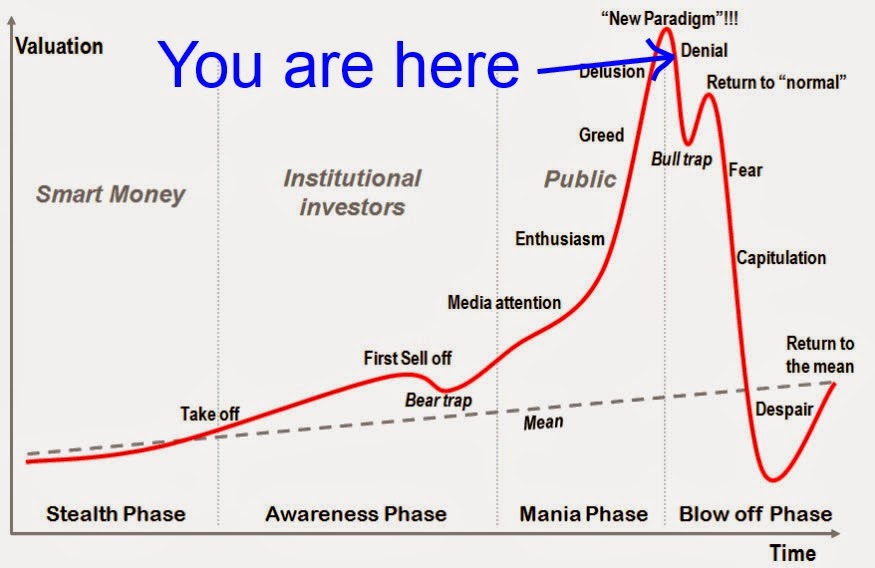

Bitcoin has been on a run. Despite its recent dipthe cryptocurrency has impressed skeptics and believers alike in its monumental rise in value since its creation nine years ago. But all that could be on the verge of change. Because while the argument rages on as to whether Bitcoin is in fact a currency or a store of valueone question looms large over all: Just what, exactly, is driving its price growth?

Well, a consensus answer is slowly forming among critics, and it doesn't look good for the world of cryptocurrency. In fact, it looks so bad that those same critics are predicting Bitcoin could take as much as an 80 percent hit in value.

Even Coinbase thinks you should maybe chill for a goddamn minute on Bitcoin. To understand why Bitcoin could be due for an imminent reckoning, one must first look to so-called stablecoins. The idea behind them is simple bitcoin price manipulation This would allow for many of the benefits of digital currency without the wild price swings bitcoin price manipulation it less than ideal for real-world transactions.

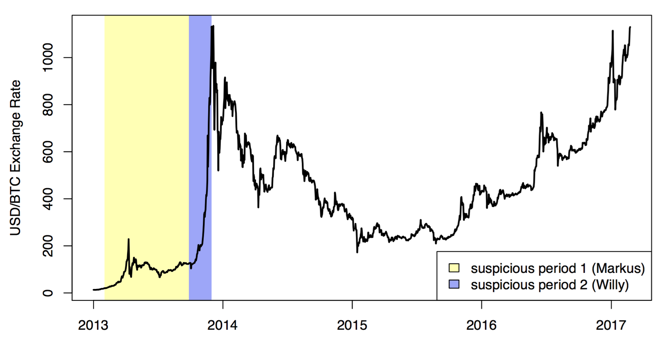

One purported stablecoin in particular has dominated the space: According to Tetheras of Jan. Founded inTether is connected to the online exchange Bitfinex. While the founders of that exchange had long insisted Tether was a separate entity, The New York Times reported in November that the Paradise Papers suggested otherwise. What does any of this have to do with Bitcoin's price?

A pseudonymous report released on Jan. The author of the self-titled Tether Report is not alone in his or her suspicions. Tony Arcieri, an independent cybersecurity expert who formerly worked at Square, released a detailed look at Tether on Jan. As in, Tether may be creating value out of thin air. And that bitcoin price manipulation, legitimate or not, is being bitcoin price manipulation into the cryptocurrency world — allegedly artificially driving up Bitcoin prices in the process.

Every crypto-currency is being priced against Bitcoin which is inflated by counterfeit money, or counterfeit money USDT pairsonce Tether implodes, nobody knows what prices will be. It's bitcoin price manipulation infected by Tether cancer.

The only bitcoin price manipulation place is out until Tether is resolved. What's more, the aforementioned Tether Report alleges that " It's not just bitcoin price manipulation critics and cybersecurity experts making this claim. That Tether may not in fact have the billions in cash reserves to back the billions of Tether tokens issued could be easily disproved by an auditing of the company's books suggests a simple solution: And yet, while long promising such an bitcoin price manipulation was forthcoming, the latest hope for such an accounting was dashed Saturday when CoinDesk reported that Tether and its supposed auditor were bitcoin price manipulation ways.

Tether did release a document in Bitcoin price manipulation which was supposed to prove it held cash reserves equal to its Tethers, but that didn't convince skeptics.

In a conversation with The New York TimesLewis Cohen — a lawyer who works with bitcoin price manipulation currency in his role at the law firm Hogan Lovells — bitcoin price manipulation that due to its wording the Tether document failed to prove Tethers are backed by dollars. Specifically, over million worth have been "minted" since the beginning of This doesn't sit well with Tether's numerous critics, who have taken to Twitter and YouTube to call out what they view as "a complete ripoff" and "a complete scam.

To make things even murkier, the ability to withdraw your Tether to your bank account in the form of USD has not always been guaranteed. We do not guarantee any right of redemption or exchange of tethers by us for money. Importantly, a search of the company's current TOS page shows that language has been removed.

Now, the company states that "Absent a reasonable legal justification not to redeem Tether Tokens, and provided that you are a fully verified customer of Tether, your Tether Tokens are freely redeemable. The Terms of Service go on to note, however, that "residents of certain U.

A recent Reddit post highlighted the confusion surrounding this. The silence in response is deafening. Mashable reached out to Tether for comment on these claims, and will update this story when and if we hear back. In the meantime, what does all this mean for Tether, Bitcoin, and cryptocurrency in general? Well, if the critics are correct, likely nothing good. In other words, if this alleged house of cards ever bitcoin price manipulation crashing down, it may bring down Bitcoin's price with it with such force that the January crash will look like a walk in the park.

And when and if that time comes, Tether's critics will be there to remind you that you were warned. We're using cookies to improve your experience. Click Here to find out more. Tech Like Follow Follow. It's all about bananacoins.