Milton ezrati bitcoin stock price

22 comments

Bitcoin news minermining the web for bitcoin news

A blockchain , [1] [2] [3] originally block chain , [4] [5] is a continuously growing list of records , called blocks , which are linked and secured using cryptography. It is "an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way".

Once recorded, the data in any given block cannot be altered retroactively without alteration of all subsequent blocks, which requires consensus of the network majority. Blockchains are secure by design and exemplify a distributed computing system with high Byzantine fault tolerance. Decentralized consensus has therefore been achieved with a blockchain. Blockchain was invented by Satoshi Nakamoto in to serve as the public transaction ledger of the cryptocurrency bitcoin.

The bitcoin design has inspired other applications. The first work on a cryptographically secured chain of blocks was described in by Stuart Haber and W.

In , Bayer, Haber and Stornetta incorporated Merkle trees to the design, which improved its efficiency by allowing several documents to be collected into one block. The first blockchain was conceptualized by a person or group of people known as Satoshi Nakamoto in It was implemented the following year by Nakamoto as a core component of the cryptocurrency bitcoin, where it serves as the public ledger for all transactions on the network.

The words block and chain were used separately in Satoshi Nakamoto's original paper, but were eventually popularized as a single word, blockchain, by The term blockchain 2. Second-generation blockchain technology makes it possible to store an individual's "persistent digital ID and persona" and provides an avenue to help solve the problem of social inequality by "potentially changing the way wealth is distributed".

In , the central securities depository of the Russian Federation NSD announced a pilot project, based on the Nxt blockchain 2. A blockchain is a decentralized, distributed and public digital ledger that is used to record transactions across many computers so that the record cannot be altered retroactively without the alteration of all subsequent blocks and the consensus of the network.

