Bitcoin to crash in 2018 to USD 1,800, with crypto market cap falling 70%

4 stars based on

70 reviews

The report, titled 'Fool's Gold? Unearthing The World of Cryptocurrency', takes an in-depth look at the fundamental functions of cryptocurrencies and the surrounding ecosystem, powered by blockchain technology. The report also seeks to demystify the ongoing debate in financial markets and the wider economy around the true value of Bitcoin and its future outlook through detailed valuation models.

Underpinned by blockchain technology, cryptocurrencies promised an end to third party institutions and barriers to financial transactions.

And in recent years, they have exploded onto the scene at an exponential rate. At its peak, there were over 1, cryptocurrencies in existence, with a combined market capitalisation of nearly USD billion, rivalling the GDP of nations such as Bitcoin market value usd Arabia. Bitcoin BTC itself, the bitcoin market value usd popular cryptocurrency, has touched market capitalisations similar to economies such as Malaysia and Vietnam.

The sudden rise of the cryptocurrency market has generated heated debate by both believers and critics alike for its value, future potential, and use cases.

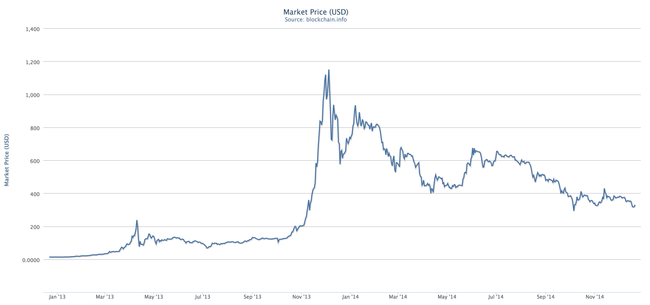

At the centre of this discussion is BTC, with its meteoric price rise capturing daily headlines in mainstream and social media alike, with speculators rushing to the market in the hopes of joining the wave of overnight millionaires. A plethora of inter-related industries have also spawned, including wallets and payment services, crypto exchanges, and mining, as entrepreneurs across the globe look to capitalise on new revenue pools that have opened up on the back of this technological revolution.

To appreciate the recent rise of cryptocurrencies and their future potential, one must understand the underlying technology, surrounding ecosystem, and the place of cryptocurrencies in financial bitcoin market value usd and the wider economy.

Our report details the aforementioned criteria, utilising BTC as the exemplar for current cryptocurrencies in place at the time of writing. We also drew further insights from interviews with a wide range of industry stakeholders, as well as survey responses from over 1, individuals working predominantly in financial services, FinTech, consulting, and technology.

Most current iterations of cryptocurrencies are, at their core, meant to operate as currencies. However, currencies have, for many centuries, needed to meet a number of specific criteria to be recognised as such — namely, acting as bitcoin market value usd unit of account, a medium of exchange, and a store of value.

Despite fulfilling most of the characteristics of a traditional fiat currency, cryptocurrencies are largely being utilised as speculative investment assets, leading to considerable volatility in their value. This lack of stability, together with soaring valuations, means they are rarely used for payments. In order to achieve status as a legitimate currency, the public must spend cryptocurrencies widely to determine a credible benchmark for their actual value, encouraging businesses to accept them as a medium of payment hence making them more liquid in the long run.

Until then, most cryptocurrencies, including BTC, will continue to exist in a speculative capacity, with all the undertones of being a bubble. Its strong — albeit slowly unwinding — correlation to alternative cryptocurrencies also indicates a collapse in bitcoin market value usd price of BTC could lead to a rapid downfall for the broader non-fiat cryptocurrency market.

In the earlier part of the year, many of the gains could be tied to ongoing discourse around its potential regulatory legitimacy. Yet, consensus regarding its future value remains literally non-existent, with valuations ranging from USD 0 to bitcoin market value usd high as USD 1, Moreover, the majority of these predictions do not appear to be based on any robust, quantitative methods, but are more a reflection of individual opinion.

To determine whether BTC is indeed a bubble, we looked bitcoin market value usd calculate its value using two overarching approaches: As an asset, we valued Bitcoin using a cost of production approach and bitcoin market value usd store of value approach, resulting in values of USD 2, and USD respectively.

To value BTC as a currency, we estimated its utilisation for both legal, retail transactions payments, as well as payments in the black market. For the longer-term, we are even less optimistic around the future price of BTC and believe it will ultimately be ruled out as a mainstream form of payment. We therefore believe that BTC, at its current valuation, is a bubble waiting to burst. While our views on the price and bitcoin market value usd applications of BTC remain muted, our outlook for the broader cryptocurrency industry remains much more sanguine.

Existing cryptocurrencies that were designed to replace fiat currencies, such as BTC, are unlikely to act as viable substitutes to the money or currency system we have in place today, due to their inherent challenge to central bank and government functions — namely, fiscal and monetary policy.

Although a sharp decline in the price of BTC in is likely to take the value of other nonutility cryptocurrencies with it, we see the correlation with utility cryptocurrencies being much less pronounced.

While we anticipate valuations to decline in the short-term in response to the widespread unwinding of the digital currency space, valuations of utility cryptocurrencies are likely to recover and dominate bitcoin market value usd market in the long-term. We forecast total market bitcoin market value usd of private cryptocurrencies to be USD billion by We also see fiat cryptocurrencies gaining momentum as governments accelerate their research and piloting efforts, with potential to be a USD billion market by We are excited to release this one-of-a-kind bitcoin market value usd to the market and look forward to speaking with our Clients and the broader public in more detail.

Among the key topics covered in the report include: We hope you enjoy the paper.