Hassonline tradeserver automated crypto currency trading bot bitcoin and altcoins feb 17 2018

15 comments

Buy liquid fructose

Bitcoin and cryptocurrency exchange businesses becomes the hot trend of online business world. It is just like finding a pearl inside the deep ocean , it contains that much of risks and challenges. Why not every business have some risks? But you can overtake the risks by understanding your core bitcoin exchange business model and writing the business plan!! This article is gonna explain you what are the things you should remember and have to kept aside of you while writing your bitcoin exchange business plan?

Understanding What is bitcoin exchange business? In short words, it is just like goods exchange that we did in ancient times. That exchange model is now transformed into digital, in order to exchange our digital assets and goods. Digital assets are, 1. Digital currency or cryptocurrency Virtual currency mostly bitcoin and ethereum. Tokens - crypto tokens or digital tokens. This business needs an online exchange portal where it connects the cloud storages like wallets, public ledger, traders and people at one place.

Bitcoin and its related business operate based on its virtual presence, when there is a need for cloud and online usage there are a lot of possibilities for unexpected things to happen.

Commons Risks that you will face when launching your bitcoin exchange business. The first risk is already there are a plenty of familiar bitcoin exchanges, So it is upon you to decide how you are going to differ from them. You should provide high security to the traders. Preventing the money laundering, and stopping the intruders. Securing the digital assets. Preventing the anonymity and securing your integrated wallet.

Keeping the traders always to engage with your portal 2. Picking the high revenue 4. Securing your website from unexpected ban or hack 5. Updating business with multiple currency trading 6.

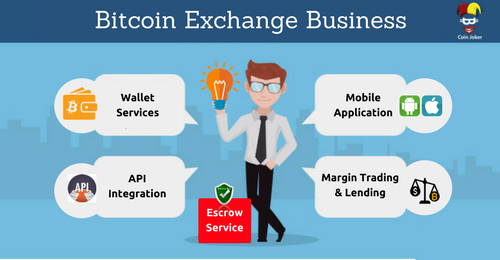

Making your website compatible for mobile users 8. Keeping the customer's privacy And more The list of challenges increases based on the current demand and business trends of cryptocurrency industry. The success of bitcoin exchange business derives a lot of subordinates business which will boost up the main business revenue. Margin trading with Lending: Margin trading increases the trading capacity of traders, it helps your business by keeping the traders always engage with your business.

Read more about margin trading here. Bitcoin lenders can lend their coins to the traders under the concept of margin trading. Token exchange and trading: In ICO processes tokens plays an important role as just like shares, Many exchanges started to give a priority for digital tokens to exchange it any cryptocurrencies.

Over the counter trading. This is an another trading in which most of the exchanges started to concentrated. New coin trading or trading with ICO The release of a new crypto coin will not create much more impact until it gets to interact with exchanges. So fresh exchanges and familiar bitcoin exchanges are now giving traders an opportunity to start an exchange with new coins. The value of a business plan is in the progress not in the papers you write.

In general, a business plan should include operational plan, analyzing the market, planning the services, marketing plan, competitor analysis, team of administration, planning and scheduling the financial expenditures.

But apart from the above a bitcoin exchange business must need some more concentrations, 1. Making your exchange portal unique from competitors Your business will get more traffic when you stand out from your competitors. Otherwise, you will miss in the startup's crowd and will hide from your people eyes 2. Integrating the current exchange business features that your customers search for As the bitcoin and cryptocurrency industry getting evolved day by day, it derives a lot of exchange business features.

Be on time to catch the features and functionalities. Utilizing the right bitcoin exchange software to easily set up your exchange portal A bitcoin exchange software can help you to setup your bitcoin exchange portal, it is easy to customize with any uptrends, and can track details of past bitcoin transactions. Technological support Blockchain technology is the most common technology support for a trading website to perfectly function. It is upon you to decide what kind of technology that you have to integrate for providing best security, and easy trading flow.

Choosing the right domain and launching in right location The final thing is you have to choose the right domain and have to launch in a demanding country.

Making the business plan and understanding the core business model not ends there, it results in better outcome when you end up with right destination. Hope bitdeal will be the best answer when you start querying about how to start bitcoin exchange business. Bitdeal is a bitcoin and cryptocurrency exchange business script, software Which powers the bitcoin and cryptocurrency startups and enterprise. Make a strong in cryptocurrency exchange and blockchain technology with the help of bitdeal!

If you are curious about our exchange software, place an order here below. Talk to our Experts. Bitcoin Exchange Business Plan and Revenue Model Bitcoin and cryptocurrency exchange businesses becomes the hot trend of online business world. Find out the Risks and challenges of bitcoin exchange business Bitcoin and its related business operate based on its virtual presence, when there is a need for cloud and online usage there are a lot of possibilities for unexpected things to happen.

Finding out the Derivatives of bitcoin exchange business The success of bitcoin exchange business derives a lot of subordinates business which will boost up the main business revenue. Banking rules causes growth for bitcoin exchanges and investments by Bitdeal How to list your cryptocurrency on exchange websites by Bitdeal How to create your own bitcoin exchange by Bitdeal