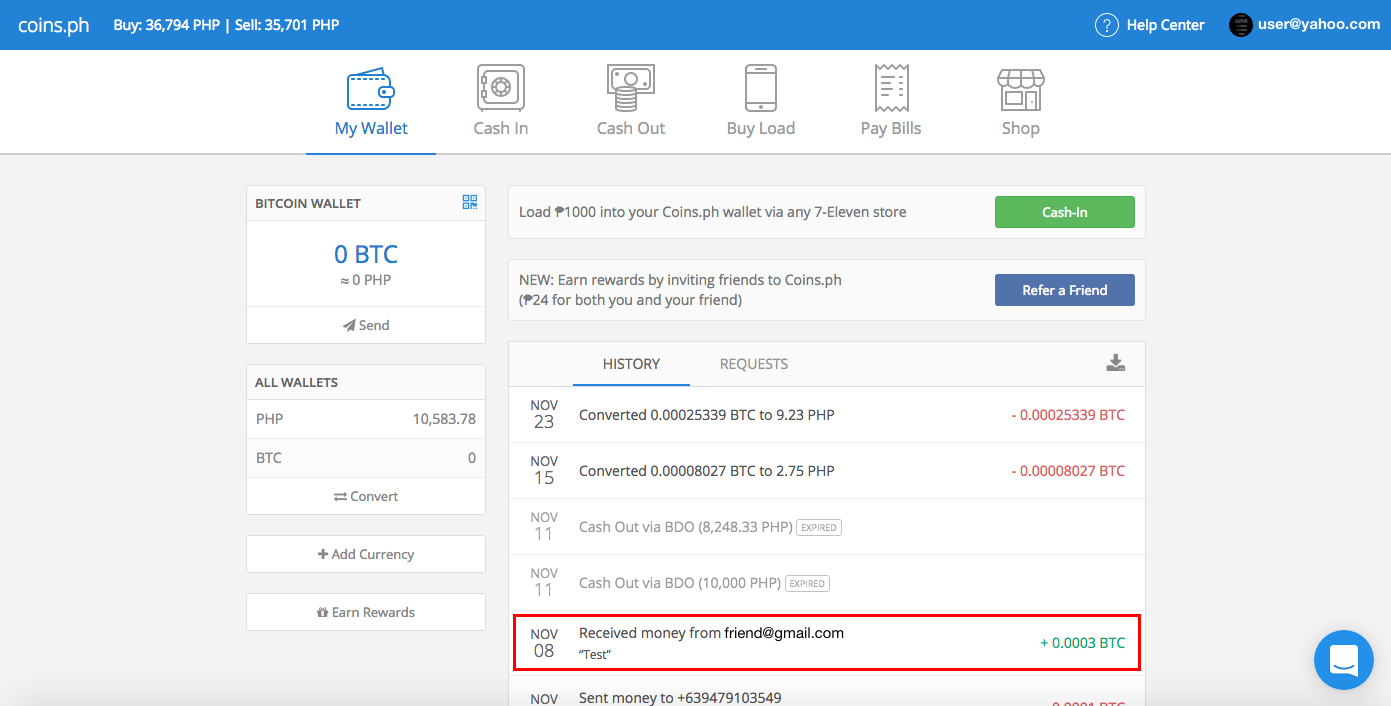

They are authenticated by mass collaboration powered by collective self-interests. The use of a blockchain removes the characteristic of infinite reproducibility from a digital asset. It confirms that each unit of value was transferred only once, solving the long-standing problem of double spending. Blockchains have been described as a value -exchange protocol.

Blocks hold batches of valid transactions that are hashed and encoded into a Merkle tree. The linked blocks form a chain. Sometimes separate blocks can be produced concurrently, creating a temporary fork. In addition to a secure hash-based history, any blockchain has a specified algorithm for scoring different versions of the history so that one with a higher value can be selected over others.

Blocks not selected for inclusion in the chain are called orphan blocks. They keep only the highest-scoring version of the database known to them. Whenever a peer receives a higher-scoring version usually the old version with a single new block added they extend or overwrite their own database and retransmit the improvement to their peers. There is never an absolute guarantee that any particular entry will remain in the best version of the history forever. Because blockchains are typically built to add the score of new blocks onto old blocks and because there are incentives to work only on extending with new blocks rather than overwriting old blocks, the probability of an entry becoming superseded goes down exponentially [37] as more blocks are built on top of it, eventually becoming very low.

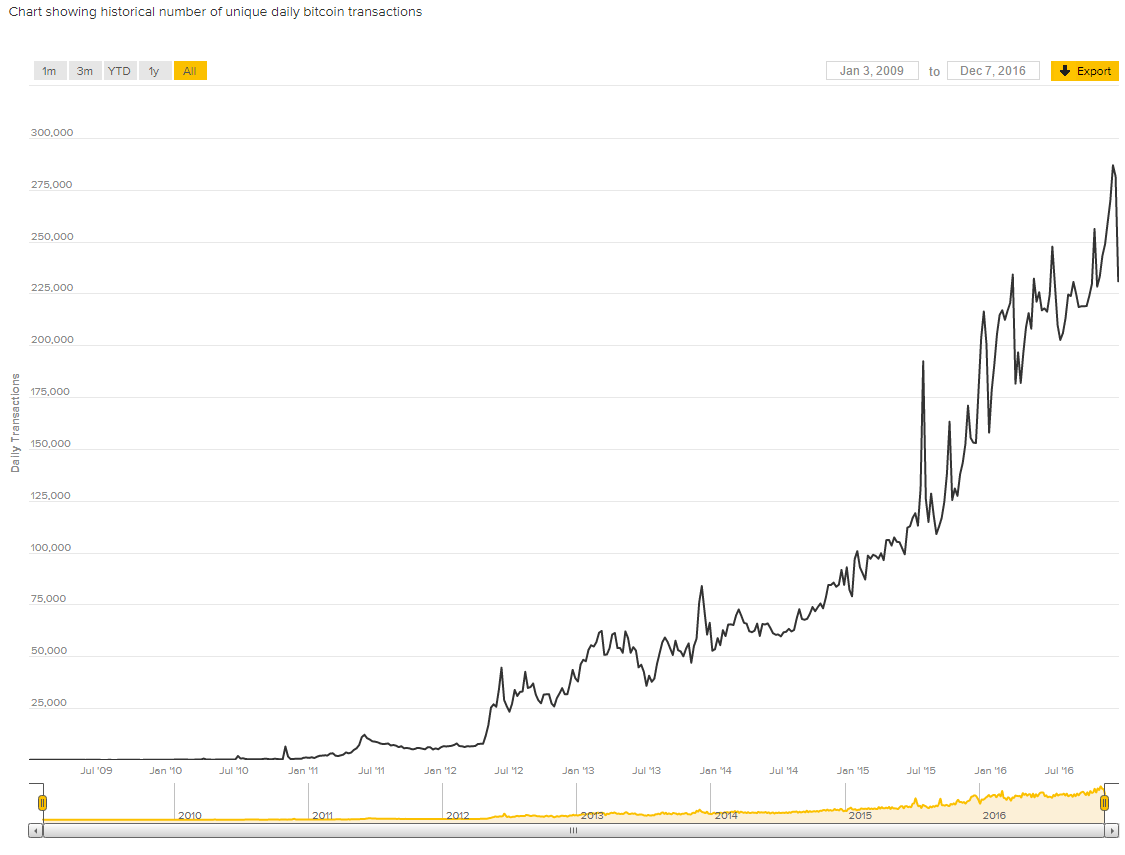

There are a number of methods that can be used to demonstrate a sufficient level of computation. Within a blockchain the computation is carried out redundantly rather than in the traditional segregated and parallel manner. The block time is the average time it takes for the network to generate one extra block in the blockchain.

In cryptocurrency, this is practically when the money transaction takes place, so a shorter block time means faster transactions. The block time for Ethereum is set to between 14 and 15 seconds, while for bitcoin it is 10 minutes. A hard fork is a rule change such that the software validating according to the old rules will see the blocks produced according to the new rules as invalid. In case of a hard fork, all nodes meant to work in accordance with the new rules need to upgrade their software.

If one group of nodes continues to use the old software while the other nodes use the new software, a split can occur. For example, Ethereum has hard-forked to "make whole" the investors in The DAO , which had been hacked by exploiting a vulnerability in its code. In the Nxt community was asked to consider a hard fork that would have led to a rollback of the blockchain records to mitigate the effects of a theft of 50 million NXT from a major cryptocurrency exchange.

The hard fork proposal was rejected, and some of the funds were recovered after negotiations and ransom payment. Alternatively, to prevent a permanent split, a majority of nodes using the new software may return to the old rules, as was the case of bitcoin split on 12 March By storing data across its peer-to-peer network, the blockchain eliminates a number of risks that come with data being held centrally.

Peer-to-peer blockchain networks lack centralized points of vulnerability that computer crackers can exploit; likewise, it has no central point of failure. Blockchain security methods include the use of public-key cryptography. Value tokens sent across the network are recorded as belonging to that address. A private key is like a password that gives its owner access to their digital assets or the means to otherwise interact with the various capabilities that blockchains now support.

Data stored on the blockchain is generally considered incorruptible. Every node in a decentralized system has a copy of the blockchain. Data quality is maintained by massive database replication [9] and computational trust. No centralized "official" copy exists and no user is "trusted" more than any other. Messages are delivered on a best-effort basis. Mining nodes validate transactions, [36] add them to the block they are building, and then broadcast the completed block to other nodes.

Open blockchains are more user-friendly than some traditional ownership records, which, while open to the public, still require physical access to view.

Because all early blockchains were permissionless, controversy has arisen over the blockchain definition. An issue in this ongoing debate is whether a private system with verifiers tasked and authorized permissioned by a central authority should be considered a blockchain. These blockchains serve as a distributed version of multiversion concurrency control MVCC in databases. The great advantage to an open, permissionless, or public, blockchain network is that guarding against bad actors is not required and no access control is needed.

Bitcoin and other cryptocurrencies currently secure their blockchain by requiring new entries to include a proof of work. To prolong the blockchain, bitcoin uses Hashcash puzzles. Financial companies have not prioritised decentralized blockchains. Permissioned blockchains use an access control layer to govern who has access to the network. They do not rely on anonymous nodes to validate transactions nor do they benefit from the network effect.

The New York Times noted in both and that many corporations are using blockchain networks "with private blockchains, independent of the public system. Nikolai Hampton pointed out in Computerworld that "There is also no need for a '51 percent' attack on a private blockchain, as the private blockchain most likely already controls percent of all block creation resources.

If you could attack or damage the blockchain creation tools on a private corporate server, you could effectively control percent of their network and alter transactions however you wished. It's unlikely that any private blockchain will try to protect records using gigawatts of computing power—it's time consuming and expensive. This means that many in-house blockchain solutions will be nothing more than cumbersome databases.

Blockchain technology can be integrated into multiple areas. The primary use of blockchains today is as a distributed ledger for cryptocurrencies, most notably bitcoin. Blockchain technology has a large potential to transform business operating models in the long term.

Blockchain distributed ledger technology is more a foundational technology —with the potential to create new foundations for global economic and social systems—than a disruptive technology , which typically "attack a traditional business model with a lower-cost solution and overtake incumbent firms quickly".

As of [update] , some observers remain skeptical. Steve Wilson, of Constellation Research, believes the technology has been hyped with unrealistic claims. This means specific blockchain applications may be a disruptive innovation, because substantially lower-cost solutions can be instantiated, which can disrupt existing business models.

Blockchains alleviate the need for a trust service provider and are predicted to result in less capital being tied up in disputes. Blockchains have the potential to reduce systemic risk and financial fraud. They automate processes that were previously time-consuming and done manually, such as the incorporation of businesses. As a distributed ledger, blockchain reduces the costs involved in verifying transactions, and by removing the need for trusted "third-parties" such as banks to complete transactions, the technology also lowers the cost of networking, therefore allowing several applications.

Starting with a strong focus on financial applications, blockchain technology is extending to activities including decentralized applications and collaborative organizations that eliminate a middleman. Frameworks and trials such as the one at the Sweden Land Registry aim to demonstrate the effectiveness of the blockchain at speeding land sale deals.

The Government of India is fighting land fraud with the help of a blockchain. Each of the Big Four accounting firms is testing blockchain technologies in various formats.

It is important to us that everybody gets on board and prepares themselves for the revolution set to take place in the business world through blockchains, [to] smart contracts and digital currencies.

Blockchain-based smart contracts are contracts that can be partially or fully executed or enforced without human interaction. The IMF believes smart contracts based on blockchain technology could reduce moral hazards and optimize the use of contracts in general.

Some blockchain implementations could enable the coding of contracts that will execute when specified conditions are met. A blockchain smart contract would be enabled by extensible programming instructions that define and execute an agreement. A number of financial institutions have adopted blockchain technology-based money transactions using smart contracts.

Companies have supposedly been suggesting blockchain-based currency solutions in the following country:. Some countries, especially Australia, are providing keynote participation in identifying the various technical issues associated with developing, governing and using blockchains:. Don Tapscott conducted a two-year research project exploring how blockchain technology can securely move and store host "money, titles, deeds, music, art, scientific discoveries, intellectual property, and even votes".

Banks are interested in this technology because it has potential to speed up back office settlement systems. Banks such as UBS are opening new research labs dedicated to blockchain technology in order to explore how blockchain can be used in financial services to increase efficiency and reduce costs. Russia has officially completed its first government-level blockchain implementation. The state-run bank Sberbank announced on 20 December that it is partnering with Russia's Federal Antimonopoly Service FAS to implement document transfer and storage via blockchain.

R3 connects 42 banks to distributed ledgers built by Ethereum, Chain. A Swiss industry consortium, including Swisscom , the Zurich Cantonal Bank and the Swiss stock exchange, is prototyping over-the-counter asset trading on a blockchain-based Ethereum technology.

The credit and debits payments company MasterCard has added three blockchain-based APIs for programmers to use in developing both person-to-person P2P and business-to-business B2B payment systems. CLS Group is using blockchain technology to expand the number of currency trade deals it can settle.